Good Health Can’t Wait.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Good</strong> <strong>Health</strong> <strong>Can’t</strong> <strong>Wait</strong>.<br />

Dr. Reddy’s Laboratories Limited<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

(All amounts in Indian Rupees millions, except share data and where otherwise stated)<br />

• The excess / deficit of cost to the parent company of its investment in the subsidiaries, joint ventures and associates over its portion of equity at<br />

the respective dates on which investment in such entities were made is recognised in the financial statements as goodwill / capital reserve.<br />

• The consolidated financial statements are presented, to the extent possible, in the same format as that adopted by the parent company for its<br />

separate financial statements.<br />

• The consolidated financial statements are prepared using uniform accounting policies for like transactions and other events in similar<br />

circumstances.<br />

e) Tangible fixed assets and depreciation<br />

Tangible fixed assets are carried at the cost of acquisition or construction less accumulated depreciation. The cost of tangible fixed assets includes<br />

non-refundable taxes, duties, freight and other incidental expenses related to the acquisition and installation of the respective assets.<br />

When parts of an item of property, plant and equipment have different useful lives, they are accounted for as separate items (major components) of<br />

property, plant and equipment.<br />

Subsequent expenditure related to an item of tangible fixed asset is capitalised only if it increases the future benefits from the existing assets beyond<br />

its previously assessed standards of performance.<br />

Depreciation on tangible fixed assets is provided using the straight-line method based on the useful life of the assets as estimated by Management.<br />

Depreciation is calculated on a pro-rata basis from the date of installation till the date the assets are sold or disposed.<br />

Assets acquired on finance leases and leasehold improvements are depreciated over the period of the lease agreement or the useful life whichever<br />

is shorter. Land is not depreciated.<br />

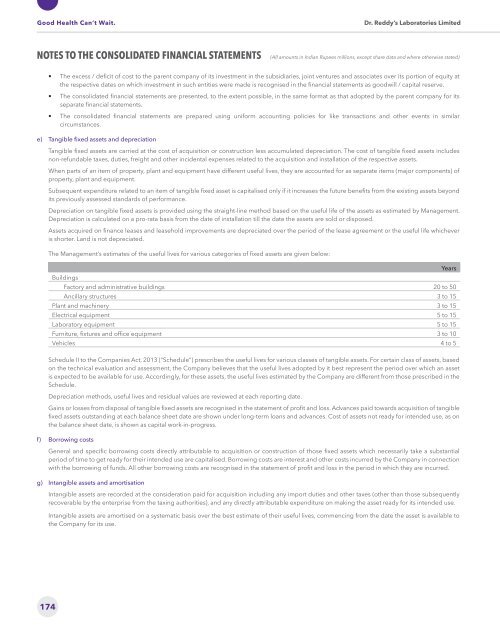

The Management’s estimates of the useful lives for various categories of fixed assets are given below:<br />

Buildings<br />

Factory and administrative buildings 20 to 50<br />

Ancillary structures 3 to 15<br />

Plant and machinery 3 to 15<br />

Electrical equipment 5 to 15<br />

Laboratory equipment 5 to 15<br />

Furniture, fixtures and office equipment 3 to 10<br />

Vehicles 4 to 5<br />

Schedule II to the Companies Act, 2013 (“Schedule”) prescribes the useful lives for various classes of tangible assets. For certain class of assets, based<br />

on the technical evaluation and assessment, the Company believes that the useful lives adopted by it best represent the period over which an asset<br />

is expected to be available for use. Accordingly, for these assets, the useful lives estimated by the Company are different from those prescribed in the<br />

Schedule.<br />

Depreciation methods, useful lives and residual values are reviewed at each reporting date.<br />

Gains or losses from disposal of tangible fixed assets are recognised in the statement of profit and loss. Advances paid towards acquisition of tangible<br />

fixed assets outstanding at each balance sheet date are shown under long-term loans and advances. Cost of assets not ready for intended use, as on<br />

the balance sheet date, is shown as capital work-in-progress.<br />

f) Borrowing costs<br />

General and specific borrowing costs directly attributable to acquisition or construction of those fixed assets which necessarily take a substantial<br />

period of time to get ready for their intended use are capitalised. Borrowing costs are interest and other costs incurred by the Company in connection<br />

with the borrowing of funds. All other borrowing costs are recognised in the statement of profit and loss in the period in which they are incurred.<br />

g) Intangible assets and amortisation<br />

Intangible assets are recorded at the consideration paid for acquisition including any import duties and other taxes (other than those subsequently<br />

recoverable by the enterprise from the taxing authorities), and any directly attributable expenditure on making the asset ready for its intended use.<br />

Intangible assets are amortised on a systematic basis over the best estimate of their useful lives, commencing from the date the asset is available to<br />

the Company for its use.<br />

<br />

Years<br />

174