Education

DoE Annual Report 2012-2013 - Department of Education

DoE Annual Report 2012-2013 - Department of Education

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

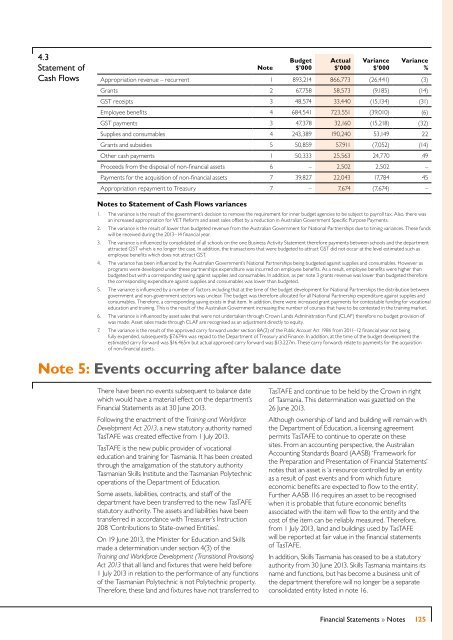

4.3<br />

Statement of<br />

Cash Flows<br />

Note<br />

Budget<br />

$’000<br />

Actual<br />

$’000<br />

Variance<br />

$’000<br />

Variance<br />

%<br />

Appropriation revenue – recurrent 1 893,214 866,773 (26,441) (3)<br />

Grants 2 67,758 58,573 (9,185) (14)<br />

GST receipts 3 48,574 33,440 (15,134) (31)<br />

Employee benefits 4 684,541 723,551 (39,010) (6)<br />

GST payments 3 47,378 32,160 (15,218) (32)<br />

Supplies and consumables 4 243,389 190,240 53,149 22<br />

Grants and subsidies 5 50,859 57,911 (7,052) (14)<br />

Other cash payments 1 50,333 25,563 24,770 49<br />

Proceeds from the disposal of non-financial assets 6 – 2,502 2,502 –<br />

Payments for the acquisition of non-financial assets 7 39,827 22,043 17,784 45<br />

Appropriation repayment to Treasury 7 – 7,674 (7,674) –<br />

Notes to Statement of Cash Flows variances<br />

1. The variance is the result of the government’s decision to remove the requirement for inner budget agencies to be subject to payroll tax. Also, there was<br />

an increased appropriation for VET Reform and asset sales offset by a reduction in Australian Government Specific Purpose Payments.<br />

2. The variance is the result of lower than budgeted revenue from the Australian Government for National Partnerships due to timing variances. These funds<br />

will be received during the 2013–14 financial year.<br />

3. The variance is influenced by consolidated of all schools on the one Business Activity Statement therefore payments between schools and the department<br />

attracted GST which is no longer the case. In addition, the transactions that were budgeted to attract GST did not occur at the level estimated such as<br />

employee benefits which does not attract GST.<br />

4. The variance has been influenced by the Australian Government’s National Partnerships being budgeted against supplies and consumables. However as<br />

programs were developed under these partnerships expenditure was incurred on employee benefits. As a result, employee benefits were higher than<br />

budgeted but with a corresponding saving against supplies and consumables. In addition, as per note 3 grants revenue was lower than budgeted therefore<br />

the corresponding expenditure against supplies and consumables was lower than budgeted.<br />

5. The variance is influenced by a number of factors including that at the time of the budget development for National Partnerships the distribution between<br />

government and non-government sectors was unclear. The budget was therefore allocated for all National Partnership expenditure against supplies and<br />

consumables. Therefore, a corresponding saving exists in that item. In addition, there were increased grant payments for contestable funding for vocational<br />

education and training. This is the result of the Australian Government increasing the number of courses that have to be contested in the training market.<br />

6. The variance is influenced by asset sales that were not undertaken through Crown Lands Administration Fund (CLAF) therefore no budget provision of<br />

was made. Asset sales made through CLAF are recognised as an adjustment directly to equity.<br />

7. The variance is the result of the approved carry forward under section 8A(2) of the Public Account Act 1986 from 2011–12 financial year not being<br />

fully expended, subsequently $7.674m was repaid to the Department of Treasury and Finance. In addition, at the time of the budget development the<br />

estimated carry forward was $16.465m but actual approved carry forward was $13.227m. These carry forwards relate to payments for the acquisition<br />

of non-financial assets.<br />

Note 5: Events occurring after balance date<br />

There have been no events subsequent to balance date<br />

which would have a material effect on the department’s<br />

Financial Statements as at 30 June 2013.<br />

Following the enactment of the Training and Workforce<br />

Development Act 2013, a new statutory authority named<br />

TasTAFE was created effective from 1 July 2013.<br />

TasTAFE is the new public provider of vocational<br />

education and training for Tasmania. It has been created<br />

through the amalgamation of the statutory authority<br />

Tasmanian Skills Institute and the Tasmanian Polytechnic<br />

operations of the Department of <strong>Education</strong>.<br />

Some assets, liabilities, contracts, and staff of the<br />

department have been transferred to the new TasTAFE<br />

statutory authority. The assets and liabilities have been<br />

transferred in accordance with Treasurer’s Instruction<br />

208 ‘Contributions to State-owned Entities’.<br />

On 19 June 2013, the Minister for <strong>Education</strong> and Skills<br />

made a determination under section 4(3) of the<br />

Training and Workforce Development (Transitional Provisions)<br />

Act 2013 that all land and fixtures that were held before<br />

1 July 2013 in relation to the performance of any functions<br />

of the Tasmanian Polytechnic is not Polytechnic property.<br />

Therefore, these land and fixtures have not transferred to<br />

TasTAFE and continue to be held by the Crown in right<br />

of Tasmania. This determination was gazetted on the<br />

26 June 2013.<br />

Although ownership of land and building will remain with<br />

the Department of <strong>Education</strong>, a licensing agreement<br />

permits TasTAFE to continue to operate on these<br />

sites. From an accounting perspective, the Australian<br />

Accounting Standards Board (AASB) ‘Framework for<br />

the Preparation and Presentation of Financial Statements’<br />

notes that an asset is ‘a resource controlled by an entity<br />

as a result of past events and from which future<br />

economic benefits are expected to flow to the entity’.<br />

Further AASB 116 requires an asset to be recognised<br />

when it is probable that future economic benefits<br />

associated with the item will flow to the entity and the<br />

cost of the item can be reliably measured. Therefore,<br />

from 1 July 2013, land and buildings used by TasTAFE<br />

will be reported at fair value in the financial statements<br />

of TasTAFE.<br />

In addition, Skills Tasmania has ceased to be a statutory<br />

authority from 30 June 2013. Skills Tasmania maintains its<br />

name and functions, but has become a business unit of<br />

the department therefore will no longer be a separate<br />

consolidated entity listed in note 16.<br />

Financial Statements » Notes<br />

125