Good Health Can’t Wait.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Statutory Reports • Management Discussion and Analysis Annual Report 2014 - 15<br />

PSAI BUSINESS<br />

HIGHLIGHTS FY2015<br />

` 25.46 bn<br />

6%<br />

REVENUE<br />

17% of Dr. Reddy’s total revenues.<br />

41%<br />

REVENUE FROM EUROPE<br />

MARGIN IMPROVEMENT<br />

Despite relatively low top-line growth,<br />

PSAI showed significant margin<br />

improvement thanks to a better<br />

product mix.<br />

77<br />

DMFs FILED GLOBALLY<br />

Including 12 in the US and 16 in<br />

Europe. Cumulatively, there were 735<br />

DMF filings as of 31 March 2015.<br />

imports. Despite uncertainties, we<br />

continue to remain positive about our<br />

therapy focused first to market approach<br />

in this market.<br />

PHARMACEUTICAL SERVICES AND<br />

ACTIVE INGREDIENTS (PSAI)<br />

Our PSAI segment includes active<br />

pharmaceutical ingredients,<br />

intermediates and contract research<br />

services business.<br />

The latest report from Transparency<br />

Market Research on active<br />

pharmaceutical ingredients (API)<br />

suggests that the segment, currently<br />

valued at approximately US$120 billion,<br />

is anticipated to grow at a CAGR of<br />

7% to reach US$180 billion by 2020.<br />

There has also been an increase in the<br />

influence of API players from emerging<br />

economies, especially India and China,<br />

which is expected to continue going<br />

forward.<br />

Although the life cycle of API emulates<br />

that of a commodity business, we expect<br />

our PSAI segment to show growth thanks<br />

to our investments in newer technologies<br />

and platforms of the future. We are also<br />

pursuing a partnership model to enable<br />

our customers to reach more markets<br />

faster and efficiently by leveraging our<br />

cost leadership and presence across<br />

the globe. We continue to be one of the<br />

significant API players in the industry,<br />

supporting internally as well as global<br />

customers such as Teva, Mylan, Sandoz,<br />

Actavis among others. Over one-third of<br />

our API sales in FY2015 were to the top<br />

five generics players in the world.<br />

FINANCIALS<br />

CONSOLIDATED FINANCIALS<br />

Table 2 below gives the abridged IFRS<br />

consolidated financial performance of<br />

Dr. Reddy’s for FY2015 compared to<br />

FY2014.<br />

REVENUES<br />

Revenues increased by 12% to ` 148,189<br />

million in FY2015. Revenue growth was<br />

largely driven by our Global Generics<br />

segment’s operations in the North<br />

America, Venezuela and India. Adverse<br />

exchange rates movement resulted in<br />

lower reported revenues because of the<br />

decrease in Indian rupee realization from<br />

sales in euro and Russian rouble.<br />

GROSS PROFIT<br />

Gross profit rose by 13% to ` 85,403<br />

million in FY2015. This translates to a<br />

gross profit margin of 57.6% in FY2015<br />

versus 57.4% in FY2014. The gross profit<br />

margin for Global Generics was 65.2%;<br />

and for the PSAI business, it was 22.4%.<br />

After taking into account the impact<br />

of the exchange rate fluctuations of<br />

the Indian rupee against multiple<br />

currencies in the markets in which<br />

the Company operates, gross profits<br />

from our Global Generics segment<br />

decreased due to impact of changes<br />

in our existing business mix (i.e., a fall<br />

in the share of sales of higher gross<br />

margin products and an increase in the<br />

share of relatively lower gross margin<br />

products). Factors that positively<br />

affected gross profit margins for the<br />

PSAI segment include an increase in<br />

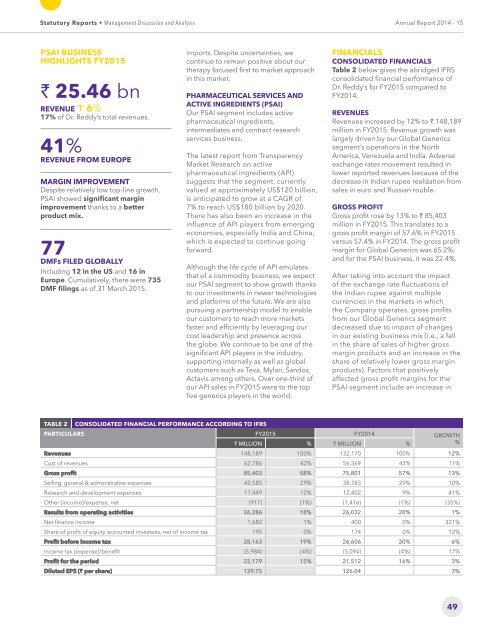

TABLE 2 CONSOLIDATED FINANCIAL PERFORMANCE ACCORDING TO IFRS<br />

PARTICULARS FY2015 FY2014 GROWTH<br />

` MILLION % W` MILLION %<br />

%<br />

Revenues 148,189 100% 132,170 100% 12%<br />

Cost of revenues 62,786 42% 56,369 43% 11%<br />

Gross profit 85,403 58% 75,801 57% 13%<br />

Selling, general & administrative expenses 42,585 29% 38,783 29% 10%<br />

Research and development expenses 17,449 12% 12,402 9% 41%<br />

Other (income)/expense, net (917) (1%) (1,416) (1%) (35%)<br />

Results from operating activities 26,286 18% 26,032 20% 1%<br />

Net finance income 1,682 1% 400 0% 321%<br />

Share of profit of equity accounted investees, net of income tax 195 0% 174 0% 12%<br />

Profit before income tax 28,163 19% 26,606 20% 6%<br />

Income tax (expense)/benefit (5,984) (4%) (5,094) (4%) 17%<br />

Profit for the period 22,179 15% 21,512 16% 3%<br />

Diluted EPS (` per share) 129.75 126.04 3%<br />

49