Good Health Can’t Wait.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Standalone Financial Statements Annual Report 2014 - 15<br />

NOTES TO FINANCIAL STATEMENTS<br />

(All amounts in Indian Rupees millions, except share data and where otherwise stated)<br />

2.36: FINANCIAL RISK MANAGEMENT<br />

The Company’s activities expose it to a variety of financial risks, including market risk, credit risk and liquidity risk. The Company’s primary risk management<br />

focus is to minimize potential adverse effects of market risk on its financial performance. The Company’s risk management assessment and policies and<br />

processes are established to identify and analyze the risks faced by the Company, to set appropriate risk limits and controls, and to monitor such risks<br />

and compliance with the same. Risk assessment and management policies and processes are reviewed regularly to reflect changes in market conditions<br />

and the Company’s activities. The Board of Directors and the Audit Committee are responsible for overseeing Company’s financial risk assessment and<br />

management policies and processes.<br />

a. Credit risk<br />

Credit risk is the risk of financial loss to the Company if a customer or counterparty to a financial instrument fails to meet its contractual obligations,<br />

and arises principally from the Company’s receivables from customers. Credit risk is managed through credit approvals, establishing credit limits and<br />

continuously monitoring the credit worthiness of customers to which the Company grants credit terms in the normal course of business. The Company<br />

establishes an allowance for doubtful debts and impairment that represents its estimate of incurred losses in respect of trade and other receivables.<br />

Trade receivables<br />

The Company’s exposure to credit risk is influenced mainly by the individual characteristics of each customer. The demographics of the customer, including<br />

the default risk of the industry and country, in which the customer operates, also has an influence on credit risk assessment. As at 31 March 2015 and 31<br />

March 2014, the maximum exposure to credit risk in relation to trade receivables is ` 47,117 and ` 45,615, respectively (net of allowances).<br />

Trade receivables include foreign currency receivables of USD 37 million (amounting to ` 2,333) from Dr. Reddy’s Venezuela, C.A., a wholly owned<br />

subsidiary of the Company in Venezuela. During the year ended 31 March 2015, the Venezuelan economy was adversely impacted by a significant<br />

decline in crude oil prices, leading to higher inflation rates and significantly delayed approvals for import payments. Further, Venezuelan government has<br />

introduced multi-tiered exchange rate system for different category of imports.<br />

As of 31 March 2015, the exchange rates in all the three aforesaid tiers are as follows:<br />

• CENCOEX preferential rate – 6.3 VEF per USD;<br />

• SICAD rate - 12 VEF per USD; and<br />

• SIMADI rate - approximately 193 VEF per USD.<br />

As per the existing laws in Venezuela, payments towards the importation of pharmaceutical products qualify for the CENCOEX preferential rate of 6.3 VEF<br />

per USD, and the Company’s Venezuelan subsidiary has been receiving approvals at such preferential rate. Accordingly, no provision for bad and doubtful<br />

debts is recorded during the year ended 31 March 2015 in respect of these outstanding trade receivables.<br />

Trade receivables that are neither past due nor impaired<br />

Trade receivables amounting to ` 28,687 and ` 30,673 were neither past due nor impaired as at 31 March2015 and 31 March 2014 respectively.<br />

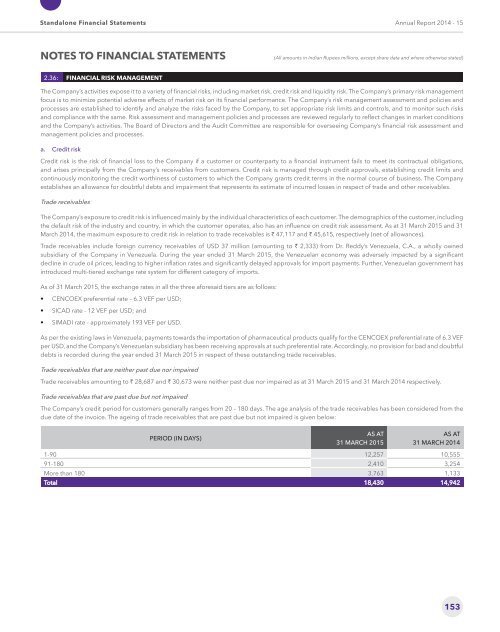

Trade receivables that are past due but not impaired<br />

The Company’s credit period for customers generally ranges from 20 – 180 days. The age analysis of the trade receivables has been considered from the<br />

due date of the invoice. The ageing of trade receivables that are past due but not impaired is given below:<br />

PERIOD (IN DAYS)<br />

AS AT<br />

31 MARCH 2015<br />

AS AT<br />

31 MARCH 2014<br />

1-90 12,257 10,555<br />

91-180 2,410 3,254<br />

More than 180 3,763 1,133<br />

Total 18,430 14,942<br />

153