Notes to the Financial Statements - Cahaya Mata Sarawak Bhd

Notes to the Financial Statements - Cahaya Mata Sarawak Bhd

Notes to the Financial Statements - Cahaya Mata Sarawak Bhd

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Notes</strong> <strong>to</strong> <strong>the</strong> <strong>Financial</strong> <strong>Statements</strong><br />

For <strong>the</strong> fi nancial year ended 31 December 2011<br />

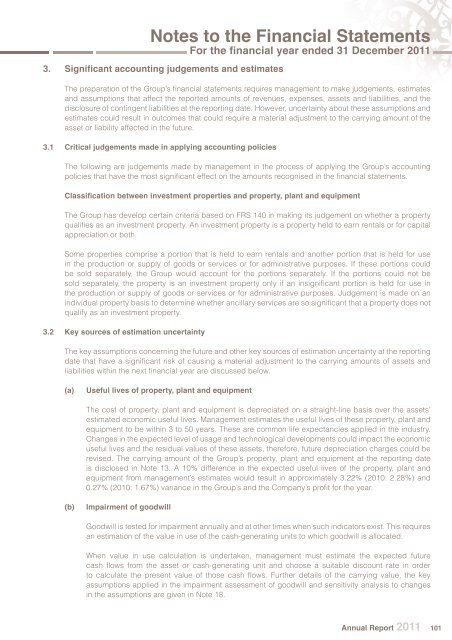

3. Signifi cant accounting judgements and estimates<br />

The preparation of <strong>the</strong> Group’s fi nancial statements requires management <strong>to</strong> make judgements, estimates<br />

and assumptions that affect <strong>the</strong> reported amounts of revenues, expenses, assets and liabilities, and <strong>the</strong><br />

disclosure of contingent liabilities at <strong>the</strong> reporting date. However, uncertainty about <strong>the</strong>se assumptions and<br />

estimates could result in outcomes that could require a material adjustment <strong>to</strong> <strong>the</strong> carrying amount of <strong>the</strong><br />

asset or liability affected in <strong>the</strong> future.<br />

3.1 Critical judgements made in applying accounting policies<br />

The following are judgements made by management in <strong>the</strong> process of applying <strong>the</strong> Group’s accounting<br />

policies that have <strong>the</strong> most signifi cant effect on <strong>the</strong> amounts recognised in <strong>the</strong> fi nancial statements.<br />

Classifi cation between investment properties and property, plant and equipment<br />

The Group has develop certain criteria based on FRS 140 in making its judgement on whe<strong>the</strong>r a property<br />

qualifi es as an investment property. An investment property is a property held <strong>to</strong> earn rentals or for capital<br />

appreciation or both.<br />

Some properties comprise a portion that is held <strong>to</strong> earn rentals and ano<strong>the</strong>r portion that is held for use<br />

in <strong>the</strong> production or supply of goods or services or for administrative purposes. If <strong>the</strong>se portions could<br />

be sold separately, <strong>the</strong> Group would account for <strong>the</strong> portions separately. If <strong>the</strong> portions could not be<br />

sold separately, <strong>the</strong> property is an investment property only if an insignifi cant portion is held for use in<br />

<strong>the</strong> production or supply of goods or services or for administrative purposes. Judgement is made on an<br />

individual property basis <strong>to</strong> determine whe<strong>the</strong>r ancillary services are so signifi cant that a property does not<br />

qualify as an investment property.<br />

3.2 Key sources of estimation uncertainty<br />

The key assumptions concerning <strong>the</strong> future and o<strong>the</strong>r key sources of estimation uncertainty at <strong>the</strong> reporting<br />

date that have a signifi cant risk of causing a material adjustment <strong>to</strong> <strong>the</strong> carrying amounts of assets and<br />

liabilities within <strong>the</strong> next fi nancial year are discussed below.<br />

(a) Useful lives of property, plant and equipment<br />

The cost of property, plant and equipment is depreciated on a straight-line basis over <strong>the</strong> assets’<br />

estimated economic useful lives. Management estimates <strong>the</strong> useful lives of <strong>the</strong>se property, plant and<br />

equipment <strong>to</strong> be within 3 <strong>to</strong> 50 years. These are common life expectancies applied in <strong>the</strong> industry.<br />

Changes in <strong>the</strong> expected level of usage and technological developments could impact <strong>the</strong> economic<br />

useful lives and <strong>the</strong> residual values of <strong>the</strong>se assets, <strong>the</strong>refore, future depreciation charges could be<br />

revised. The carrying amount of <strong>the</strong> Group’s property, plant and equipment at <strong>the</strong> reporting date<br />

is disclosed in Note 13. A 10% difference in <strong>the</strong> expected useful lives of <strong>the</strong> property, plant and<br />

equipment from management’s estimates would result in approximately 3.22% (2010: 2.28%) and<br />

0.27% (2010: 1.67%) variance in <strong>the</strong> Group’s and <strong>the</strong> Company’s profi t for <strong>the</strong> year.<br />

(b) Impairment of goodwill<br />

Goodwill is tested for impairment annually and at o<strong>the</strong>r times when such indica<strong>to</strong>rs exist. This requires<br />

an estimation of <strong>the</strong> value in use of <strong>the</strong> cash-generating units <strong>to</strong> which goodwill is allocated.<br />

When value in use calculation is undertaken, management must estimate <strong>the</strong> expected future<br />

cash fl ows from <strong>the</strong> asset or cash-generating unit and choose a suitable discount rate in order<br />

<strong>to</strong> calculate <strong>the</strong> present value of those cash fl ows. Fur<strong>the</strong>r details of <strong>the</strong> carrying value, <strong>the</strong> key<br />

assumptions applied in <strong>the</strong> impairment assessment of goodwill and sensitivity analysis <strong>to</strong> changes<br />

in <strong>the</strong> assumptions are given in Note 18.<br />

Annual Report 2011 101