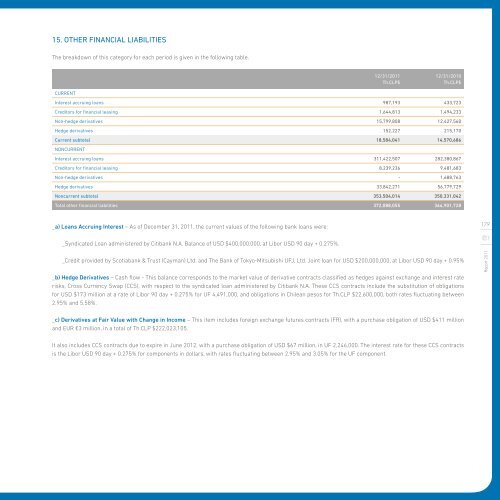

15. OTHER FINANCIAL LIABILITIESThe breakdown of this category for each period is given in the following table.12/31/2011Th.CLP$12/31/2010Th.CLP$CurrentInterest accruing loans 987,193 433,723Creditors for financial leasing 1,644,813 1,494,233Non-hedge derivatives 15,799,808 12,427,560Hedge derivatives 152,227 215,170Current subtotal 18,584,041 14,570,686NoncurrentInterest accruing loans 311,422,507 282,380,867Creditors for financial leasing 8,239,236 9,481,683Non-hedge derivatives - 1,688,763Hedge derivatives 33,842,271 56,779,729Noncurrent subtotal 353,504,014 350,331,042Total other financial liabilities 372,088,055 364,901,728_a) Loans Accruing Interest – As of December 31, 2011, the current values of the following bank loans were:179_Syndicated Loan administered by Citibank N.A. Balance of USD $400,000,000, at Libor USD 90 day + 0.275%._Credit provided by Scotiabank & Trust (Cayman) Ltd. and The Bank of Tokyo-Mitsubishi UFJ, Ltd. Joint loan for USD $200,000,000, at Libor USD 90 day + 0.95%_b) Hedge Derivatives – Cash flow - This balance corresponds to the market value of derivative contracts classified as hedges against exchange and interest raterisks, Cross Currency Swap (CCS), with respect to the syndicated loan administered by Citibank N.A. These CCS contracts include the substitution of obligationsfor USD $173 million at a rate of Libor 90 day + 0.275% for UF 4,491,000, and obligations in Chilean pesos for Th.CLP $22,600,000, both rates fluctuating between2.95% and 5.58%.Report 2011_c) Derivatives at Fair Value with Change in Income – This item includes foreign exchange futures contracts (FR), with a purchase obligation of USD $411 millionand EUR €3 million, in a total of Th.CLP $222,023,105.It also includes CCS contracts due to expire in June 2012, with a purchase obligation of USD $67 million, in UF 2,246,000. The interest rate for these CCS contractsis the Libor USD 90 day + 0.275% for components in dollars, with rates fluctuating between 2.95% and 3.05% for the UF component.

In calculating the market value of derivative instruments flows are discounted considering variables quoted on active markets (interest rates). Consequently, themarket values determined are classified under the second level of the IFRS 7 hierarchy.The expiry profile of the nominal flows for other financial liabilities is presented in the following table. For the purposes of calculating values, capital and interestpayment flows (without discounting values) have been considered for financial debts and the compensation value of financial derivatives with favorable balances,according to the current exchange rates at the close of the period.CreditorClass ofLiabilityTotal debtTh.CLP$Current (term in days)0–90 daysOn 12/31/201191 days – 1yearTotalCurrentTh.CLP$Noncurrent (term in years)1 - 3 3–5Morethan 5TotalNoncurrentTh.CLP$Banco de Crédito e Inversiones Loans 448,197 448,197 - 448,197 - - - -Citibank N.A. (syndicated) Loans 211,306,353 506,934 1,360,268 1,867,202 209,439,151 - - 209,439,151The Bank of Tokyo-Mitsubishi UFJ, Ltd (deal) Loans 53,293,443 136,209 340,067 476,276 52,817,167 - - 52,817,167Scotiabank & Trust (Cayman) Ltd (deal) Loans 53,293,443 136,209 340,067 476,276 52,817,167 - - 52,817,167Banco de Crédito e Inversiones Loans 341,752 29,292 87,878 117,170 224,582 - - 224,582Claro Comunicaciones S.A. (Telmex S.A.) Loans 3,305,099 472,157 - 472,157 944,314 944,314 944,314 2,832,942Deutsche Bank (Chile) Hedge derivatives 17,622,114 344,410 885,165 1,229,575 16,392,539 - - 16,392,539Banco Santander - Chile Hedge derivatives 8,863,497 173,675 446,361 620,036 8,243,461 - - 8,243,461Banco de Chile Hedge derivatives 1,506,385 120,646 307,908 428,554 1,077,831 - - -180Scotiabank Chile Hedge derivatives 8,910,091 181,357 433,424 614,781 8,295,310 - - -Scotiabank Chile Hedge derivatives 2,341,189 176,306 449,520 625,826 1,715,363 - - -Deutsche Bank (Chile) Non-hedge derivatives 7,947,800 172,205 7,775,595 7,947,800 - - - -Banco Santander - Chile Non-hedge derivatives 3,996,417 86,837 3,909,580 3,996,417 - - - -Report 2011Scotiabank Chile Non-hedge derivatives 4,104,206 90,678 4,013,528 4,104,206 - - - -Banco Bice Non-hedge derivatives 49,000 - 49,000 49,000 - - - -Banco de Crédito e Inversiones Non-hedge derivatives 1,059,480 184,000 875,480 1,059,480 - - - -Banco Bilbao Vizcaya Argentaria, Chile Non-hedge derivatives 244,250 76,050 168,200 244,250 - - - -Corpbanca Non-hedge derivatives 140,725 63,225 77,500 140,725 - - - -Banco de Chile Non-hedge derivatives 162,780 98,280 64,500 162,780 - - - -Banco Santander - Chile Non-hedge derivatives 1,800 1,800 - 1,800 - - - -Banco del Estado de Chile Non-hedge derivatives 352,950 - 352,950 352,950 - - - -HSBC Bank (Chile) Non-hedge derivatives 190,700 - 190,700 190,700 - - - -JP Morgan Chase Bank, N.A. Non-hedge derivatives 89,400 7,500 81,900 89,400 - - - -Banco de Crédito e Inversiones Non-hedge derivatives 1,140 1,140 - 1,140 - - - -Banco Bilbao Vizcaya Argentaria, Chile Non-hedge derivatives 4,600 4,600 - 4,600 - - - -Corpbanca Non-hedge derivatives 500 500 - 500 - - - -Deutsche Bank (Chile) Non-hedge derivatives 30,000 30,000 - 30,000 - - - -Banco del Estado de Chile Non-hedge derivatives 6,780 6,780 - 6,780 - - - -HSBC Bank (Chile) Non-hedge derivatives 21,150 21,150 - 21,150 - - - -Scotiabank Chile Non-hedge derivatives 11,240 11,240 - 11,240 - - - -Consorcio Nacional de Seguros S.A. Financial Leasing 9,447,934 497,248 1,396,275 1,893,523 3,723,401 2,108,482 1,722,528 7,554,411Chilena Consolidada Seguros de Vida S.A. Financial Leasing 1,455,908 54,597 163,790 218,387 436,772 436,772 363,977 1,237,521Banco Bice Financial Leasing 1,023,873 41,508 124,525 166,033 332,067 332,067 193,706 857,840Bice Vida Cía. de Seguros de Vida S.A. Financial Leasing 454,968 23,533 70,598 94,131 188,263 172,574 - 360,837Commercial accounts payable and other Commercial credit 326,224,772 326,224,772 - 326,224,772 - - - -Total 718,253,936 330,423,035 23,964,779 354,387,814 356,647,388 3,994,209 3,224,525 363,866,122

- Page 5 and 6:

Company IdentificationChairman’s

- Page 7 and 8:

Juan José Hurtado VicuñaChairmanC

- Page 9 and 10:

CONSOLIDATED REVENUEValues calculat

- Page 11 and 12:

CONSOLIDATED OPERATING INCOMEValues

- Page 14 and 15:

Chapter 1CompanyinfOrmation_

- Page 16:

KEY FIGURES 2011In CLP$ million 200

- Page 20:

1997199820002001PCS MOBILE TELEPHON

- Page 23:

Since 2009, Entel has had a Code of

- Page 26 and 27:

23Report 2011Raúl AlcaínoLihnDire

- Page 28 and 29:

New StructureIn its current organiz

- Page 30 and 31:

“workForce*_27ParentCompanyMobile

- Page 32 and 33:

72 projectswere undertaken by Human

- Page 34 and 35:

31Report 2011

- Page 36 and 37:

Entel sponsored the Sensation and C

- Page 38 and 39:

“Live better connected” Campaig

- Page 40 and 41:

Chapter 2StrategicfouNdations_

- Page 42:

Entel spentUSD $502 millionon the d

- Page 45 and 46:

custOmerserVice_42Report 2011The ma

- Page 47 and 48:

Consultancy, good practices and the

- Page 49 and 50:

innovAtion_46Report 2011Innovation

- Page 51 and 52:

48Report 2011I-factoryEntel has cre

- Page 54 and 55:

MarketSegments_Chapter 3

- Page 56 and 57:

REVENUE FOR CHILEAN TELECOMMUNICATI

- Page 58 and 59:

Connectivity Breaking Down Barriers

- Page 60 and 61:

December 5, 2011January 16, 2012Mar

- Page 62 and 63:

CONSUMERS SEGMENT SHARE OF TOTALENT

- Page 64 and 65:

945,429 subscribersMBB services (in

- Page 66 and 67:

Innovations 2011The new products an

- Page 68 and 69:

ENTERPRISE SEGMENT SHARE OF TOTALEN

- Page 70 and 71:

+50% market sharein mobile services

- Page 72 and 73:

CORPORATE SEGMENT SHARE OF TOTAL EN

- Page 74:

Mobile ServicesInfrastructureFor th

- Page 77 and 78:

15 %annual growthin Wholesale Segme

- Page 79 and 80:

...

- Page 81 and 82:

pOlicy andactiOns_78Corporate socia

- Page 83 and 84:

In August 2011, the second stage of

- Page 85:

(* ) USD$ 45 millionParticipants in

- Page 89 and 90:

(* )...consOlidatedresultS_86Report

- Page 91 and 92:

mobilebUsiness_88Report 2011Market

- Page 93:

wirElinebusinEss_90Report 2011Focus

- Page 96:

#...

- Page 99 and 100:

AmericatelpErú_96Report 2011Aligne

- Page 102 and 103:

AMERICATEL PERÚ GROSS REvENUE(in U

- Page 104 and 105:

(* )24%annual growthactive position

- Page 106:

COPC® CertificationIn April 2011,

- Page 110 and 111:

compAny andfiNancialinformation_

- Page 112 and 113:

*Tax ID No. Shareholders Quantity o

- Page 114 and 115:

On January 24, 2005, the board of d

- Page 116 and 117:

]q) Inversiones La Estancia II S.A.

- Page 118 and 119:

:)divideNdpOlicy_The dividend polic

- Page 120:

invEstmentpOlicy_The objective of t

- Page 123 and 124:

sumMary oftransactiOns_Summary shar

- Page 125 and 126:

iSkfactoRs_122Report 2011The Risk o

- Page 127 and 128:

Interest Rate Risks124Report 2011Th

- Page 129 and 130:

consolidAted materiAlevEnts 2011_12

- Page 131 and 132: 128Report 20112) Shareholding of Co

- Page 133 and 134: 130Report 2011agreement before Dece

- Page 135 and 136: (* )132Report 2011The main policies

- Page 138 and 139: ConsolidatedFinancialStatements

- Page 140 and 141: IndependentAuditor ReportIndependen

- Page 142 and 143: EMPRESA NACIONAL DE TELECOMUNICACIO

- Page 144 and 145: EMPRESA NACIONAL DE TELECOMUNICACIO

- Page 146 and 147: EMPRESA NACIONAL DE TELECOMUNICACIO

- Page 148 and 149: 2. BASIS FOR THE PREPARATION OF THE

- Page 150 and 151: 3. SUMMARY OF ACCOUNTING POLICIESa)

- Page 152 and 153: ) Transactions and Balances in Fore

- Page 156 and 157: j) GoodwillIn the case of the compl

- Page 158 and 159: Such programs include: calling cred

- Page 160 and 161: Non-Derivatives Financial Instrumen

- Page 162 and 163: CATEGORIES OF FINANCIAL ASSETS AND

- Page 164 and 165: Institution Currency DateplacementD

- Page 166 and 167: The derivatives category applies to

- Page 168 and 169: The breakdown of commercial debtors

- Page 170 and 171: 9. ACCOUNTS RECEIVABLE WITH RELATED

- Page 172 and 173: 10. INVENTORYInventory is primarily

- Page 174 and 175: Intangible assets are amortized in

- Page 176 and 177: Transactions in 2011 for property,

- Page 178 and 179: Components affected by impairment a

- Page 180 and 181: c) Unrecognized Deferred Tax Assets

- Page 184 and 185: CreditorClass ofLiabilityTotal debt

- Page 186 and 187: On 12/31/2010Debtor Tax IDDebtorEnt

- Page 188 and 189: 17. OTHER PROVISIONSThe breakdown o

- Page 190 and 191: The benefit is provided to staff th

- Page 192 and 193: _Other reservesThe other reserves p

- Page 194 and 195: c) Ordinary ExpenditureThe breakdow

- Page 196 and 197: Class of asset Currency 12/31/2011T

- Page 198 and 199: 25. OPERATIONAL LEASESThe main oper

- Page 200 and 201: General information on income, asse

- Page 202 and 203: at the start of January for subsequ

- Page 204 and 205: _Grupo Consultor en Telecomunicacio

- Page 207 and 208: Current procedural stage: Ruling fo

- Page 209 and 210: g. There are management restriction

- Page 211 and 212: Ratio analYsis of consOlidatedfinAn

- Page 213 and 214: Investments were mainly focused on

- Page 215 and 216: In consideration of the aforementio

- Page 217 and 218: consolidAtedmateriAl evEntsIn compl

- Page 219 and 220: 2) Shareholding of Coigüe in Entel

- Page 221 and 222: IX. Parent Company - Merger by Abso

- Page 224 and 225: sUbsidiariesand associAtecOmpanies_

- Page 226 and 227: Entel Servicios Empresariales ( Ex

- Page 228 and 229: Entel Servicios Empresariales (Red

- Page 230 and 231: Subsidiaries of Entel S.A.Company N

- Page 232 and 233:

Subsidiaries of Entel S.A.Company N

- Page 234 and 235:

231Report 2011PrintingFYRMA GRÁFIC

- Page 236:

mejor Conecjor Conectado.Vivir mejo