| Special Reports 專 題 報 導 |問 : 香 港 經 濟 又 如 何 ?答 :2004 至 2009 年 是 香 港 經 濟 最 活 躍 的 時 期 ;2010 至 15 年 , 經 濟 處 於下 滑 的 形 勢 , 而 由 於 2012 年 屬 於 虛 火 年 , 因 此 經 濟 在 出 現 輕 微 反 彈後 , 會 再 度 下 跌 ; 直 至 2016 至 2021 年 , 香 港 才 回 復 升 軌 。問 : 中 國 近 年 經 濟 快 速 崛 起 , 不 少 與 大 陸 經 貿 關 係 密 切 的 企 業 也 十 分 關注 中 國 前 景 , 龍 年 中 國 的 發 展 又 將 如 何 ?答 : 中 國 西 面 有 水 的 地 區 正 行 地 運 , 加 上 競 爭 較 小 , 因 此 企 業 在 當 地 發問 : 龍 年 有 何 特 性 ?展 的 成 功 機 會 也 較 高 。 舉 例 說 , 甘 肅 省 會 蘭 州 的 樓 價 在 短 短 一 年 間 已 上答 : 龍 年 是 虛 火 年 , 經 濟 上 表 面 活 躍 , 但 實 際 卻 是 假 象 , 情 升 一 倍 ( 蘭 州 是 中 國 西 北 區 域 中 心 城 市 , 位 於 黃 河 上 游 ); 位 於 中 國 中況 與 千 禧 年 科 網 泡 沫 爆 破 相 近 。 另 外 , 龍 年 亦 是 腸 胃 疾 病 西 部 的 四 川 省 成 都 市 亦 發 展 迅 速 , 當 地 房 價 大 漲 , 經 濟 起 飛 , 做 生 意 固年 , 所 以 大 家 必 須 注 意 飲 食 。然 有 好 處 。 相 反 , 北 京 及 上 海 等 城 市 欠 缺 地 運 , 加 上 當 地 白 熱 化 的 競爭 , 企 業 將 面 對 嚴 峻 的 挑 戰 。問 : 隨 著 歐 債 危 機 愈 演 愈 烈 , 龍 年 全 球 經 濟 有 何 發 展 ?答 : 歐 洲 經 濟 自 2008 至 2009 年 起 步 入 衰 退 , 最 快 於 2014 問 : 哪 至 些 行 業 在 龍 年 最 好 運 , 哪 些 又 有 困 難 ?2015 年 才 跌 至 谷 底 , 可 見 歐 債 危 機 仍 未 結 束 。 就 美 國 而 言 , 答 :2011 年 , 最 差 的 行 業 是 與 「 水 」 相 關 的 行 業 , 包 括 航 運 、 貿 易 及自 從 2006 年 起 開 始 衰 退 , 到 2012 年 到 谷 底 , 已 逐 步 回 升 銀 , 行 , 但 2011 年 到 谷 底 , 因 此 明 年 這 些 行 業 的 值 博 率 較 高 。 買 股 票 的由 於 美 國 經 濟 再 下 滑 的 成 數 較 低 , 企 業 應 密 切 留 意 當 地 巿 場 人 士 , 明 年 可 多 加 留 意 航 運 及 銀 行 等 股 票 。發 展 。問 : 如 果 今 年 生 意 不 順 利 , 在 龍 年 有 否 方 法 趨 吉 避 凶 ?問 : 除 美 國 外 , 哪 些 國 家 或 地 區 在 龍 年 將 會 有 蓬 勃 發 展 ? 答 : 龍 年 的 財 位 在 正 西 、 西 北 及 東 北 , 三 方 各 放 一 杯 水 可 催 財 。答 :2004 年 之 前 , 東 邊 有 水 的 國 家 或 地 區 發 展 迅 速 ( 有 水 指靠 近 海 洋 、 湖 泊 及 河 流 ); 但 該 年 之 後 , 西 方 有 水 的 國 家 或 問 : 龍 年 應 否 創 業 , 還 是 應 該 守 業 ?地 區 就 會 興 旺 起 來 。 馬 來 西 亞 就 是 很 好 的 例 子 , 當 地 經 濟 以 答 : 香 港 經 濟 於 2013 至 2016 年 呈 下 滑 走 勢 , 因 此 龍 年 守 業 較 創 業 好 。往 一 向 遠 遠 落 後 於 其 他 國 家 , 但 近 年 經 濟 發 展 蓬 勃 , 吸 引 不 龍 年 對 賣 平 貨 的 公 司 有 利 , 奢 侈 品 生 意 會 較 遜 色 。少 外 資 , 包 括 來 自 中 東 及 北 非 等 地 區 的 投 資 者 。近 來 , 中 東 及 北 非 等 地 區 政 局 動 盪 , 並 受 歐 債 危 機 升 級 問 : 企 業 龍 年 應 有 何 策 略 ?影 響 , 引 發 資 金 撤 離 , 因 此 同 屬 回 教 國 家 的 馬 來 西 亞 最 受 青 答 : 雖 然 經 濟 處 於 下 跌 形 勢 , 但 龍 年 香 港 經 濟 尚 算 可 以 , 到 2013 至睞 。 另 外 , 馬 來 西 亞 目 前 樓 價 只 及 香 港 的 五 分 之 一 , 可 見 發 2015 年 才 擔 心 也 未 遲 。 未 來 將 有 一 場 淘 汰 戰 , 企 業 應 保 留 現 金 , 以 成展 潛 力 強 大 , 加 上 乘 著 地 運 起 飛 , 當 地 經 濟 可 望 看 高 一 線 。 為 汰 弱 留 強 中 的 強 者 。Dog (1946, 1958, 1970, 1982, 1994, 2006)Honest, loyal, sincere. Believes in justice for all. Fights forprinciples. Sometimes bad tempered, self-righteous.忠 誠 正 直 。 相 信 公 義 。 堅 守 原 則 。 偶 爾 比 較 易 怒 , 自 以 為 是 。will be another tough year for dogs, as you will haveThis to confront many changes in terms <strong>of</strong> relationships, career,and your living and work places. However, not all <strong>of</strong> these arenecessarily bad. <strong>The</strong>se changes could improve your social status,result in a promotion, or entrepreneurs’ businesses mayget a boost. Dogs need to watch their health in 2012, as thereare signs you may have abdominal issues. So make sure you getplenty <strong>of</strong> sleep and keep stress levels low.狗 今 年 是 艱 難 的 一 年 , 變 化 必 多 , 容 易 有 感 情 、 事 業 、 住 屋 或 工肖 作 地 點 等 變 化 , 但 變 化 本 身 難 言 好 壞 , 因 變 化 可 以 是 地 位 提 升 、升 遷 或 業 務 擴 展 。 肖 狗 人 士 在 2012 年 需 留 意 健 康 , 尤 其 是 腹 部 和 腸 胃病 , 因 此 要 確 保 睡 眠 充 足 , 並 盡 量 放 鬆 心 情 , 減 輕 壓 力 。Pig (1947, 1959, 1971, 1983, 1995, 2007)Kind and thoughtful. Sincere and honourable. Self-sacrificingand altruistic. Occasional fits <strong>of</strong> wilfulness and rage.親 切 體 貼 。 誠 懇 正 直 。 自 我 犧 牲 , 成 全 別 人 。 有 時 顯 得 倔 強 、任 性 。Pigs will be lucky in love and relationships this year. Single pigscan use this year to find the love <strong>of</strong> their life as the star <strong>of</strong>lasting relationships is shining upon you. It is also a good yearfor investing, although you are advised to think short-term, andthis luck should last until spring 2013. You will also get usefulhelp from powerful figures who will take you under their wingto boost your career or business. You don’t have much to worryabout this year, although you might lose some personal possessions,so look after your belongings.肖豬 今 年 為 紅 鸞 桃 花 年 。 單 身 的 你 容 易 在 今 年 開 展 一 段 長 久 關 係 。 今年 亦 宜 投 資 , 但 以 短 線 為 佳 , 因 這 流 年 好 運 最 多 能 延 續 至 2013 年 春季 。 你 會 得 到 有 勢 力 的 貴 人 扶 助 , 讓 你 事 業 或 業 務 更 上 一 層 樓 。 肖 豬 者 今年 除 了 容 易 遺 失 個 人 物 品 外 , 並 沒 有 其 他 事 情 要 特 別 提 防 。38 January 2012 <strong>The</strong> Bulletin 工 商 月 刊

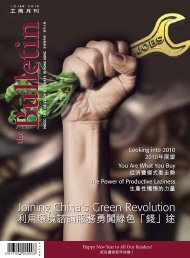

What do businesses企 業 需 要 甚 麼 銀 行 服 務 ?<strong>The</strong> ever increasing trade opportunities with Mainland Chinese companies,liberalization <strong>of</strong> the Renminbi (RMB) and expansion <strong>of</strong> RMB productsin <strong>Hong</strong> <strong>Kong</strong> are bringing real benefits to <strong>Hong</strong> <strong>Kong</strong> companies,not least cost savings and simplicity <strong>of</strong> trading in the same currency. <strong>The</strong> growingdemand for RMB services is also causing businesses to re-evaluate if theyare getting the best out <strong>of</strong> their bank partnership.Susan Yuen, Chief Executive Officer,ANZ <strong>Hong</strong> <strong>Kong</strong>澳 盛 銀 行 香 港 區 行 政 總 裁 袁 素 明Why change banks?Susan Yuen, Chief Executive Officer for ANZ in <strong>Hong</strong> <strong>Kong</strong>, suggests businessesshould consider developing relationships with a number <strong>of</strong> banks.“<strong>The</strong>re are a number <strong>of</strong> reasons for this, as a business grows, its requirementsalso change and sometimes it is sensible to have the support <strong>of</strong> more than onebank for large transactions,” she explained. “Also, given the current economicenvironment, some banks might be constrained by the level <strong>of</strong> support theycan <strong>of</strong>fer, which also limits their opportunities to expand with customers. <strong>The</strong>refore,it makes sense to have relationships with more than one bank.”Customer relationships & industry expertiseYuen stresses there should always be trust and honesty between both partiesin a relationship. Banks, for example, are commonly asked if they will supportbusinesses through difficult times.Yuen said ANZ does not enter into relationships for the short term; they arethere to work with their clients through good times and bad. However this doesnot mean they can grant every financing request, but as in all good relationshipsthere should be honest and clear communication.“Our approach is very relationship based – a little different to other banks. Wetake time to understand our clients and their business and then provide themwith insights to help them make the right decisions,” she said.“For example, many manufacturing and trading companies are concernedabout foreign exchange risks, interest rates, and the economic environment.We help these businesses by providing timely economic research, such as dataand insight on the economic indicators for Greater China, trade flows, moneyflows etc.”ANZ also has specific industry specialisations with help desks located in acrossa number <strong>of</strong> markets in the region to work closely with customers and <strong>of</strong>fer insightsand advice on specific industries.