Technologies · Systems · Solutions - Dürr

Technologies · Systems · Solutions - Dürr

Technologies · Systems · Solutions - Dürr

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

100<br />

90<br />

80<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

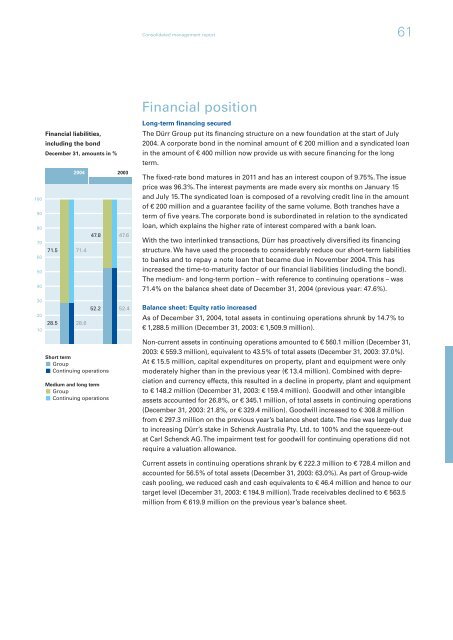

Financial liabilities,<br />

including the bond<br />

December 31, amounts in %<br />

71.5<br />

28.5<br />

2004 2003<br />

71.4<br />

28.6<br />

47.8<br />

52.2<br />

Short term<br />

Group<br />

Continuing operations<br />

Medium and long term<br />

Group<br />

Continuing operations<br />

47.6<br />

52.4<br />

Consolidated management report<br />

Financial position<br />

Long-term financing secured<br />

61<br />

The <strong>Dürr</strong> Group put its financing structure on a new foundation at the start of July<br />

2004. A corporate bond in the nominal amount of € 200 million and a syndicated loan<br />

in the amount of € 400 million now provide us with secure financing for the long<br />

term.<br />

The fixed-rate bond matures in 2011 and has an interest coupon of 9.75%. The issue<br />

price was 96.3%. The interest payments are made every six months on January 15<br />

and July 15. The syndicated loan is composed of a revolving credit line in the amount<br />

of € 200 million and a guarantee facility of the same volume. Both tranches have a<br />

term of five years. The corporate bond is subordinated in relation to the syndicated<br />

loan, which explains the higher rate of interest compared with a bank loan.<br />

With the two interlinked transactions, <strong>Dürr</strong> has proactively diversified its financing<br />

structure. We have used the proceeds to considerably reduce our short-term liabilities<br />

to banks and to repay a note loan that became due in November 2004. This has<br />

increased the time-to-maturity factor of our financial liabilities (including the bond).<br />

The medium- and long-term portion – with reference to continuing operations – was<br />

71.4% on the balance sheet date of December 31, 2004 (previous year: 47.6%).<br />

Balance sheet: Equity ratio increased<br />

As of December 31, 2004, total assets in continuing operations shrunk by 14.7% to<br />

€ 1,288.5 million (December 31, 2003: € 1,509.9 million).<br />

Non-current assets in continuing operations amounted to € 560.1 million (December 31,<br />

2003: € 559.3 million), equivalent to 43.5% of total assets (December 31, 2003: 37.0%).<br />

At € 15.5 million, capital expenditures on property, plant and equipment were only<br />

moderately higher than in the previous year (€ 13.4 million). Combined with depreciation<br />

and currency effects, this resulted in a decline in property, plant and equipment<br />

to € 148.2 million (December 31, 2003: € 159.4 million). Goodwill and other intangible<br />

assets accounted for 26.8%, or € 345.1 million, of total assets in continuing operations<br />

(December 31, 2003: 21.8%, or € 329.4 million). Goodwill increased to € 308.8 million<br />

from € 297.3 million on the previous year’s balance sheet date. The rise was largely due<br />

to increasing <strong>Dürr</strong>’s stake in Schenck Australia Pty. Ltd. to 100% and the squeeze-out<br />

at Carl Schenck AG. The impairment test for goodwill for continuing operations did not<br />

require a valuation allowance.<br />

Current assets in continuing operations shrank by € 222.3 million to € 728.4 millon and<br />

accounted for 56.5% of total assets (December 31, 2003: 63.0%). As part of Group-wide<br />

cash pooling, we reduced cash and cash equivalents to € 46.4 million and hence to our<br />

target level (December 31, 2003: € 194.9 million). Trade receivables declined to € 563.5<br />

million from € 619.9 million on the previous year’s balance sheet.