view / download the documents. - til india

view / download the documents. - til india

view / download the documents. - til india

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

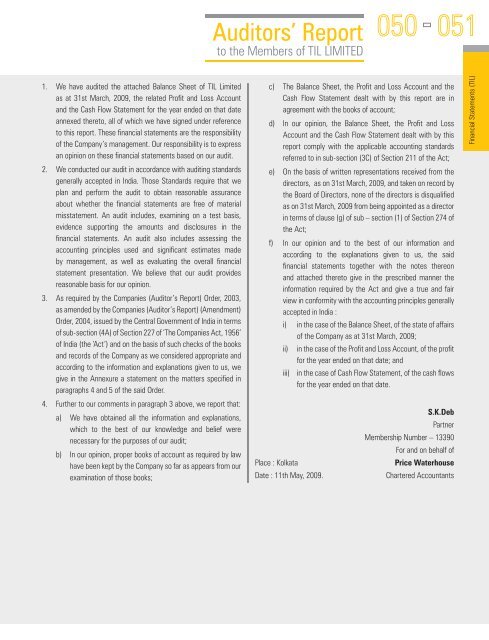

Auditors’ Reportto <strong>the</strong> Members of TIL LIMITED0500511. We have audited <strong>the</strong> attached Balance Sheet of TIL Limitedas at 31st March, 2009, <strong>the</strong> related Profit and Loss Accountand <strong>the</strong> Cash Flow Statement for <strong>the</strong> year ended on that dateannexed <strong>the</strong>reto, all of which we have signed under referenceto this report. These financial statements are <strong>the</strong> responsibilityof <strong>the</strong> Company’s management. Our responsibility is to expressan opinion on <strong>the</strong>se financial statements based on our audit.2. We conducted our audit in accordance with auditing standardsgenerally accepted in India. Those Standards require that weplan and perform <strong>the</strong> audit to obtain reasonable assuranceabout whe<strong>the</strong>r <strong>the</strong> financial statements are free of materialmisstatement. An audit includes, examining on a test basis,evidence supporting <strong>the</strong> amounts and disclosures in <strong>the</strong>financial statements. An audit also includes assessing <strong>the</strong>accounting principles used and significant estimates madeby management, as well as evaluating <strong>the</strong> overall financialstatement presentation. We believe that our audit providesreasonable basis for our opinion.3. As required by <strong>the</strong> Companies (Auditor’s Report) Order, 2003,as amended by <strong>the</strong> Companies (Auditor’s Report) (Amendment)Order, 2004, issued by <strong>the</strong> Central Government of India in termsof sub-section (4A) of Section 227 of ‘The Companies Act, 1956’of India (<strong>the</strong> ‘Act’) and on <strong>the</strong> basis of such checks of <strong>the</strong> booksand records of <strong>the</strong> Company as we considered appropriate andaccording to <strong>the</strong> information and explanations given to us, wegive in <strong>the</strong> Annexure a statement on <strong>the</strong> matters specified inparagraphs 4 and 5 of <strong>the</strong> said Order.4. Fur<strong>the</strong>r to our comments in paragraph 3 above, we report that:a) We have obtained all <strong>the</strong> information and explanations,which to <strong>the</strong> best of our knowledge and belief werenecessary for <strong>the</strong> purposes of our audit;b) In our opinion, proper books of account as required by lawhave been kept by <strong>the</strong> Company so far as appears from ourexamination of those books;c) The Balance Sheet, <strong>the</strong> Profit and Loss Account and <strong>the</strong>Cash Flow Statement dealt with by this report are inagreement with <strong>the</strong> books of account;d) In our opinion, <strong>the</strong> Balance Sheet, <strong>the</strong> Profit and LossAccount and <strong>the</strong> Cash Flow Statement dealt with by thisreport comply with <strong>the</strong> applicable accounting standardsreferred to in sub-section (3C) of Section 211 of <strong>the</strong> Act;e) On <strong>the</strong> basis of written representations received from <strong>the</strong>directors, as on 31st March, 2009, and taken on record by<strong>the</strong> Board of Directors, none of <strong>the</strong> directors is disqualifiedas on 31st March, 2009 from being appointed as a directorin terms of clause (g) of sub – section (1) of Section 274 of<strong>the</strong> Act;f) In our opinion and to <strong>the</strong> best of our information andaccording to <strong>the</strong> explanations given to us, <strong>the</strong> saidfinancial statements toge<strong>the</strong>r with <strong>the</strong> notes <strong>the</strong>reonand attached <strong>the</strong>reto give in <strong>the</strong> prescribed manner <strong>the</strong>information required by <strong>the</strong> Act and give a true and fair<strong>view</strong> in conformity with <strong>the</strong> accounting principles generallyaccepted in India :i) in <strong>the</strong> case of <strong>the</strong> Balance Sheet, of <strong>the</strong> state of affairsof <strong>the</strong> Company as at 31st March, 2009;ii) in <strong>the</strong> case of <strong>the</strong> Profit and Loss Account, of <strong>the</strong> profitfor <strong>the</strong> year ended on that date; andiii) in <strong>the</strong> case of Cash Flow Statement, of <strong>the</strong> cash flowsfor <strong>the</strong> year ended on that date.Place : KolkataDate : 11th May, 2009.S.K.DebPartnerMembership Number – 13390For and on behalf ofPrice WaterhouseChartered AccountantsFinancial Statements (TIL)