view / download the documents. - til india

view / download the documents. - til india

view / download the documents. - til india

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

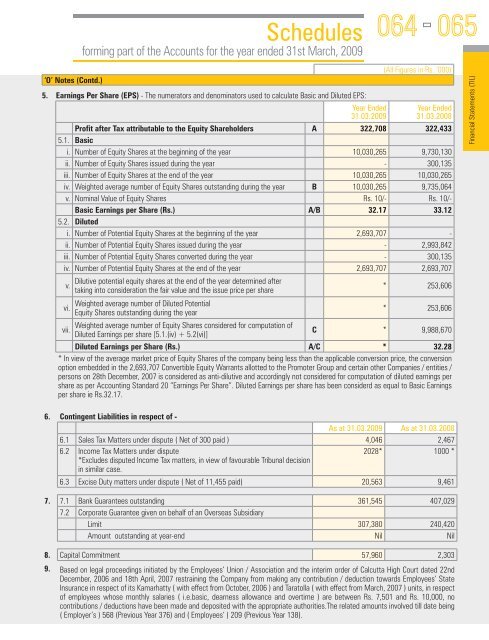

Schedulesforming part of <strong>the</strong> Accounts for <strong>the</strong> year ended 31st March, 2009064065‘O’ Notes (Contd.)5. Earnings Per Share (EPS) - The numerators and denominators used to calculate Basic and Diluted EPS:Year Ended31.03.2009Year Ended31.03.2008Profit after Tax attributable to <strong>the</strong> Equity Shareholders A 322,708 322,4335.1. Basici. Number of Equity Shares at <strong>the</strong> beginning of <strong>the</strong> year 10,030,265 9,730,130ii. Number of Equity Shares issued during <strong>the</strong> year - 300,135iii. Number of Equity Shares at <strong>the</strong> end of <strong>the</strong> year 10,030,265 10,030,265iv. Weighted average number of Equity Shares outstanding during <strong>the</strong> year B 10,030,265 9,735,064v. Nominal Value of Equity Shares Rs. 10/- Rs. 10/-Basic Earnings per Share (Rs.) A/B 32.17 33.125.2. Dilutedi. Number of Potential Equity Shares at <strong>the</strong> beginning of <strong>the</strong> year 2,693,707 -ii. Number of Potential Equity Shares issued during <strong>the</strong> year - 2,993,842iii. Number of Potential Equity Shares converted during <strong>the</strong> year - 300,135iv. Number of Potential Equity Shares at <strong>the</strong> end of <strong>the</strong> year 2,693,707 2,693,707v.vi.Dilutive potential equity shares at <strong>the</strong> end of <strong>the</strong> year determined aftertaking into consideration <strong>the</strong> fair value and <strong>the</strong> issue price per shareWeighted average number of Diluted PotentialEquity Shares outstanding during <strong>the</strong> year(All Figures in Rs. ‘000)* 253,606* 253,606Weighted average number of Equity Shares considered for computation ofvii.C * 9,988,670Diluted Earnings per share [5.1.(iv) + 5.2(vi)]Diluted Earnings per Share (Rs.) A/C * 32.28* In <strong>view</strong> of <strong>the</strong> average market price of Equity Shares of <strong>the</strong> company being less than <strong>the</strong> applicable conversion price, <strong>the</strong> conversionoption embedded in <strong>the</strong> 2,693,707 Convertible Equity Warrants allotted to <strong>the</strong> Promoter Group and certain o<strong>the</strong>r Companies / entities /persons on 28th December, 2007 is considered as anti-dilutive and accordingly not considered for computation of diluted earnings pershare as per Accounting Standard 20 “Earnings Per Share”. Diluted Earnings per share has been considerd as equal to Basic Earningsper share ie Rs.32.17.Financial Statements (TIL)6. Contingent Liabilities in respect of -As at 31.03.2009 As at 31.03.20086.1 Sales Tax Matters under dispute ( Net of 300 paid ) 4,046 2,4676.2 Income Tax Matters under dispute*Excludes disputed Income Tax matters, in <strong>view</strong> of favourable Tribunal decisionin similar case.2028* 1000 *6.3 Excise Duty matters under dispute ( Net of 11,455 paid) 20,563 9,4617. 7.1 Bank Guarantees outstanding 361,545 407,0297.2 Corporate Guarantee given on behalf of an Overseas SubsidiaryLimit 307,380 240,420Amount outstanding at year-end Nil Nil8. Capital Commitment 57,960 2,3039. Based on legal proceedings initiated by <strong>the</strong> Employees’ Union / Association and <strong>the</strong> interim order of Calcutta High Court dated 22ndDecember, 2006 and 18th April, 2007 restraining <strong>the</strong> Company from making any contribution / deduction towards Employees’ StateInsurance in respect of its Kamarhatty ( with effect from October, 2006 ) and Taratolla ( with effect from March, 2007 ) units, in respectof employees whose monthly salaries ( i.e.basic, dearness allowance and overtime ) are between Rs. 7,501 and Rs. 10,000, nocontributions / deductions have been made and deposited with <strong>the</strong> appropriate authorities.The related amounts involved <strong>til</strong>l date being( Employer’s ) 568 (Previous Year 376) and ( Employees’ ) 209 (Previous Year 138).