The Executive Compensation Controversy - Fondazione Rodolfo ...

The Executive Compensation Controversy - Fondazione Rodolfo ...

The Executive Compensation Controversy - Fondazione Rodolfo ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

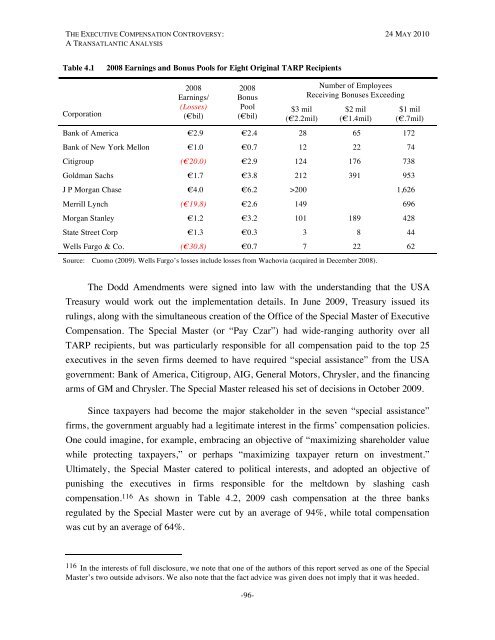

THE EXECUTIVE COMPENSATION CONTROVERSY: 24 MAY 2010A TRANSATLANTIC ANALYSISTable 4.12008 Earnings and Bonus Pools for Eight Original TARP RecipientsCorporation2008Earnings/(Losses)(€bil)2008BonusPool(€bil)$3 mil(€2.2mil)Number of EmployeesReceiving Bonuses Exceeding$2 mil(€1.4mil)$1 mil(€.7mil)Bank of America €2.9 €2.4 28 65 172Bank of New York Mellon €1.0 €0.7 12 22 74Citigroup (€20.0) €2.9 124 176 738Goldman Sachs €1.7 €3.8 212 391 953J P Morgan Chase €4.0 €6.2 >200 1,626Merrill Lynch (€19.8) €2.6 149 696Morgan Stanley €1.2 €3.2 101 189 428State Street Corp €1.3 €0.3 3 8 44Wells Fargo & Co. (€30.8) €0.7 7 22 62Source: Cuomo (2009). Wells Fargo’s losses include losses from Wachovia (acquired in December 2008).<strong>The</strong> Dodd Amendments were signed into law with the understanding that the USATreasury would work out the implementation details. In June 2009, Treasury issued itsrulings, along with the simultaneous creation of the Office of the Special Master of <strong>Executive</strong><strong>Compensation</strong>. <strong>The</strong> Special Master (or “Pay Czar”) had wide-ranging authority over allTARP recipients, but was particularly responsible for all compensation paid to the top 25executives in the seven firms deemed to have required “special assistance” from the USAgovernment: Bank of America, Citigroup, AIG, General Motors, Chrysler, and the financingarms of GM and Chrysler. <strong>The</strong> Special Master released his set of decisions in October 2009.Since taxpayers had become the major stakeholder in the seven “special assistance”firms, the government arguably had a legitimate interest in the firms’ compensation policies.One could imagine, for example, embracing an objective of “maximizing shareholder valuewhile protecting taxpayers,” or perhaps “maximizing taxpayer return on investment.”Ultimately, the Special Master catered to political interests, and adopted an objective ofpunishing the executives in firms responsible for the meltdown by slashing cashcompensation. 116 As shown in Table 4.2, 2009 cash compensation at the three banksregulated by the Special Master were cut by an average of 94%, while total compensationwas cut by an average of 64%.116 In the interests of full disclosure, we note that one of the authors of this report served as one of the SpecialMaster’s two outside advisors. We also note that the fact advice was given does not imply that it was heeded.-96-