Technologies · Systems · Solutions - Dürr

Technologies · Systems · Solutions - Dürr

Technologies · Systems · Solutions - Dürr

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Nature and purpose of<br />

reserves<br />

Dividends<br />

Other comprehensive income<br />

24. Minority interests<br />

25. Provisions for pension<br />

obligations<br />

Consolidated financial statements of <strong>Dürr</strong> AG<br />

107<br />

The capital reserve of <strong>Dürr</strong> Aktiengesellschaft results from the premium of the share issue; it may<br />

only be used in accordance with stock corporation regulations. Pursuant to Sec. 150 of the AktG,<br />

the legal reserve and the capital reserve together must exceed one tenth of the capital stock to<br />

be used to offset losses or for a capital increase from company funds. If the legal reserve and the<br />

capital reserve together do not exceed one tenth of the capital stock, they may only be used to<br />

offset losses if the loss is not covered by the profit carry-forward or net income and cannot be<br />

offset by releasing other revenue reserves.<br />

The revenue reserves contain profits of the parent company and of subsidiaries transferred to<br />

the reserves.<br />

The amount of dividends available for distribution to shareholders is regulated by the AktG,<br />

and is based upon the earnings of <strong>Dürr</strong> AG as reported in its statutory financial statements prepared<br />

in accordance with the HGB. The shareholders’ meeting will propose to carry forward<br />

retained earnings.<br />

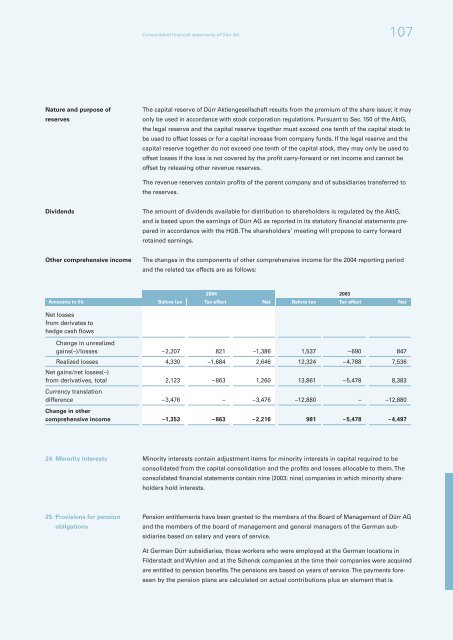

The changes in the components of other comprehensive income for the 2004 reporting period<br />

and the related tax effects are as follows:<br />

2004 2003<br />

Amounts in €k Before tax Tax effect Net Before tax Tax effect Net<br />

Net losses<br />

from derivates to<br />

hedge cash flows<br />

Change in unrealized<br />

gains(–)/losses –2,207 821 –1,386 1,537 –690 847<br />

Realized losses<br />

Net gains/net losses(–)<br />

4,330 –1,684 2,646 12,324 –4,788 7,536<br />

from derivatives, total<br />

Currency translation<br />

2,123 –863 1,260 13,861 –5,478 8,383<br />

difference –3,476 – –3,476 –12,880 – –12,880<br />

Change in other<br />

comprehensive income –1,353 –863 –2,216 981 –5,478 –4,497<br />

Minority interests contain adjustment items for minority interests in capital required to be<br />

consolidated from the capital consolidation and the profits and losses allocable to them. The<br />

consolidated financial statements contain nine (2003: nine) companies in which minority shareholders<br />

hold interests.<br />

Pension entitlements have been granted to the members of the Board of Management of <strong>Dürr</strong> AG<br />

and the members of the board of management and general managers of the German subsidiaries<br />

based on salary and years of service.<br />

At German <strong>Dürr</strong> subsidiaries, those workers who were employed at the German locations in<br />

Filderstadt and Wyhlen and at the Schenck companies at the time their companies were acquired<br />

are entitled to pension benefits. The pensions are based on years of service. The payments foreseen<br />

by the pension plans are calculated on actual contributions plus an element that is