Education

DoE Annual Report 2012-2013 - Department of Education

DoE Annual Report 2012-2013 - Department of Education

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

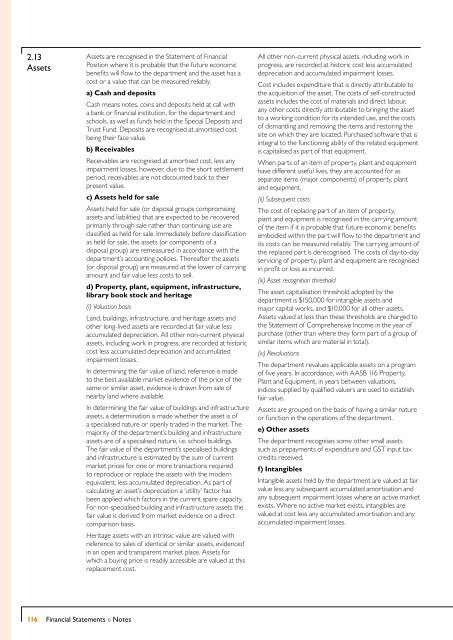

2.13<br />

Assets<br />

Assets are recognised in the Statement of Financial<br />

Position where it is probable that the future economic<br />

benefits will flow to the department and the asset has a<br />

cost or a value that can be measured reliably.<br />

a) Cash and deposits<br />

Cash means notes, coins and deposits held at call with<br />

a bank or financial institution, for the department and<br />

schools, as well as funds held in the Special Deposits and<br />

Trust Fund. Deposits are recognised at amortised cost<br />

being their face value.<br />

b) Receivables<br />

Receivables are recognised at amortised cost, less any<br />

impairment losses, however, due to the short settlement<br />

period, receivables are not discounted back to their<br />

present value.<br />

c) Assets held for sale<br />

Assets held for sale (or disposal groups compromising<br />

assets and liabilities) that are expected to be recovered<br />

primarily through sale rather than continuing use are<br />

classified as held for sale. Immediately before classification<br />

as held for sale, the assets (or components of a<br />

disposal group) are remeasured in accordance with the<br />

department’s accounting policies. Thereafter the assets<br />

(or disposal group) are measured at the lower of carrying<br />

amount and fair value less costs to sell.<br />

d) Property, plant, equipment, infrastructure,<br />

library book stock and heritage<br />

(i) Valuation basis<br />

Land, buildings, infrastructure, and heritage assets and<br />

other long-lived assets are recorded at fair value less<br />

accumulated depreciation. All other non-current physical<br />

assets, including work in progress, are recorded at historic<br />

cost less accumulated depreciation and accumulated<br />

impairment losses.<br />

In determining the fair value of land, reference is made<br />

to the best available market evidence of the price of the<br />

same or similar asset, evidence is drawn from sale of<br />

nearby land where available.<br />

In determining the fair value of buildings and infrastructure<br />

assets, a determination is made whether the asset is of<br />

a specialised nature or openly traded in the market. The<br />

majority of the department’s building and infrastructure<br />

assets are of a specialised nature, i.e. school buildings.<br />

The fair value of the department’s specialised buildings<br />

and infrastructure is estimated by the sum of current<br />

market prices for one or more transactions required<br />

to reproduce or replace the assets with the modern<br />

equivalent, less accumulated depreciation. As part of<br />

calculating an asset’s depreciation a ‘utility’ factor has<br />

been applied which factors in the current spare capacity.<br />

For non-specialised building and infrastructure assets the<br />

fair value is derived from market evidence on a direct<br />

comparison basis.<br />

Heritage assets with an intrinsic value are valued with<br />

reference to sales of identical or similar assets, evidenced<br />

in an open and transparent market place. Assets for<br />

which a buying price is readily accessible are valued at this<br />

replacement cost.<br />

All other non-current physical assets, including work in<br />

progress, are recorded at historic cost less accumulated<br />

depreciation and accumulated impairment losses.<br />

Cost includes expenditure that is directly attributable to<br />

the acquisition of the asset. The costs of self-constructed<br />

assets includes the cost of materials and direct labour,<br />

any other costs directly attributable to bringing the asset<br />

to a working condition for its intended use, and the costs<br />

of dismantling and removing the items and restoring the<br />

site on which they are located. Purchased software that is<br />

integral to the functioning ability of the related equipment<br />

is capitalised as part of that equipment.<br />

When parts of an item of property, plant and equipment<br />

have different useful lives, they are accounted for as<br />

separate items (major components) of property, plant<br />

and equipment.<br />

(ii) Subsequent costs<br />

The cost of replacing part of an item of property,<br />

plant and equipment is recognised in the carrying amount<br />

of the item if it is probable that future economic benefits<br />

embodied within the part will flow to the department and<br />

its costs can be measured reliably. The carrying amount of<br />

the replaced part is derecognised. The costs of day-to-day<br />

servicing of property, plant and equipment are recognised<br />

in profit or loss as incurred.<br />

(iii) Asset recognition threshold<br />

The asset capitalisation threshold adopted by the<br />

department is $150,000 for intangible assets and<br />

major capital works, and $10,000 for all other assets.<br />

Assets valued at less than these thresholds are charged to<br />

the Statement of Comprehensive Income in the year of<br />

purchase (other than where they form part of a group of<br />

similar items which are material in total).<br />

(iv) Revaluations<br />

The department revalues applicable assets on a program<br />

of five years. In accordance, with AASB 116 Property,<br />

Plant and Equipment, in years between valuations,<br />

indices supplied by qualified valuers are used to establish<br />

fair value.<br />

Assets are grouped on the basis of having a similar nature<br />

or function in the operations of the department.<br />

e) Other assets<br />

The department recognises some other small assets<br />

such as prepayments of expenditure and GST input tax<br />

credits received.<br />

f) Intangibles<br />

Intangible assets held by the department are valued at fair<br />

value less any subsequent accumulated amortisation and<br />

any subsequent impairment losses where an active market<br />

exists. Where no active market exists, intangibles are<br />

valued at cost less any accumulated amortisation and any<br />

accumulated impairment losses.<br />

116 Financial Statements » Notes