view / download the documents. - til india

view / download the documents. - til india

view / download the documents. - til india

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

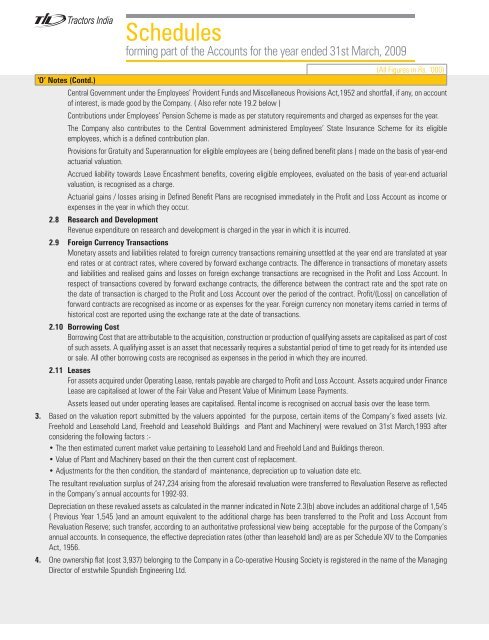

‘O’ Notes (Contd.)Schedulesforming part of <strong>the</strong> Accounts for <strong>the</strong> year ended 31st March, 2009(All Figures in Rs. ‘000)Central Government under <strong>the</strong> Employees’ Provident Funds and Miscellaneous Provisions Act,1952 and shortfall, if any, on accountof interest, is made good by <strong>the</strong> Company. ( Also refer note 19.2 below )Contributions under Employees’ Pension Scheme is made as per statutory requirements and charged as expenses for <strong>the</strong> year.The Company also contributes to <strong>the</strong> Central Government administered Employees’ State Insurance Scheme for its eligibleemployees, which is a defined contribution plan.Provisions for Gratuity and Superannuation for eligible employees are ( being defined benefit plans ) made on <strong>the</strong> basis of year-endactuarial valuation.Accrued liability towards Leave Encashment benefits, covering eligible employees, evaluated on <strong>the</strong> basis of year-end actuarialvaluation, is recognised as a charge.Actuarial gains / losses arising in Defined Benefit Plans are recognised immediately in <strong>the</strong> Profit and Loss Account as income orexpenses in <strong>the</strong> year in which <strong>the</strong>y occur.2.8 Research and DevelopmentRevenue expenditure on research and development is charged in <strong>the</strong> year in which it is incurred.2.9 Foreign Currency TransactionsMonetary assets and liabilities related to foreign currency transactions remaining unsettled at <strong>the</strong> year end are translated at yearend rates or at contract rates, where covered by forward exchange contracts. The difference in transactions of monetary assetsand liabilities and realised gains and losses on foreign exchange transactions are recognised in <strong>the</strong> Profit and Loss Account. Inrespect of transactions covered by forward exchange contracts, <strong>the</strong> difference between <strong>the</strong> contract rate and <strong>the</strong> spot rate on<strong>the</strong> date of transaction is charged to <strong>the</strong> Profit and Loss Account over <strong>the</strong> period of <strong>the</strong> contract. Profit/(Loss) on cancellation offorward contracts are recognised as income or as expenses for <strong>the</strong> year. Foreign currency non monetary items carried in terms ofhistorical cost are reported using <strong>the</strong> exchange rate at <strong>the</strong> date of transactions.2.10 Borrowing CostBorrowing Cost that are attributable to <strong>the</strong> acquisition, construction or production of qualifying assets are capitalised as part of costof such assets. A qualifying asset is an asset that necessarily requires a substantial period of time to get ready for its intended useor sale. All o<strong>the</strong>r borrowing costs are recognised as expenses in <strong>the</strong> period in which <strong>the</strong>y are incurred.2.11 LeasesFor assets acquired under Operating Lease, rentals payable are charged to Profit and Loss Account. Assets acquired under FinanceLease are capitalised at lower of <strong>the</strong> Fair Value and Present Value of Minimum Lease Payments.Assets leased out under operating leases are capitalised. Rental income is recognised on accrual basis over <strong>the</strong> lease term.3. Based on <strong>the</strong> valuation report submitted by <strong>the</strong> valuers appointed for <strong>the</strong> purpose, certain items of <strong>the</strong> Company’s fixed assets (viz.Freehold and Leasehold Land, Freehold and Leasehold Buildings and Plant and Machinery) were revalued on 31st March,1993 afterconsidering <strong>the</strong> following factors :-• The <strong>the</strong>n estimated current market value pertaining to Leasehold Land and Freehold Land and Buildings <strong>the</strong>reon.• Value of Plant and Machinery based on <strong>the</strong>ir <strong>the</strong> <strong>the</strong>n current cost of replacement.• Adjustments for <strong>the</strong> <strong>the</strong>n condition, <strong>the</strong> standard of maintenance, depreciation up to valuation date etc.The resultant revaluation surplus of 247,234 arising from <strong>the</strong> aforesaid revaluation were transferred to Revaluation Reserve as reflectedin <strong>the</strong> Company’s annual accounts for 1992-93.Depreciation on <strong>the</strong>se revalued assets as calculated in <strong>the</strong> manner indicated in Note 2.3(b) above includes an additional charge of 1,545( Previous Year 1,545 )and an amount equivalent to <strong>the</strong> additional charge has been transferred to <strong>the</strong> Profit and Loss Account fromRevaluation Reserve; such transfer, according to an authoritative professional <strong>view</strong> being acceptable for <strong>the</strong> purpose of <strong>the</strong> Company’sannual accounts. In consequence, <strong>the</strong> effective depreciation rates (o<strong>the</strong>r than leasehold land) are as per Schedule XIV to <strong>the</strong> CompaniesAct, 1956.4. One ownership flat (cost 3,937) belonging to <strong>the</strong> Company in a Co-operative Housing Society is registered in <strong>the</strong> name of <strong>the</strong> ManagingDirector of erstwhile Spundish Engineering Ltd.