Technologies · Systems · Solutions - Dürr

Technologies · Systems · Solutions - Dürr

Technologies · Systems · Solutions - Dürr

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

120<br />

Accounting and disclosure<br />

of derivative financial<br />

instruments and hedge<br />

accounting<br />

35. Additional local<br />

disclosure requirements<br />

Exemption pursuant to<br />

Sec. 264b No. 4 of the HGB<br />

Exemption from the requirement<br />

to prepare consolidated<br />

financial statements<br />

for a Spanish sub-group<br />

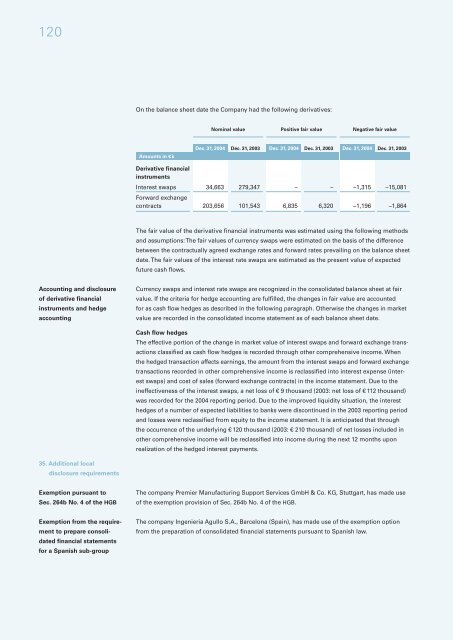

On the balance sheet date the Company had the following derivatives:<br />

Amounts in €k<br />

The fair value of the derivative financial instruments was estimated using the following methods<br />

and assumptions: The fair values of currency swaps were estimated on the basis of the difference<br />

between the contractually agreed exchange rates and forward rates prevailing on the balance sheet<br />

date. The fair values of the interest rate swaps are estimated as the present value of expected<br />

future cash flows.<br />

Nominal value Positive fair value Negative fair value<br />

Dec. 31, 2004 Dec. 31, 2003 Dec. 31, 2004 Dec. 31, 2003 Dec. 31, 2004 Dec. 31, 2003<br />

Derivative financial<br />

instruments<br />

Interest swaps<br />

Forward exchange<br />

34,663 279,347 – – –1,315 –15,081<br />

contracts 203,656 101,543 6,835 6,320 –1,196 –1,864<br />

Currency swaps and interest rate swaps are recognized in the consolidated balance sheet at fair<br />

value. If the criteria for hedge accounting are fulfilled, the changes in fair value are accounted<br />

for as cash flow hedges as described in the following paragraph. Otherwise the changes in market<br />

value are recorded in the consolidated income statement as of each balance sheet date.<br />

Cash flow hedges<br />

The effective portion of the change in market value of interest swaps and forward exchange transactions<br />

classified as cash flow hedges is recorded through other comprehensive income. When<br />

the hedged transaction affects earnings, the amount from the interest swaps and forward exchange<br />

transactions recorded in other comprehensive income is reclassified into interest expense (interest<br />

swaps) and cost of sales (forward exchange contracts) in the income statement. Due to the<br />

ineffectiveness of the interest swaps, a net loss of € 9 thousand (2003: net loss of € 112 thousand)<br />

was recorded for the 2004 reporting period. Due to the improved liquidity situation, the interest<br />

hedges of a number of expected liabilities to banks were discontinued in the 2003 reporting period<br />

and losses were reclassified from equity to the income statement. It is anticipated that through<br />

the occurrence of the underlying € 120 thousand (2003: € 210 thousand) of net losses included in<br />

other comprehensive income will be reclassified into income during the next 12 months upon<br />

realization of the hedged interest payments.<br />

The company Premier Manufacturing Support Services GmbH & Co. KG, Stuttgart, has made use<br />

of the exemption provision of Sec. 264b No. 4 of the HGB.<br />

The company Ingenieria Agullo S.A., Barcelona (Spain), has made use of the exemption option<br />

from the preparation of consolidated financial statements pursuant to Spanish law.