Good Health Can’t Wait.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Statutory Reports • Board’s Report<br />

Annual Report 2014 - 15<br />

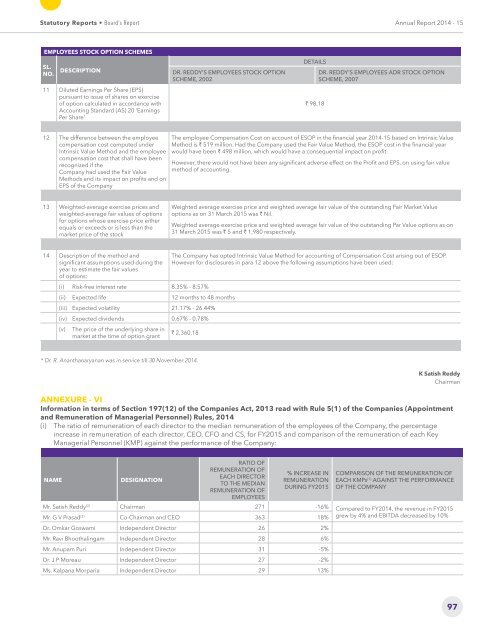

EMPLOYEES STOCK OPTION SCHEMES<br />

SL.<br />

NO.<br />

DESCRIPTION<br />

11 Diluted Earnings Per Share (EPS)<br />

pursuant to issue of shares on exercise<br />

of option calculated in accordance with<br />

Accounting Standard (AS) 20 ‘Earnings<br />

Per Share’<br />

DR. REDDY’S EMPLOYEES STOCK OPTION<br />

SCHEME, 2002<br />

DETAILS<br />

` 98.18<br />

DR. REDDY’S EMPLOYEES ADR STOCK OPTION<br />

SCHEME, 2007<br />

12 The difference between the employee<br />

compensation cost computed under<br />

Intrinsic Value Method and the employee<br />

compensation cost that shall have been<br />

recognized if the<br />

Company had used the Fair Value<br />

Methods and its impact on profits and on<br />

EPS of the Company<br />

The employee Compensation Cost on account of ESOP in the financial year 2014-15 based on Intrinsic Value<br />

Method is ` 519 million. Had the Company used the Fair Value Method, the ESOP cost in the financial year<br />

would have been ` 498 million, which would have a consequential impact on profit.<br />

However, there would not have been any significant adverse effect on the Profit and EPS, on using fair value<br />

method of accounting.<br />

13 Weighted-average exercise prices and<br />

weighted-average fair values of options<br />

for options whose exercise price either<br />

equals or exceeds or is less than the<br />

market price of the stock<br />

Weighted average exercise price and weighted average fair value of the outstanding Fair Market Value<br />

options as on 31 March 2015 was ` Nil.<br />

Weighted average exercise price and weighted average fair value of the outstanding Par Value options as on<br />

31 March 2015 was ` 5 and ` 1,980 respectively.<br />

14 Description of the method and<br />

significant assumptions used during the<br />

year to estimate the fair values<br />

of options:<br />

(i) Risk-free interest rate 8.35% - 8.57%<br />

(ii) Expected life 12 months to 48 months<br />

(iii) Expected volatility 21.17% - 26.44%<br />

(iv) Expected dividends 0.67% - 0.78%<br />

(v)<br />

The price of the underlying share in<br />

market at the time of option grant<br />

The Company has opted Intrinsic Value Method for accounting of Compensation Cost arising out of ESOP.<br />

However for disclosures in para 12 above the following assumptions have been used:<br />

` 2,360.18<br />

* Dr. R. Ananthanaryanan was in service till 30 November 2014.<br />

K Satish Reddy<br />

Chairman<br />

ANNEXURE - VI<br />

Information in terms of Section 197(12) of the Companies Act, 2013 read with Rule 5(1) of the Companies (Appointment<br />

and Remuneration of Managerial Personnel) Rules, 2014<br />

(i) The ratio of remuneration of each director to the median remuneration of the employees of the Company, the percentage<br />

increase in remuneration of each director, CEO, CFO and CS, for FY2015 and comparison of the remuneration of each Key<br />

Managerial Personnel (KMP) against the performance of the Company:<br />

NAME<br />

DESIGNATION<br />

RATIO OF<br />

REMUNERATION OF<br />

EACH DIRECTOR<br />

TO THE MEDIAN<br />

REMUNERATION OF<br />

EMPLOYEES<br />

% INCREASE IN<br />

REMUNERATION<br />

DURING FY2015<br />

COMPARISON OF THE REMUNERATION OF<br />

EACH KMPs (1) AGAINST THE PERFORMANCE<br />

OF THE COMPANY<br />

Mr. Satish Reddy (2) Chairman 271 -16% Compared to FY2014, the revenue in FY2015<br />

Mr. G V Prasad (2) Co-Chairman and CEO 363 18% grew by 4% and EBITDA decreased by 10%<br />

Dr. Omkar Goswami Independent Director 26 2%<br />

Mr. Ravi Bhoothalingam Independent Director 28 6%<br />

Mr. Anupam Puri Independent Director 31 -5%<br />

Dr. J P Moreau Independent Director 27 -2%<br />

Ms. Kalpana Morparia Independent Director 29 13%<br />

97