Technologies · Systems · Solutions - Dürr

Technologies · Systems · Solutions - Dürr

Technologies · Systems · Solutions - Dürr

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Bond<br />

ISIN (Reg S): XS0195957658<br />

ISIN (144a): XS0195957815<br />

ISIN DE0005565204<br />

Reuters symbol DUEG<br />

Bloomberg code DUE GY<br />

120<br />

110<br />

100<br />

90<br />

80<br />

<strong>Dürr</strong> on the capital market<br />

trading volume and market capitalization of free float. A designated sponsor, who<br />

regularly makes prices in our stock, ensures that it has adequate liquidity at all times<br />

in trading.<br />

2004: Debut on the bond market<br />

13<br />

We put our financing on a new foundation and restructured the liabilities side of our<br />

balance sheet in 2004. The aim was to reduce short-term debt and convert it into longterm<br />

financial liabilities. A corporate bond in the nominal amount of € 200 million<br />

and a syndicated loan in the amount of € 400 million now provide long-term financing<br />

security and greater financial leeway to develop the operating business. The fixedinterest<br />

bond matures in 2011 and has a coupon of 9.75%.<br />

With the two interconnected transactions, we have settled our short-term liabilities<br />

to banks to a very large extent and have diversified our financing structure. At the<br />

same time, we have attracted a new group of investors, primarily in the institutional<br />

segment. The corporate bond is subordinated to the syndicated loan. In that respect,<br />

it explains, among other things, the higher interest rate on the bond compared with<br />

a bank loan.<br />

Our bond started trading at a price of 96.40 at the beginning of July 2004 and rose<br />

until September 20 to 107.10. After the price declined to a level of just over 100 by<br />

mid-October, it advanced again and reached the year’s high at 108.60 on December<br />

16. At year’s end, the price was little changed at 108.20. The bond quoted at 101.91<br />

on March 31, 2005.<br />

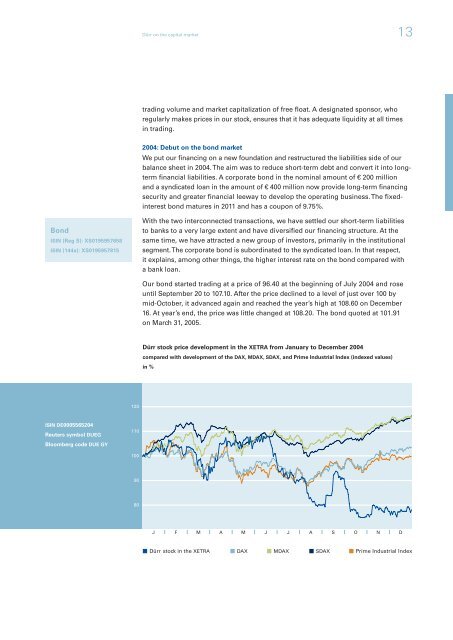

<strong>Dürr</strong> stock price development in the XETRA from January to December 2004<br />

compared with development of the DAX, MDAX, SDAX, and Prime Industrial Index (indexed values)<br />

in %<br />

J F M A M J J A S O N D<br />

<strong>Dürr</strong> stock in the XETRA DAX MDAX SDAX Prime Industrial Index