The Executive Compensation Controversy - Fondazione Rodolfo ...

The Executive Compensation Controversy - Fondazione Rodolfo ...

The Executive Compensation Controversy - Fondazione Rodolfo ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

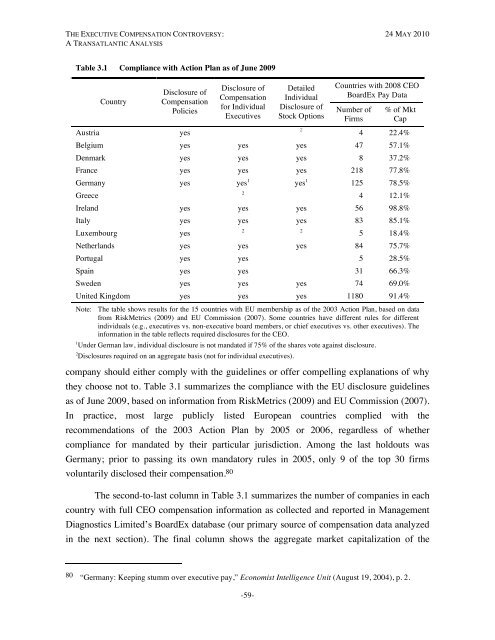

THE EXECUTIVE COMPENSATION CONTROVERSY: 24 MAY 2010A TRANSATLANTIC ANALYSISTable 3.1 Compliance with Action Plan as of June 2009AustriaCountryDisclosure of<strong>Compensation</strong>Policiesyescompany should either comply with the guidelines or offer compelling explanations of whythey choose not to. Table 3.1 summarizes the compliance with the EU disclosure guidelinesas of June 2009, based on information from RiskMetrics (2009) and EU Commission (2007).In practice, most large publicly listed European countries complied with therecommendations of the 2003 Action Plan by 2005 or 2006, regardless of whethercompliance for mandated by their particular jurisdiction. Among the last holdouts wasGermany; prior to passing its own mandatory rules in 2005, only 9 of the top 30 firmsvoluntarily disclosed their compensation. 80Disclosure of<strong>Compensation</strong>for Individual<strong>Executive</strong>sDetailedIndividualDisclosure ofStock OptionsCountries with 2008 CEOBoardEx Pay DataNumber ofFirms% of MktCap<strong>The</strong> second-to-last column in Table 3.1 summarizes the number of companies in eachcountry with full CEO compensation information as collected and reported in ManagementDiagnostics Limited’s BoardEx database (our primary source of compensation data analyzedin the next section). <strong>The</strong> final column shows the aggregate market capitalization of the24 22.4%Belgium yes yes yes 47 57.1%Denmark yes yes yes 8 37.2%France yes yes yes 218 77.8%Germany yes yes 1 yes 1 125 78.5%Greece24 12.1%Ireland yes yes yes 56 98.8%Italy yes yes yes 83 85.1%Luxembourgyes2 25 18.4%Netherlands yes yes yes 84 75.7%Portugal yes yes 5 28.5%Spain yes yes 31 66.3%Sweden yes yes yes 74 69.0%United Kingdom yes yes yes 1180 91.4%Note: <strong>The</strong> table shows results for the 15 countries with EU membership as of the 2003 Action Plan, based on datafrom RiskMetrics (2009) and EU Commission (2007). Some countries have different rules for differentindividuals (e.g., executives vs. non-executive board members, or chief executives vs. other executives). <strong>The</strong>information in the table reflects required disclosures for the CEO.1Under German law, individual disclosure is not mandated if 75% of the shares vote against disclosure.2Disclosures required on an aggregate basis (not for individual executives).80 “Germany: Keeping stumm over executive pay,” Economist Intelligence Unit (August 19, 2004), p. 2.-59-