view / download the documents. - til india

view / download the documents. - til india

view / download the documents. - til india

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

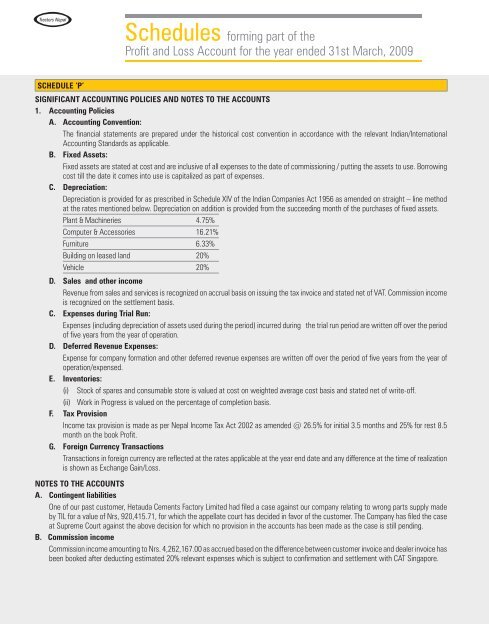

Tractors NepalSchedules forming part of <strong>the</strong>Profit and Loss Account for <strong>the</strong> year ended 31st March, 2009SCHEDULE ‘P’SIGNIFICANT ACCOUNTING POLICIES AND NOTES TO THE ACCOUNTS1. Accounting PoliciesA. Accounting Convention:The financial statements are prepared under <strong>the</strong> historical cost convention in accordance with <strong>the</strong> relevant Indian/InternationalAccounting Standards as applicable.B. Fixed Assets:Fixed assets are stated at cost and are inclusive of all expenses to <strong>the</strong> date of commissioning / putting <strong>the</strong> assets to use. Borrowingcost <strong>til</strong>l <strong>the</strong> date it comes into use is capitalized as part of expenses.C. Depreciation:Depreciation is provided for as prescribed in Schedule XIV of <strong>the</strong> Indian Companies Act 1956 as amended on straight – line methodat <strong>the</strong> rates mentioned below. Depreciation on addition is provided from <strong>the</strong> succeeding month of <strong>the</strong> purchases of fixed assets.Plant & Machineries 4.75%Computer & Accessories 16.21%Furniture 6.33%Building on leased land 20%Vehicle 20%D. Sales and o<strong>the</strong>r incomeRevenue from sales and services is recognized on accrual basis on issuing <strong>the</strong> tax invoice and stated net of VAT. Commission incomeis recognized on <strong>the</strong> settlement basis.C. Expenses during Trial Run:Expenses (including depreciation of assets used during <strong>the</strong> period) incurred during <strong>the</strong> trial run period are written off over <strong>the</strong> periodof five years from <strong>the</strong> year of operation.D. Deferred Revenue Expenses:Expense for company formation and o<strong>the</strong>r deferred revenue expenses are written off over <strong>the</strong> period of five years from <strong>the</strong> year ofoperation/expensed.E. Inventories:(i) Stock of spares and consumable store is valued at cost on weighted average cost basis and stated net of write-off.(ii) Work in Progress is valued on <strong>the</strong> percentage of completion basis.F. Tax ProvisionIncome tax provision is made as per Nepal Income Tax Act 2002 as amended @ 26.5% for initial 3.5 months and 25% for rest 8.5month on <strong>the</strong> book Profit.G. Foreign Currency TransactionsTransactions in foreign currency are reflected at <strong>the</strong> rates applicable at <strong>the</strong> year end date and any difference at <strong>the</strong> time of realizationis shown as Exchange Gain/Loss.NOTES TO THE ACCOUNTSA. Contingent liabilitiesOne of our past customer, Hetauda Cements Factory Limited had filed a case against our company relating to wrong parts supply madeby TIL for a value of Nrs, 920,415.71, for which <strong>the</strong> appellate court has decided in favor of <strong>the</strong> customer. The Company has filed <strong>the</strong> caseat Supreme Court against <strong>the</strong> above decision for which no provision in <strong>the</strong> accounts has been made as <strong>the</strong> case is s<strong>til</strong>l pending.B. Commission incomeCommission income amounting to Nrs. 4,262,167.00 as accrued based on <strong>the</strong> difference between customer invoice and dealer invoice hasbeen booked after deducting estimated 20% relevant expenses which is subject to confirmation and settlement with CAT Singapore.