view / download the documents. - til india

view / download the documents. - til india

view / download the documents. - til india

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

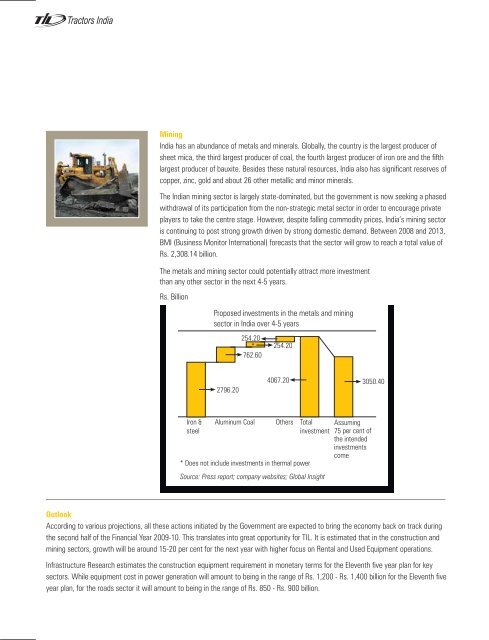

MiningIndia has an abundance of metals and minerals. Globally, <strong>the</strong> country is <strong>the</strong> largest producer ofsheet mica, <strong>the</strong> third largest producer of coal, <strong>the</strong> fourth largest producer of iron ore and <strong>the</strong> fifthlargest producer of bauxite. Besides <strong>the</strong>se natural resources, India also has significant reserves ofcopper, zinc, gold and about 26 o<strong>the</strong>r metallic and minor minerals.The Indian mining sector is largely state-dominated, but <strong>the</strong> government is now seeking a phasedwithdrawal of its participation from <strong>the</strong> non-strategic metal sector in order to encourage privateplayers to take <strong>the</strong> centre stage. However, despite falling commodity prices, India’s mining sectoris continuing to post strong growth driven by strong domestic demand. Between 2008 and 2013,BMI (Business Monitor International) forecasts that <strong>the</strong> sector will grow to reach a total value ofRs. 2,308.14 billion.The metals and mining sector could potentially attract more investmentthan any o<strong>the</strong>r sector in <strong>the</strong> next 4-5 years.Rs. BillionProposed investments in <strong>the</strong> metals and miningsector in India over 4-5 years254.20*762.60254.202796.204067.20 3050.40Iron &steelAluminum CoalO<strong>the</strong>rsTotalinvestment* Does not include investments in <strong>the</strong>rmal powerSource: Press report; company websites; Global InsightAssuming75 per cent of<strong>the</strong> intendedinvestmentscomeOutlookAccording to various projections, all <strong>the</strong>se actions initiated by <strong>the</strong> Government are expected to bring <strong>the</strong> economy back on track during<strong>the</strong> second half of <strong>the</strong> Financial Year 2009-10. This translates into great opportunity for TIL. It is estimated that in <strong>the</strong> construction andmining sectors, growth will be around 15-20 per cent for <strong>the</strong> next year with higher focus on Rental and Used Equipment operations.Infrastructure Research estimates <strong>the</strong> construction equipment requirement in monetary terms for <strong>the</strong> Eleventh five year plan for keysectors. While equipment cost in power generation will amount to being in <strong>the</strong> range of Rs. 1,200 - Rs. 1,400 billion for <strong>the</strong> Eleventh fiveyear plan, for <strong>the</strong> roads sector it will amount to being in <strong>the</strong> range of Rs. 850 - Rs. 900 billion.