view / download the documents. - til india

view / download the documents. - til india

view / download the documents. - til india

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

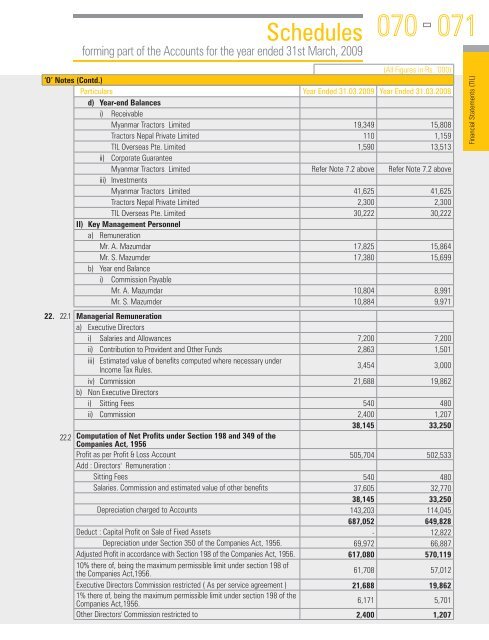

Schedulesforming part of <strong>the</strong> Accounts for <strong>the</strong> year ended 31st March, 2009070071(All Figures in Rs. ‘000)‘O’ Notes (Contd.)Particulars Year Ended 31.03.2009 Year Ended 31.03.2008d) Year-end Balancesi) ReceivableMyanmar Tractors Limited 19,349 15,808Tractors Nepal Private Limited 110 1,159TIL Overseas Pte. Limited 1,590 13,513ii) Corporate GuaranteeMyanmar Tractors Limited Refer Note 7.2 above Refer Note 7.2 aboveiii) InvestmentsMyanmar Tractors Limited 41,625 41,625Tractors Nepal Private Limited 2,300 2,300TIL Overseas Pte. Limited 30,222 30,222II) Key Management Personnela) RemunerationMr. A. Mazumdar 17,825 15,864Mr. S. Mazumder 17,380 15,699b) Year end Balancei) Commission PayableMr. A. Mazumdar 10,804 8,991Mr. S. Mazumder 10,884 9,97122. 22.1 Managerial Remunerationa) Executive Directorsi) Salaries and Allowances 7,200 7,200ii) Contribution to Provident and O<strong>the</strong>r Funds 2,863 1,501iii) Estimated value of benefits computed where necessary underIncome Tax Rules.3,454 3,000iv) Commission 21,688 19,862b) Non Executive Directorsi) Sitting Fees 540 480ii) Commission 2,400 1,20738,145 33,25022.2 Computation of Net Profits under Section 198 and 349 of <strong>the</strong>Companies Act, 1956Profit as per Profit & Loss Account 505,704 502,533Add : Directors' Remuneration :Sitting Fees 540 480Salaries. Commission and estimated value of o<strong>the</strong>r benefits 37,605 32,77038,145 33,250Depreciation charged to Accounts 143,203 114,045687,052 649,828Deduct : Capital Profit on Sale of Fixed Assets - 12,822Depreciation under Section 350 of <strong>the</strong> Companies Act, 1956. 69,972 66,887Adjusted Profit in accordance with Section 198 of <strong>the</strong> Companies Act, 1956. 617,080 570,11910% <strong>the</strong>re of, being <strong>the</strong> maximum permissible limit under section 198 of<strong>the</strong> Companies Act,1956.61,708 57,012Executive Directors Commission restricted ( As per service agreement ) 21,688 19,8621% <strong>the</strong>re of, being <strong>the</strong> maximum permissible limit under section 198 of <strong>the</strong>Companies Act,1956.6,171 5,701O<strong>the</strong>r Directors' Commission restricted to 2,400 1,207Financial Statements (TIL)