Good Health Can’t Wait.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Consolidated Financial Statements<br />

Annual Report 2014 - 15<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

(All amounts in Indian Rupees millions, except share data and where otherwise stated)<br />

2.35: EMPLOYEE BENEFIT PLANS (CONTINUED)<br />

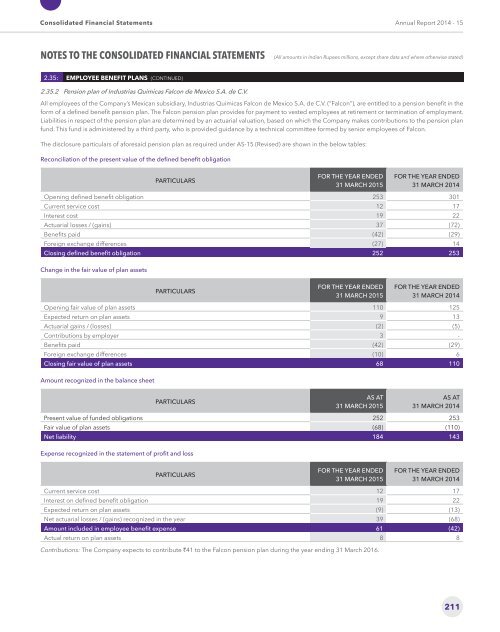

2.35.2 Pension plan of Industrias Quimicas Falcon de Mexico S.A. de C.V.<br />

All employees of the Company’s Mexican subsidiary, Industrias Quimicas Falcon de Mexico S.A. de C.V. (“Falcon”), are entitled to a pension benefit in the<br />

form of a defined benefit pension plan. The Falcon pension plan provides for payment to vested employees at retirement or termination of employment.<br />

Liabilities in respect of the pension plan are determined by an actuarial valuation, based on which the Company makes contributions to the pension plan<br />

fund. This fund is administered by a third party, who is provided guidance by a technical committee formed by senior employees of Falcon.<br />

The disclosure particulars of aforesaid pension plan as required under AS-15 (Revised) are shown in the below tables:<br />

Reconciliation of the present value of the defined benefit obligation<br />

PARTICULARS<br />

FOR THE YEAR ENDED<br />

31 MARCH 2015<br />

FOR THE YEAR ENDED<br />

31 MARCH 2014<br />

Opening defined benefit obligation 253 301<br />

Current service cost 12 17<br />

Interest cost 19 22<br />

Actuarial losses / (gains) 37 (72)<br />

Benefits paid (42) (29)<br />

Foreign exchange differences (27) 14<br />

Closing defined benefit obligation 252 253<br />

Change in the fair value of plan assets<br />

PARTICULARS<br />

FOR THE YEAR ENDED<br />

31 MARCH 2015<br />

FOR THE YEAR ENDED<br />

31 MARCH 2014<br />

Opening fair value of plan assets 110 125<br />

Expected return on plan assets 9 13<br />

Actuarial gains / (losses) (2) (5)<br />

Contributions by employer 3 -<br />

Benefits paid (42) (29)<br />

Foreign exchange differences (10) 6<br />

Closing fair value of plan assets 68 110<br />

Amount recognized in the balance sheet<br />

PARTICULARS<br />

AS AT<br />

31 MARCH 2015<br />

AS AT<br />

31 MARCH 2014<br />

Present value of funded obligations 252 253<br />

Fair value of plan assets (68) (110)<br />

Net liability 184 143<br />

Expense recognized in the statement of profit and loss<br />

PARTICULARS<br />

FOR THE YEAR ENDED<br />

31 MARCH 2015<br />

FOR THE YEAR ENDED<br />

31 MARCH 2014<br />

Current service cost 12 17<br />

Interest on defined benefit obligation 19 22<br />

Expected return on plan assets (9) (13)<br />

Net actuarial losses / (gains) recognized in the year 39 (68)<br />

Amount included in employee benefit expense 61 (42)<br />

Actual return on plan assets 8 8<br />

Contributions: The Company expects to contribute `41 to the Falcon pension plan during the year ending 31 March 2016.<br />

211