The Executive Compensation Controversy - Fondazione Rodolfo ...

The Executive Compensation Controversy - Fondazione Rodolfo ...

The Executive Compensation Controversy - Fondazione Rodolfo ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

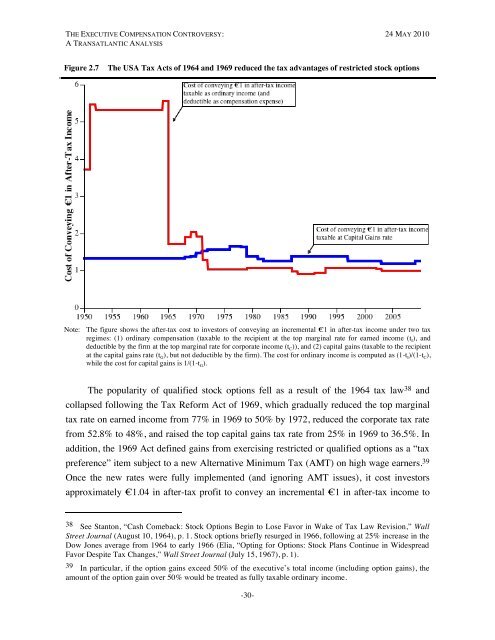

THE EXECUTIVE COMPENSATION CONTROVERSY: 24 MAY 2010A TRANSATLANTIC ANALYSISFigure 2.7<strong>The</strong> USA Tax Acts of 1964 and 1969 reduced the tax advantages of restricted stock optionsNote: <strong>The</strong> figure shows the after-tax cost to investors of conveying an incremental €1 in after-tax income under two taxregimes: (1) ordinary compensation (taxable to the recipient at the top marginal rate for earned income (t I ), anddeductible by the firm at the top marginal rate for corporate income (t C )), and (2) capital gains (taxable to the recipientat the capital gains rate (t G ), but not deductible by the firm). <strong>The</strong> cost for ordinary income is computed as (1-t I )/(1-t C ),while the cost for capital gains is 1/(1-t G ).<strong>The</strong> popularity of qualified stock options fell as a result of the 1964 tax law 38 andcollapsed following the Tax Reform Act of 1969, which gradually reduced the top marginaltax rate on earned income from 77% in 1969 to 50% by 1972, reduced the corporate tax ratefrom 52.8% to 48%, and raised the top capital gains tax rate from 25% in 1969 to 36.5%. Inaddition, the 1969 Act defined gains from exercising restricted or qualified options as a “taxpreference” item subject to a new Alternative Minimum Tax (AMT) on high wage earners. 39Once the new rates were fully implemented (and ignoring AMT issues), it cost investorsapproximately €1.04 in after-tax profit to convey an incremental €1 in after-tax income to38 See Stanton, “Cash Comeback: Stock Options Begin to Lose Favor in Wake of Tax Law Revision,” WallStreet Journal (August 10, 1964), p. 1. Stock options briefly resurged in 1966, following at 25% increase in theDow Jones average from 1964 to early 1966 (Elia, “Opting for Options: Stock Plans Continue in WidespreadFavor Despite Tax Changes,” Wall Street Journal (July 15, 1967), p. 1).39 In particular, if the option gains exceed 50% of the executive’s total income (including option gains), theamount of the option gain over 50% would be treated as fully taxable ordinary income.-30-