Notes to the Financial Statements - Cahaya Mata Sarawak Bhd

Notes to the Financial Statements - Cahaya Mata Sarawak Bhd

Notes to the Financial Statements - Cahaya Mata Sarawak Bhd

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

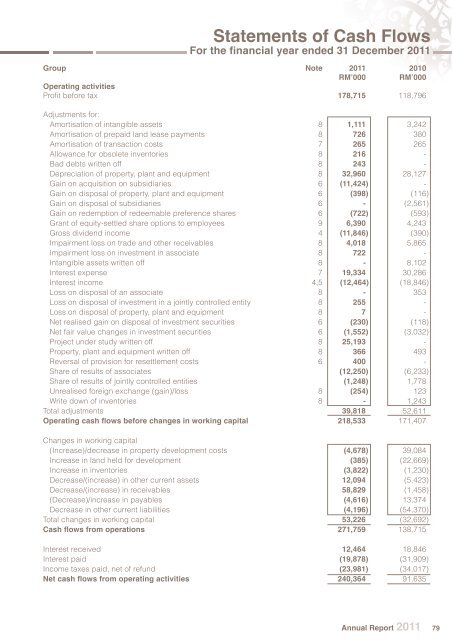

<strong>Statements</strong> of Cash Flows<br />

For <strong>the</strong> fi nancial year ended 31 December 2011<br />

Group Note 2011 2010<br />

RM’000 RM’000<br />

Operating activities<br />

Profi t before tax 178,715 118,796<br />

Adjustments for:<br />

Amortisation of intangible assets 8 1,111 3,242<br />

Amortisation of prepaid land lease payments 8 726 380<br />

Amortisation of transaction costs 7 265 265<br />

Allowance for obsolete inven<strong>to</strong>ries 8 216 -<br />

Bad debts written off 8 243 -<br />

Depreciation of property, plant and equipment 8 32,960 28,127<br />

Gain on acquisition on subsidiaries 6 (11,424 ) -<br />

Gain on disposal of property, plant and equipment 6 (398 ) (116 )<br />

Gain on disposal of subsidiaries 6 - (2,561 )<br />

Gain on redemption of redeemable preference shares 6 (722 ) (593 )<br />

Grant of equity-settled share options <strong>to</strong> employees 9 6,390 4,243<br />

Gross dividend income 4 (11,846 ) (390 )<br />

Impairment loss on trade and o<strong>the</strong>r receivables 8 4,018 5,865<br />

Impairment loss on investment in associate 8 722 -<br />

Intangible assets written off 8 - 8,102<br />

Interest expense 7 19,334 30,286<br />

Interest income 4,5 (12,464) (18,846 )<br />

Loss on disposal of an associate 8 - 353<br />

Loss on disposal of investment in a jointly controlled entity 8 255 -<br />

Loss on disposal of property, plant and equipment 8 7 -<br />

Net realised gain on disposal of investment securities 6 (230 ) (118 )<br />

Net fair value changes in investment securities 6 (1,552 ) (3,032 )<br />

Project under study written off 8 25,193 -<br />

Property, plant and equipment written off 8 366 493<br />

Reversal of provision for resettlement costs 6 400 -<br />

Share of results of associates (12,250 ) (6,233 )<br />

Share of results of jointly controlled entities (1,248 ) 1,778<br />

Unrealised foreign exchange (gain)/loss 8 (254 ) 123<br />

Write down of inven<strong>to</strong>ries 8 - 1,243<br />

Total adjustments 39,818 52,611<br />

Operating cash fl ows before changes in working capital 218,533 171,407<br />

Changes in working capital<br />

(Increase)/decrease in property development costs (4,678 ) 39,084<br />

Increase in land held for development (385 ) (22,669 )<br />

Increase in inven<strong>to</strong>ries (3,822 ) (1,230 )<br />

Decrease/(increase) in o<strong>the</strong>r current assets 12,094 (5,423 )<br />

Decrease/(increase) in receivables 58,829 (1,458 )<br />

(Decrease)/increase in payables (4,616 ) 13,374<br />

Decrease in o<strong>the</strong>r current liabilities (4,196 ) (54,370 )<br />

Total changes in working capital 53,226 (32,692 )<br />

Cash fl ows from operations 271,759 138,715<br />

Interest received 12,464 18,846<br />

Interest paid (19,878 ) (31,909 )<br />

Income taxes paid, net of refund (23,981 ) (34,017 )<br />

Net cash fl ows from operating activities 240,364 91,635<br />

Annual Report 2011 79