Technologies · Systems · Solutions - Dürr

Technologies · Systems · Solutions - Dürr

Technologies · Systems · Solutions - Dürr

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

82<br />

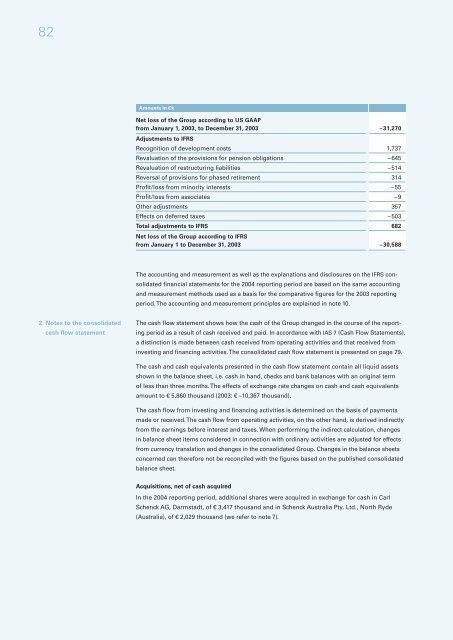

2. Notes to the consolidated<br />

cash flow statement<br />

Amounts in €k<br />

Net loss of the Group according to US GAAP<br />

from January 1, 2003, to December 31, 2003<br />

Adjustments to IFRS<br />

–31,270<br />

Recognition of development costs 1,737<br />

Revaluation of the provisions for pension obligations –645<br />

Revaluation of restructuring liabilities –514<br />

Reversal of provisions for phased retirement 314<br />

Profit/loss from minority interests –55<br />

Profit/loss from associates –9<br />

Other adjustments 357<br />

Effects on deferred taxes –503<br />

Total adjustments to IFRS<br />

Net loss of the Group according to IFRS<br />

682<br />

from January 1 to December 31, 2003 –30,588<br />

The accounting and measurement as well as the explanations and disclosures on the IFRS con-<br />

solidated financial statements for the 2004 reporting period are based on the same accounting<br />

and measurement methods used as a basis for the comparative figures for the 2003 reporting<br />

period. The accounting and measurement principles are explained in note 10.<br />

The cash flow statement shows how the cash of the Group changed in the course of the report-<br />

ing period as a result of cash received and paid. In accordance with IAS 7 (Cash Flow Statements),<br />

a distinction is made between cash received from operating activities and that received from<br />

investing and financing activities. The consolidated cash flow statement is presented on page 79.<br />

The cash and cash equivalents presented in the cash flow statement contain all liquid assets<br />

shown in the balance sheet, i.e. cash in hand, checks and bank balances with an original term<br />

of less than three months. The effects of exchange rate changes on cash and cash equivalents<br />

amount to € 5,860 thousand (2003: € –10,367 thousand).<br />

The cash flow from investing and financing activities is determined on the basis of payments<br />

made or received. The cash flow from operating activities, on the other hand, is derived indirectly<br />

from the earnings before interest and taxes. When performing the indirect calculation, changes<br />

in balance sheet items considered in connection with ordinary activities are adjusted for effects<br />

from currency translation and changes in the consolidated Group. Changes in the balance sheets<br />

concerned can therefore not be reconciled with the figures based on the published consolidated<br />

balance sheet.<br />

Acquisitions, net of cash acquired<br />

In the 2004 reporting period, additional shares were acquired in exchange for cash in Carl<br />

Schenck AG, Darmstadt, of € 3,417 thousand and in Schenck Australia Pty. Ltd., North Ryde<br />

(Australia), of € 2,029 thousand (we refer to note 7).