view / download the documents. - til india

view / download the documents. - til india

view / download the documents. - til india

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

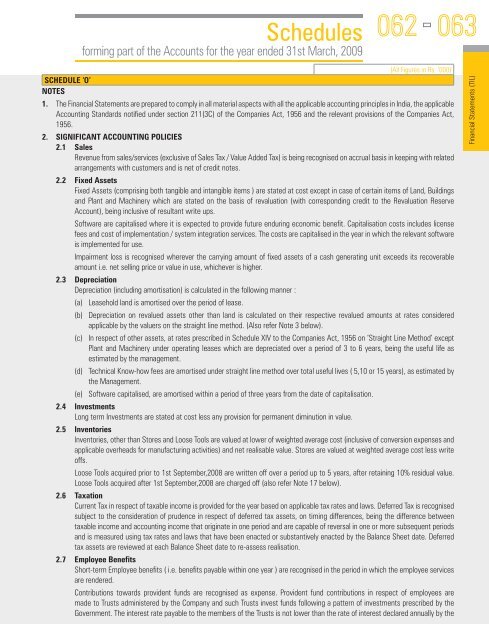

Schedulesforming part of <strong>the</strong> Accounts for <strong>the</strong> year ended 31st March, 2009062063(All Figures in Rs. ‘000)SCHEDULE ‘O’NOTES1. The Financial Statements are prepared to comply in all material aspects with all <strong>the</strong> applicable accounting principles in India, <strong>the</strong> applicableAccounting Standards notified under section 211(3C) of <strong>the</strong> Companies Act, 1956 and <strong>the</strong> relevant provisions of <strong>the</strong> Companies Act,1956.2. SIGNIFICANT ACCOUNTING POLICIES2.1 SalesRevenue from sales/services (exclusive of Sales Tax / Value Added Tax) is being recognised on accrual basis in keeping with relatedarrangements with customers and is net of credit notes.2.2 Fixed AssetsFixed Assets (comprising both tangible and intangible items ) are stated at cost except in case of certain items of Land, Buildingsand Plant and Machinery which are stated on <strong>the</strong> basis of revaluation (with corresponding credit to <strong>the</strong> Revaluation ReserveAccount), being inclusive of resultant write ups.Software are capitalised where it is expected to provide future enduring economic benefit. Capitalisation costs includes licensefees and cost of implementation / system integration services. The costs are capitalised in <strong>the</strong> year in which <strong>the</strong> relevant softwareis implemented for use.Impairment loss is recognised wherever <strong>the</strong> carrying amount of fixed assets of a cash generating unit exceeds its recoverableamount i.e. net selling price or value in use, whichever is higher.2.3 DepreciationDepreciation (including amortisation) is calculated in <strong>the</strong> following manner :(a) Leasehold land is amortised over <strong>the</strong> period of lease.(b) Depreciation on revalued assets o<strong>the</strong>r than land is calculated on <strong>the</strong>ir respective revalued amounts at rates consideredapplicable by <strong>the</strong> valuers on <strong>the</strong> straight line method. (Also refer Note 3 below).(c) In respect of o<strong>the</strong>r assets, at rates prescribed in Schedule XIV to <strong>the</strong> Companies Act, 1956 on ‘Straight Line Method’ exceptPlant and Machinery under operating leases which are depreciated over a period of 3 to 6 years, being <strong>the</strong> useful life asestimated by <strong>the</strong> management.(d) Technical Know-how fees are amortised under straight line method over total useful lives ( 5,10 or 15 years), as estimated by<strong>the</strong> Management.(e) Software capitalised, are amortised within a period of three years from <strong>the</strong> date of capitalisation.2.4 InvestmentsLong term Investments are stated at cost less any provision for permanent diminution in value.2.5 InventoriesInventories, o<strong>the</strong>r than Stores and Loose Tools are valued at lower of weighted average cost (inclusive of conversion expenses andapplicable overheads for manufacturing activities) and net realisable value. Stores are valued at weighted average cost less writeoffs.Loose Tools acquired prior to 1st September,2008 are written off over a period up to 5 years, after retaining 10% residual value.Loose Tools acquired after 1st September,2008 are charged off (also refer Note 17 below).2.6 TaxationCurrent Tax in respect of taxable income is provided for <strong>the</strong> year based on applicable tax rates and laws. Deferred Tax is recognisedsubject to <strong>the</strong> consideration of prudence in respect of deferred tax assets, on timing differences, being <strong>the</strong> difference betweentaxable income and accounting income that originate in one period and are capable of reversal in one or more subsequent periodsand is measured using tax rates and laws that have been enacted or substantively enacted by <strong>the</strong> Balance Sheet date. Deferredtax assets are re<strong>view</strong>ed at each Balance Sheet date to re-assess realisation.2.7 Employee BenefitsShort-term Employee benefits ( i.e. benefits payable within one year ) are recognised in <strong>the</strong> period in which <strong>the</strong> employee servicesare rendered.Contributions towards provident funds are recognised as expense. Provident fund contributions in respect of employees aremade to Trusts administered by <strong>the</strong> Company and such Trusts invest funds following a pattern of investments prescribed by <strong>the</strong>Government. The interest rate payable to <strong>the</strong> members of <strong>the</strong> Trusts is not lower than <strong>the</strong> rate of interest declared annually by <strong>the</strong>Financial Statements (TIL)