Institution Currency DateplacementDateexpiryDaysValueTh.CLP$DaysaccruedInterestaccruedTh.CLP$Total12/31/2010Th.CLP$Banco de Chile CLP 11/18/10 01/11/11 54 3,180,000 43 13,674 3,193,674Banco de Chile CLP 12/06/10 02/01/11 57 4,479,103 25 11,571 4,490,674Banco de Crédito Inversiones CLP 12/15/10 02/21/11 68 2,400,000 16 4,224 2,404,224Banco de Crédito Inversiones CLP 12/27/10 03/01/11 64 2,420,605 4 1,130 2,421,735Banco de Crédito Inversiones CLP 12/27/10 03/01/11 64 2,000,000 4 933 2,000,933Banco de Crédito Inversiones CLP 12/28/10 03/24/11 86 4,216,856 3 1,560 4,218,416Banco de Crédito Inversiones CLP 12/28/10 03/28/11 90 4,200,000 3 1,554 4,201,554Banco Santander CLP 12/01/10 01/24/11 54 2,000,000 30 6,200 2,006,200Banco Santander CLP 12/14/10 02/15/11 63 4,300,000 17 8,041 4,308,041Banco Santander CLP 12/28/10 03/28/11 90 3,333,000 3 1,200 3,334,200Banco Santander CLP 12/30/10 01/29/11 30 50,000 1 574 50,574Banco Security CLP 12/09/10 01/24/11 46 1,876,000 22 4,265 1,880,265Banco Security CLP 12/10/10 02/08/11 60 3,500,000 21 8,085 3,508,085Banco Security CLP 12/27/10 03/08/11 71 4,000,000 4 1,813 4,001,813Corpbanca CLP 11/16/10 01/04/11 49 2,567,651 45 11,940 2,579,591Corpbanca CLP 11/24/10 01/18/11 55 2,265,000 37 8,381 2,273,381161Corpbanca CLP 12/02/10 01/25/11 54 2,000,153 29 5,800 2,005,953Corpbanca CLP 12/15/10 02/24/11 71 3,000,000 16 5,600 3,005,600Corpbanca CLP 12/17/10 02/22/11 67 2,240,172 14 3,554 2,243,726Corpbanca CLP 12/27/10 03/21/11 84 4,000,000 4 1,867 4,001,867Report 2011Scotiabank CLP 11/29/10 01/20/11 52 2,300,529 32 7,362 2,307,891Scotiabank CLP 12/27/10 03/15/11 78 4,000,000 4 1,813 4,001,813Banco de Credito del Perú (BCP) PEN 12/20/10 01/05/11 16 78,128 11 59 78,187Banco de Credito del Perú (BCP) PEN 12/22/10 01/11/11 20 20,015 9 12 20,027Banco de Credito del Perú (BCP) PEN 12/23/10 01/04/11 12 100,074 8 54 100,128Banco de Credito del Perú (BCP) PEN 12/23/10 01/11/11 19 84,396 8 46 84,442Banco de Credito del Perú (BCP) PEN 12/27/10 01/04/11 8 33,358 4 10 33,368Banco de Credito del Perú (BCP) PEN 12/28/10 01/07/11 10 130,096 3 27 130,123Banco de Credito del Perú (BCP) PEN 12/29/10 01/12/11 14 40,030 2 5 40,035Banco de Credito del Perú (BCP) PEN 12/30/10 01/14/11 15 30,022 1 2 30,024Banco de Credito del Perú (BCP) PEN 12/30/10 01/03/11 4 25,019 1 2 25,021Interbank PEN 12/28/10 01/12/11 15 22,350 3 5 22,355Scotiabank PEN 12/23/10 01/07/11 15 31,690 8 15 31,705Scotiabank PEN 12/27/10 01/11/11 15 16,679 4 5 16,684Scotiabank PEN 12/28/10 01/11/11 14 46,201 3 8 46,209Scotiabank PEN 12/29/10 01/07/11 9 58,377 2 8 58,385Scotiabank PEN 12/30/10 01/07/11 8 42,698 1 3 42,701Scotiabank USD 12/28/10 01/07/11 10 36,543 2 2 36,545Total 65,124,745 111,404 65,236,149

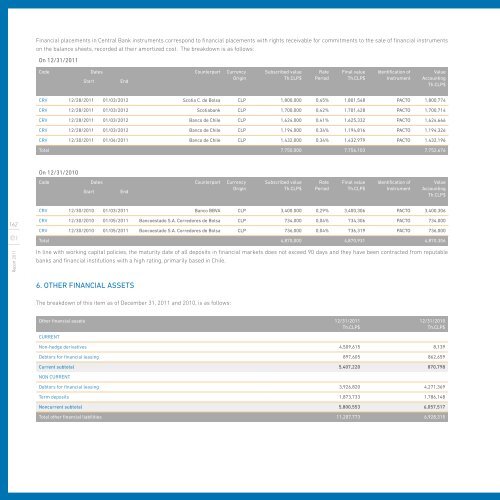

Financial placements in Central Bank instruments correspond to financial placements with rights receivable for commitments to the sale of financial instrumentson the balance sheets, recorded at their amortized cost. The breakdown is as follows:On 12/31/2011Code Dates Counterpart CurrencyOriginStartEndSubscribed valueTh.CLP$RatePeriodFinal valueTh.CLP$Identification ofInstrumentValueAccountingTh.CLP$CRV 12/28/2011 01/03/2012 Scotia C. de Bolsa CLP 1,800,000 0,45% 1,801,548 PACTO 1,800,774CRV 12/28/2011 01/03/2012 Scotiabank CLP 1,700,000 0,42% 1,701,428 PACTO 1,700,714CRV 12/28/2011 01/03/2012 Banco de Chile CLP 1,624,000 0,41% 1,625,332 PACTO 1,624,666CRV 12/28/2011 01/03/2012 Banco de Chile CLP 1,194,000 0,34% 1,194,816 PACTO 1,194,326CRV 12/30/2011 01/04/2011 Banco de Chile CLP 1,432,000 0,34% 1,432,979 PACTO 1,432,196Total 7,750,000 7,756,103 7,752,676On 12/31/2010Code Dates Counterpart CurrencyOriginStartEndSubscribed valueTh.CLP$RatePeriodFinal valueTh.CLP$Identification ofInstrumentValueAccountingTh.CLP$CRV 12/30/2010 01/03/2011 Banco BBVA CLP 3,400.000 0,29% 3,400,306 PACTO 3,400,306162CRV 12/30/2010 01/05/2011 Bancoestado S.A. Corredores de Bolsa CLP 734,000 0,04% 734,306 PACTO 734,000CRV 12/30/2010 01/05/2011 Bancoestado S.A. Corredores de Bolsa CLP 736,000 0,04% 736,319 PACTO 736,000Total 4,870,000 4,870,931 4,870,306Report 2011In line with working capital policies, the maturity date of all deposits in financial markets does not exceed 90 days and they have been contracted from reputablebanks and financial institutions with a high rating, primarily based in Chile.6. OTHER FINANCIAL ASSETSThe breakdown of this item as of December 31, 2011 and 2010, is as follows:Other financial assets 12/31/2011Th.CLP$Current12/31/2010Th.CLP$Non-hedge derivatives 4,509,615 8,139Debtors for financial leasing 897,605 862,659Current subtotal 5,407,220 870,798Non currentDebtors for financial leasing 3,926,820 4,271,369Term deposits 1,873,733 1,786,148Noncurrent subtotal 5,800,553 6,057,517Total other financial liabilities 11,207,773 6,928,315

- Page 5 and 6:

Company IdentificationChairman’s

- Page 7 and 8:

Juan José Hurtado VicuñaChairmanC

- Page 9 and 10:

CONSOLIDATED REVENUEValues calculat

- Page 11 and 12:

CONSOLIDATED OPERATING INCOMEValues

- Page 14 and 15:

Chapter 1CompanyinfOrmation_

- Page 16:

KEY FIGURES 2011In CLP$ million 200

- Page 20:

1997199820002001PCS MOBILE TELEPHON

- Page 23:

Since 2009, Entel has had a Code of

- Page 26 and 27:

23Report 2011Raúl AlcaínoLihnDire

- Page 28 and 29:

New StructureIn its current organiz

- Page 30 and 31:

“workForce*_27ParentCompanyMobile

- Page 32 and 33:

72 projectswere undertaken by Human

- Page 34 and 35:

31Report 2011

- Page 36 and 37:

Entel sponsored the Sensation and C

- Page 38 and 39:

“Live better connected” Campaig

- Page 40 and 41:

Chapter 2StrategicfouNdations_

- Page 42:

Entel spentUSD $502 millionon the d

- Page 45 and 46:

custOmerserVice_42Report 2011The ma

- Page 47 and 48:

Consultancy, good practices and the

- Page 49 and 50:

innovAtion_46Report 2011Innovation

- Page 51 and 52:

48Report 2011I-factoryEntel has cre

- Page 54 and 55:

MarketSegments_Chapter 3

- Page 56 and 57:

REVENUE FOR CHILEAN TELECOMMUNICATI

- Page 58 and 59:

Connectivity Breaking Down Barriers

- Page 60 and 61:

December 5, 2011January 16, 2012Mar

- Page 62 and 63:

CONSUMERS SEGMENT SHARE OF TOTALENT

- Page 64 and 65:

945,429 subscribersMBB services (in

- Page 66 and 67:

Innovations 2011The new products an

- Page 68 and 69:

ENTERPRISE SEGMENT SHARE OF TOTALEN

- Page 70 and 71:

+50% market sharein mobile services

- Page 72 and 73:

CORPORATE SEGMENT SHARE OF TOTAL EN

- Page 74:

Mobile ServicesInfrastructureFor th

- Page 77 and 78:

15 %annual growthin Wholesale Segme

- Page 79 and 80:

...

- Page 81 and 82:

pOlicy andactiOns_78Corporate socia

- Page 83 and 84:

In August 2011, the second stage of

- Page 85:

(* ) USD$ 45 millionParticipants in

- Page 89 and 90:

(* )...consOlidatedresultS_86Report

- Page 91 and 92:

mobilebUsiness_88Report 2011Market

- Page 93:

wirElinebusinEss_90Report 2011Focus

- Page 96:

#...

- Page 99 and 100:

AmericatelpErú_96Report 2011Aligne

- Page 102 and 103:

AMERICATEL PERÚ GROSS REvENUE(in U

- Page 104 and 105:

(* )24%annual growthactive position

- Page 106:

COPC® CertificationIn April 2011,

- Page 110 and 111:

compAny andfiNancialinformation_

- Page 112 and 113:

*Tax ID No. Shareholders Quantity o

- Page 114 and 115: On January 24, 2005, the board of d

- Page 116 and 117: ]q) Inversiones La Estancia II S.A.

- Page 118 and 119: :)divideNdpOlicy_The dividend polic

- Page 120: invEstmentpOlicy_The objective of t

- Page 123 and 124: sumMary oftransactiOns_Summary shar

- Page 125 and 126: iSkfactoRs_122Report 2011The Risk o

- Page 127 and 128: Interest Rate Risks124Report 2011Th

- Page 129 and 130: consolidAted materiAlevEnts 2011_12

- Page 131 and 132: 128Report 20112) Shareholding of Co

- Page 133 and 134: 130Report 2011agreement before Dece

- Page 135 and 136: (* )132Report 2011The main policies

- Page 138 and 139: ConsolidatedFinancialStatements

- Page 140 and 141: IndependentAuditor ReportIndependen

- Page 142 and 143: EMPRESA NACIONAL DE TELECOMUNICACIO

- Page 144 and 145: EMPRESA NACIONAL DE TELECOMUNICACIO

- Page 146 and 147: EMPRESA NACIONAL DE TELECOMUNICACIO

- Page 148 and 149: 2. BASIS FOR THE PREPARATION OF THE

- Page 150 and 151: 3. SUMMARY OF ACCOUNTING POLICIESa)

- Page 152 and 153: ) Transactions and Balances in Fore

- Page 156 and 157: j) GoodwillIn the case of the compl

- Page 158 and 159: Such programs include: calling cred

- Page 160 and 161: Non-Derivatives Financial Instrumen

- Page 162 and 163: CATEGORIES OF FINANCIAL ASSETS AND

- Page 166 and 167: The derivatives category applies to

- Page 168 and 169: The breakdown of commercial debtors

- Page 170 and 171: 9. ACCOUNTS RECEIVABLE WITH RELATED

- Page 172 and 173: 10. INVENTORYInventory is primarily

- Page 174 and 175: Intangible assets are amortized in

- Page 176 and 177: Transactions in 2011 for property,

- Page 178 and 179: Components affected by impairment a

- Page 180 and 181: c) Unrecognized Deferred Tax Assets

- Page 182 and 183: 15. OTHER FINANCIAL LIABILITIESThe

- Page 184 and 185: CreditorClass ofLiabilityTotal debt

- Page 186 and 187: On 12/31/2010Debtor Tax IDDebtorEnt

- Page 188 and 189: 17. OTHER PROVISIONSThe breakdown o

- Page 190 and 191: The benefit is provided to staff th

- Page 192 and 193: _Other reservesThe other reserves p

- Page 194 and 195: c) Ordinary ExpenditureThe breakdow

- Page 196 and 197: Class of asset Currency 12/31/2011T

- Page 198 and 199: 25. OPERATIONAL LEASESThe main oper

- Page 200 and 201: General information on income, asse

- Page 202 and 203: at the start of January for subsequ

- Page 204 and 205: _Grupo Consultor en Telecomunicacio

- Page 207 and 208: Current procedural stage: Ruling fo

- Page 209 and 210: g. There are management restriction

- Page 211 and 212: Ratio analYsis of consOlidatedfinAn

- Page 213 and 214: Investments were mainly focused on

- Page 215 and 216:

In consideration of the aforementio

- Page 217 and 218:

consolidAtedmateriAl evEntsIn compl

- Page 219 and 220:

2) Shareholding of Coigüe in Entel

- Page 221 and 222:

IX. Parent Company - Merger by Abso

- Page 224 and 225:

sUbsidiariesand associAtecOmpanies_

- Page 226 and 227:

Entel Servicios Empresariales ( Ex

- Page 228 and 229:

Entel Servicios Empresariales (Red

- Page 230 and 231:

Subsidiaries of Entel S.A.Company N

- Page 232 and 233:

Subsidiaries of Entel S.A.Company N

- Page 234 and 235:

231Report 2011PrintingFYRMA GRÁFIC

- Page 236:

mejor Conecjor Conectado.Vivir mejo