Technologies · Systems · Solutions - Dürr

Technologies · Systems · Solutions - Dürr

Technologies · Systems · Solutions - Dürr

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

58<br />

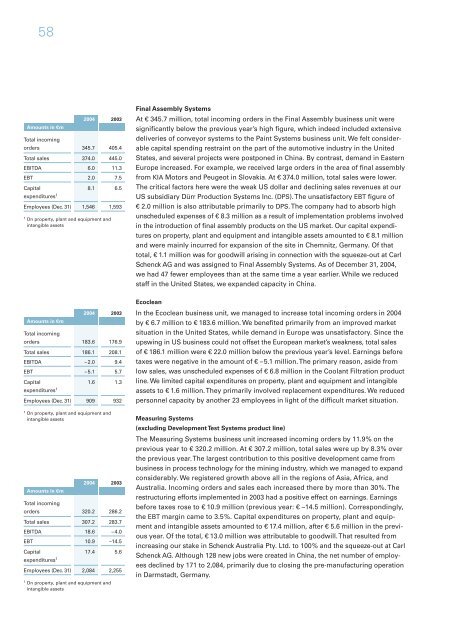

Amounts in €m<br />

Amounts in €m<br />

2004 2003<br />

Total incoming<br />

orders 183.6 176.9<br />

Total sales 186.1 208.1<br />

EBITDA –2.0 9.4<br />

EBT –5.1 5.7<br />

Capital 1.6 1.3<br />

expenditures 1<br />

Employees (Dec. 31) 909 932<br />

1 On property, plant and equipment and<br />

intangible assets<br />

Amounts in €m<br />

2004 2003<br />

Total incoming<br />

orders 320.2 286.2<br />

Total sales 307.2 283.7<br />

EBITDA 18.6 –4.0<br />

EBT 10.9 –14.5<br />

Capital 17.4 5.6<br />

expenditures 1<br />

2004 2003<br />

Total incoming<br />

orders 345.7 405.4<br />

Total sales 374.0 445.0<br />

EBITDA 6.0 11.3<br />

EBT 2.0 7.5<br />

Capital 8.1 6.5<br />

expenditures 1<br />

Employees (Dec. 31) 1,546 1,593<br />

1 On property, plant and equipment and<br />

intangible assets<br />

Employees (Dec. 31) 2,084 2,255<br />

1 On property, plant and equipment and<br />

intangible assets<br />

Final Assembly <strong>Systems</strong><br />

At € 345.7 million, total incoming orders in the Final Assembly business unit were<br />

significantly below the previous year’s high figure, which indeed included extensive<br />

deliveries of conveyor systems to the Paint <strong>Systems</strong> business unit. We felt considerable<br />

capital spending restraint on the part of the automotive industry in the United<br />

States, and several projects were postponed in China. By contrast, demand in Eastern<br />

Europe increased. For example, we received large orders in the area of final assembly<br />

from KIA Motors and Peugeot in Slovakia. At € 374.0 million, total sales were lower.<br />

The critical factors here were the weak US dollar and declining sales revenues at our<br />

US subsidiary <strong>Dürr</strong> Production <strong>Systems</strong> Inc. (DPS). The unsatisfactory EBT figure of<br />

€ 2.0 million is also attributable primarily to DPS. The company had to absorb high<br />

unscheduled expenses of € 8.3 million as a result of implementation problems involved<br />

in the introduction of final assembly products on the US market. Our capital expenditures<br />

on property, plant and equipment and intangible assets amounted to € 8.1 million<br />

and were mainly incurred for expansion of the site in Chemnitz, Germany. Of that<br />

total, € 1.1 million was for goodwill arising in connection with the squeeze-out at Carl<br />

Schenck AG and was assigned to Final Assembly <strong>Systems</strong>. As of December 31, 2004,<br />

we had 47 fewer employees than at the same time a year earlier. While we reduced<br />

staff in the United States, we expanded capacity in China.<br />

Ecoclean<br />

In the Ecoclean business unit, we managed to increase total incoming orders in 2004<br />

by € 6.7 million to € 183.6 million. We benefited primarily from an improved market<br />

situation in the United States, while demand in Europe was unsatisfactory. Since the<br />

upswing in US business could not offset the European market’s weakness, total sales<br />

of € 186.1 million were € 22.0 million below the previous year’s level. Earnings before<br />

taxes were negative in the amount of € –5.1 million. The primary reason, aside from<br />

low sales, was unscheduled expenses of € 6.8 million in the Coolant Filtration product<br />

line. We limited capital expenditures on property, plant and equipment and intangible<br />

assets to € 1.6 million. They primarily involved replacement expenditures. We reduced<br />

personnel capacity by another 23 employees in light of the difficult market situation.<br />

Measuring <strong>Systems</strong><br />

(excluding Development Test <strong>Systems</strong> product line)<br />

The Measuring <strong>Systems</strong> business unit increased incoming orders by 11.9% on the<br />

previous year to € 320.2 million. At € 307.2 million, total sales were up by 8.3% over<br />

the previous year. The largest contribution to this positive development came from<br />

business in process technology for the mining industry, which we managed to expand<br />

considerably. We registered growth above all in the regions of Asia, Africa, and<br />

Australia. Incoming orders and sales each increased there by more than 30%. The<br />

restructuring efforts implemented in 2003 had a positive effect on earnings. Earnings<br />

before taxes rose to € 10.9 million (previous year: € –14.5 million). Correspondingly,<br />

the EBT margin came to 3.5%. Capital expenditures on property, plant and equipment<br />

and intangible assets amounted to € 17.4 million, after € 5.6 million in the previous<br />

year. Of the total, € 13.0 million was attributable to goodwill. That resulted from<br />

increasing our stake in Schenck Australia Pty. Ltd. to 100% and the squeeze-out at Carl<br />

Schenck AG. Although 128 new jobs were created in China, the net number of employees<br />

declined by 171 to 2,084, primarily due to closing the pre-manufacturing operation<br />

in Darmstadt, Germany.