Education

DoE Annual Report 2012-2013 - Department of Education

DoE Annual Report 2012-2013 - Department of Education

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

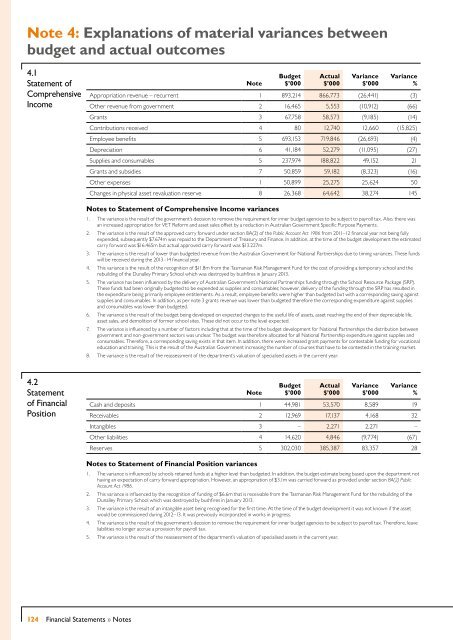

Note 4: Explanations of material variances between<br />

budget and actual outcomes<br />

4.1<br />

Statement of<br />

Comprehensive<br />

Income<br />

Note<br />

Budget<br />

$’000<br />

Actual<br />

$’000<br />

Variance<br />

$’000<br />

Variance<br />

%<br />

Appropriation revenue – recurrent 1 893,214 866,773 (26,441) (3)<br />

Other revenue from government 2 16,465 5,553 (10,912) (66)<br />

Grants 3 67,758 58,573 (9,185) (14)<br />

Contributions received 4 80 12,740 12,660 (15,825)<br />

Employee benefits 5 693,153 719,846 (26,693) (4)<br />

Depreciation 6 41,184 52,279 (11,095) (27)<br />

Supplies and consumables 5 237,974 188,822 49,152 21<br />

Grants and subsidies 7 50,859 59,182 (8,323) (16)<br />

Other expenses 1 50,899 25,275 25,624 50<br />

Changes in physical asset revaluation reserve 8 26,368 64,642 38,274 145<br />

Notes to Statement of Comprehensive Income variances<br />

1. The variance is the result of the government’s decision to remove the requirement for inner budget agencies to be subject to payroll tax. Also, there was<br />

an increased appropriation for VET Reform and asset sales offset by a reduction in Australian Government Specific Purpose Payments.<br />

2. The variance is the result of the approved carry forward under section 8A(2) of the Public Account Act 1986 from 2011–12 financial year not being fully<br />

expended, subsequently $7.674m was repaid to the Department of Treasury and Finance. In addition, at the time of the budget development the estimated<br />

carry forward was $16.465m but actual approved carry forward was $13.227m.<br />

3. The variance is the result of lower than budgeted revenue from the Australian Government for National Partnerships due to timing variances. These funds<br />

will be received during the 2013–14 financial year.<br />

4. This variance is the result of the recognition of $11.8m from the Tasmanian Risk Management Fund for the cost of providing a temporary school and the<br />

rebuilding of the Dunalley Primary School which was destroyed by bushfires in January 2013.<br />

5. The variance has been influenced by the delivery of Australian Government’s National Partnerships funding through the School Resource Package (SRP).<br />

These funds had been originally budgeted to be expended as supplies and consumables; however, delivery of the funding through the SRP has resulted in<br />

the expenditure being primarily employee entitlements. As a result, employee benefits were higher than budgeted but with a corresponding saving against<br />

supplies and consumables. In addition, as per note 3 grants revenue was lower than budgeted therefore the corresponding expenditure against supplies<br />

and consumables was lower than budgeted.<br />

6. The variance is the result of the budget being developed on expected changes to the useful life of assets, asset reaching the end of their depreciable life,<br />

asset sales, and demolition of former school sites. These did not occur to the level expected.<br />

7. The variance is influenced by a number of factors including that at the time of the budget development for National Partnerships the distribution between<br />

government and non-government sectors was unclear. The budget was therefore allocated for all National Partnership expenditure against supplies and<br />

consumables. Therefore, a corresponding saving exists in that item. In addition, there were increased grant payments for contestable funding for vocational<br />

education and training. This is the result of the Australian Government increasing the number of courses that have to be contested in the training market.<br />

8. The variance is the result of the reassessment of the department’s valuation of specialised assets in the current year.<br />

4.2<br />

Statement<br />

of Financial<br />

Position<br />

Note<br />

Budget<br />

$’000<br />

Actual<br />

$’000<br />

Variance<br />

$’000<br />

Variance<br />

%<br />

Cash and deposits 1 44,981 53,570 8,589 19<br />

Receivables 2 12,969 17,137 4,168 32<br />

Intangibles 3 – 2,271 2,271 –<br />

Other liabilities 4 14,620 4,846 (9,774) (67)<br />

Reserves 5 302,030 385,387 83,357 28<br />

Notes to Statement of Financial Position variances<br />

1. The variance is influenced by schools retained funds at a higher level than budgeted. In addition, the budget estimate being based upon the department not<br />

having an expectation of carry forward appropriation. However, an appropriation of $3.1m was carried forward as provided under section 8A(2) Public<br />

Account Act 1986.<br />

2. This variance is influenced by the recognition of funding of $6.6m that is receivable from the Tasmanian Risk Management Fund for the rebuilding of the<br />

Dunalley Primary School which was destroyed by bushfires in January 2013.<br />

3. The variance is the result of an intangible asset being recognised for the first time. At the time of the budget development it was not known if the asset<br />

would be commissioned during 2012–13. It was previously incorporated in works in progress.<br />

4. The variance is the result of the government’s decision to remove the requirement for inner budget agencies to be subject to payroll tax. Therefore, leave<br />

liabilities no longer accrue a provision for payroll tax.<br />

5. The variance is the result of the reassessment of the department’s valuation of specialised assets in the current year.<br />

124 Financial Statements » Notes