view / download the documents. - til india

view / download the documents. - til india

view / download the documents. - til india

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

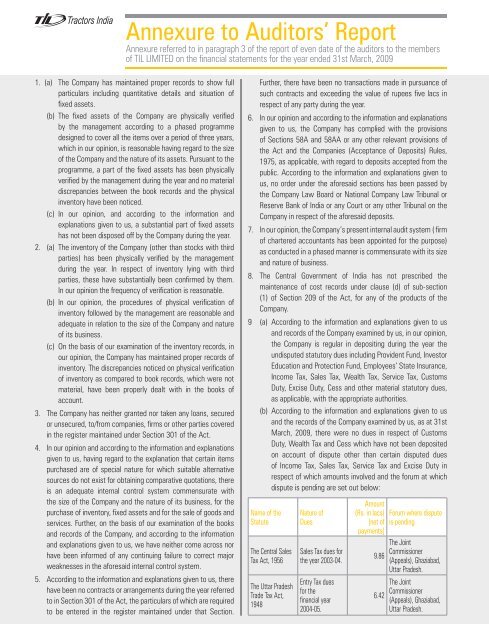

Annexure to Auditors’ ReportAnnexure referred to in paragraph 3 of <strong>the</strong> report of even date of <strong>the</strong> auditors to <strong>the</strong> membersof TIL LIMITED on <strong>the</strong> financial statements for <strong>the</strong> year ended 31st March, 20091. (a) The Company has maintained proper records to show fullparticulars including quantitative details and situation offixed assets.(b) The fixed assets of <strong>the</strong> Company are physically verifiedby <strong>the</strong> management according to a phased programmedesigned to cover all <strong>the</strong> items over a period of three years,which in our opinion, is reasonable having regard to <strong>the</strong> sizeof <strong>the</strong> Company and <strong>the</strong> nature of its assets. Pursuant to <strong>the</strong>programme, a part of <strong>the</strong> fixed assets has been physicallyverified by <strong>the</strong> management during <strong>the</strong> year and no materialdiscrepancies between <strong>the</strong> book records and <strong>the</strong> physicalinventory have been noticed.(c) In our opinion, and according to <strong>the</strong> information andexplanations given to us, a substantial part of fixed assetshas not been disposed off by <strong>the</strong> Company during <strong>the</strong> year.2. (a) The inventory of <strong>the</strong> Company (o<strong>the</strong>r than stocks with thirdparties) has been physically verified by <strong>the</strong> managementduring <strong>the</strong> year. In respect of inventory lying with thirdparties, <strong>the</strong>se have substantially been confirmed by <strong>the</strong>m.In our opinion <strong>the</strong> frequency of verification is reasonable.(b) In our opinion, <strong>the</strong> procedures of physical verification ofinventory followed by <strong>the</strong> management are reasonable andadequate in relation to <strong>the</strong> size of <strong>the</strong> Company and natureof its business.(c) On <strong>the</strong> basis of our examination of <strong>the</strong> inventory records, inour opinion, <strong>the</strong> Company has maintained proper records ofinventory. The discrepancies noticed on physical verificationof inventory as compared to book records, which were notmaterial, have been properly dealt with in <strong>the</strong> books ofaccount.3. The Company has nei<strong>the</strong>r granted nor taken any loans, securedor unsecured, to/from companies, firms or o<strong>the</strong>r parties coveredin <strong>the</strong> register maintained under Section 301 of <strong>the</strong> Act.4. In our opinion and according to <strong>the</strong> information and explanationsgiven to us, having regard to <strong>the</strong> explanation that certain itemspurchased are of special nature for which suitable alternativesources do not exist for obtaining comparative quotations, <strong>the</strong>reis an adequate internal control system commensurate with<strong>the</strong> size of <strong>the</strong> Company and <strong>the</strong> nature of its business, for <strong>the</strong>purchase of inventory, fixed assets and for <strong>the</strong> sale of goods andservices. Fur<strong>the</strong>r, on <strong>the</strong> basis of our examination of <strong>the</strong> booksand records of <strong>the</strong> Company, and according to <strong>the</strong> informationand explanations given to us, we have nei<strong>the</strong>r come across norhave been informed of any continuing failure to correct majorweaknesses in <strong>the</strong> aforesaid internal control system.5. According to <strong>the</strong> information and explanations given to us, <strong>the</strong>rehave been no contracts or arrangements during <strong>the</strong> year referredto in Section 301 of <strong>the</strong> Act, <strong>the</strong> particulars of which are requiredto be entered in <strong>the</strong> register maintained under that Section.Fur<strong>the</strong>r, <strong>the</strong>re have been no transactions made in pursuance ofsuch contracts and exceeding <strong>the</strong> value of rupees five lacs inrespect of any party during <strong>the</strong> year.6. In our opinion and according to <strong>the</strong> information and explanationsgiven to us, <strong>the</strong> Company has complied with <strong>the</strong> provisionsof Sections 58A and 58AA or any o<strong>the</strong>r relevant provisions of<strong>the</strong> Act and <strong>the</strong> Companies (Acceptance of Deposits) Rules,1975, as applicable, with regard to deposits accepted from <strong>the</strong>public. According to <strong>the</strong> information and explanations given tous, no order under <strong>the</strong> aforesaid sections has been passed by<strong>the</strong> Company Law Board or National Company Law Tribunal orReserve Bank of India or any Court or any o<strong>the</strong>r Tribunal on <strong>the</strong>Company in respect of <strong>the</strong> aforesaid deposits.7. In our opinion, <strong>the</strong> Company’s present internal audit system ( firmof chartered accountants has been appointed for <strong>the</strong> purpose)as conducted in a phased manner is commensurate with its sizeand nature of business.8. The Central Government of India has not prescribed <strong>the</strong>maintenance of cost records under clause (d) of sub-section(1) of Section 209 of <strong>the</strong> Act, for any of <strong>the</strong> products of <strong>the</strong>Company.9 (a) According to <strong>the</strong> information and explanations given to usand records of <strong>the</strong> Company examined by us, in our opinion,<strong>the</strong> Company is regular in depositing during <strong>the</strong> year <strong>the</strong>undisputed statutory dues including Provident Fund, InvestorEducation and Protection Fund, Employees’ State Insurance,Income Tax, Sales Tax, Wealth Tax, Service Tax, CustomsDuty, Excise Duty, Cess and o<strong>the</strong>r material statutory dues,as applicable, with <strong>the</strong> appropriate authorities.(b) According to <strong>the</strong> information and explanations given to usand <strong>the</strong> records of <strong>the</strong> Company examined by us, as at 31stMarch, 2009, <strong>the</strong>re were no dues in respect of CustomsDuty, Wealth Tax and Cess which have not been depositedon account of dispute o<strong>the</strong>r than certain disputed duesof Income Tax, Sales Tax, Service Tax and Excise Duty inrespect of which amounts involved and <strong>the</strong> forum at whichdispute is pending are set out below:Name of <strong>the</strong>StatuteThe Central SalesTax Act, 1956The Uttar PradeshTrade Tax Act,1948Nature ofDuesSales Tax dues for<strong>the</strong> year 2003-04.Entry Tax duesfor <strong>the</strong>financial year2004-05.Amount(Rs. in lacs)[net ofpayments]9.866.42Forum where disputeis pendingThe JointCommissioner(Appeals), Ghaziabad,Uttar Pradesh.The JointCommissioner(Appeals), Ghaziabad,Uttar Pradesh.