view / download the documents. - til india

view / download the documents. - til india

view / download the documents. - til india

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

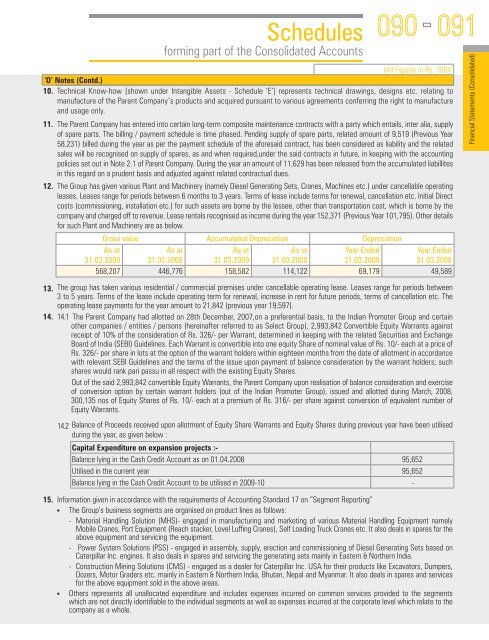

Schedulesforming part of <strong>the</strong> Consolidated Accounts090(All Figures in Rs. ‘000)‘O’ Notes (Contd.)10. Technical Know-how [shown under Intangible Assets - Schedule ‘E’] represents technical drawings, designs etc. relating tomanufacture of <strong>the</strong> Parent Company’s products and acquired pursuant to various agreements conferring <strong>the</strong> right to manufactureand usage only.11. The Parent Company has entered into certain long-term composite maintenance contracts with a party which entails, inter alia, supplyof spare parts. The billing / payment schedule is time phased. Pending supply of spare parts, related amount of 9,519 (Previous Year58,231) billed during <strong>the</strong> year as per <strong>the</strong> payment schedule of <strong>the</strong> aforesaid contract, has been considered as liability and <strong>the</strong> relatedsales will be recognised on supply of spares, as and when required,under <strong>the</strong> said contracts in future, in keeping with <strong>the</strong> accountingpolicies set out in Note 2.1 of Parent Company. During <strong>the</strong> year an amount of 11,629 has been released from <strong>the</strong> accumulated liabillitesin this regard on a prudent basis and adjusted against related contractual dues.12. The Group has given various Plant and Machinery (namely Diesel Generating Sets, Cranes, Machines etc.) under cancellable operatingleases. Leases range for periods between 6 months to 3 years. Terms of lease include terms for renewal, cancellation etc. Initial Directcosts (commissioning, installation etc.) for such assets are borne by <strong>the</strong> lessee, o<strong>the</strong>r than transportation cost, which is borne by <strong>the</strong>company and charged off to revenue. Lease rentals recognised as income during <strong>the</strong> year 152,371 (Previous Year 101,795). O<strong>the</strong>r detailsfor such Plant and Machinery are as below.Gross value Accumulated Depreciation DepreciationAs atAs atAs atAs atYear EndedYear Ended31.03.2009 31.03.200831.03.2009 31.03.200831.03.200931.03.2008568,207 446,776 158,582 114,122 69,179 49,58913. The group has taken various residential / commercial premises under cancellable operating lease. Leases range for periods between3 to 5 years. Terms of <strong>the</strong> lease include operating term for renewal, increase in rent for future periods, terms of cancellation etc. Theoperating lease payments for <strong>the</strong> year amount to 21,842 (previous year 19,597).14. 14.1 The Parent Company had allotted on 28th December, 2007,on a preferential basis, to <strong>the</strong> Indian Promoter Group and certaino<strong>the</strong>r companies / entities / persons (hereinafter referred to as Select Group), 2,993,842 Convertible Equity Warrants againstreceipt of 10% of <strong>the</strong> consideration of Rs. 326/- per Warrant, determined in keeping with <strong>the</strong> related Securities and ExchangeBoard of India (SEBI) Guidelines. Each Warrant is convertible into one equity Share of nominal value of Rs. 10/- each at a price ofRs. 326/- per share in lots at <strong>the</strong> option of <strong>the</strong> warrant holders within eighteen months from <strong>the</strong> date of allotment in accordancewith relevant SEBI Guidelines and <strong>the</strong> terms of <strong>the</strong> issue upon payment of balance consideration by <strong>the</strong> warrant holders; suchshares would rank pari passu in all respect with <strong>the</strong> existing Equity Shares.Out of <strong>the</strong> said 2,993,842 convertible Equity Warrants, <strong>the</strong> Parent Company upon realisation of balance consideration and exerciseof conversion option by certain warrant holders (out of <strong>the</strong> Indian Promoter Group), issued and allotted during March, 2008,300,135 nos of Equity Shares of Rs. 10/- each at a premium of Rs. 316/- per share against conversion of equivalent number ofEquity Warrants.14.2 Balance of Proceeds received upon allotment of Equity Share Warrants and Equity Shares during previous year have been u<strong>til</strong>isedduring <strong>the</strong> year, as given below :Capital Expenditure on expansion projects :-Balance lying in <strong>the</strong> Cash Credit Account as on 01.04.2008 95,652U<strong>til</strong>ised in <strong>the</strong> current year 95,652Balance lying in <strong>the</strong> Cash Credit Account to be u<strong>til</strong>ised in 2009-10 -15. Information given in accordance with <strong>the</strong> requirements of Accounting Standard 17 on “Segment Reporting”The Group’s business segments are organised on product lines as follows:- Material Handling Solution (MHS)- engaged in manufacturing and marketing of various Material Handling Equipment namelyMobile Cranes, Port Equipment (Reach stacker, Level Luffing Cranes), Self Loading Truck Cranes etc. It also deals in spares for <strong>the</strong>above equipment and servicing <strong>the</strong> equipment.- Power System Solutions (PSS) - engaged in assembly, supply, erection and commissioning of Diesel Generating Sets based onCaterpillar Inc. engines. It also deals in spares and servicing <strong>the</strong> generating sets mainly in Eastern & Nor<strong>the</strong>rn India.- Construction Mining Solutions (CMS) - engaged as a dealer for Caterpillar Inc. USA for <strong>the</strong>ir products like Excavators, Dumpers,Dozers, Motor Graders etc. mainly in Eastern & Nor<strong>the</strong>rn India, Bhutan, Nepal and Myanmar. It also deals in spares and servicesfor <strong>the</strong> above equipment sold in <strong>the</strong> above areas.O<strong>the</strong>rs represents all unallocated expenditure and includes expenses incurred on common services provided to <strong>the</strong> segmentswhich are not directly identifiable to <strong>the</strong> individual segments as well as expenses incurred at <strong>the</strong> corporate level which relate to <strong>the</strong>company as a whole.091Financial Statements (Consolidated)