Notes to the Financial Statements - Cahaya Mata Sarawak Bhd

Notes to the Financial Statements - Cahaya Mata Sarawak Bhd

Notes to the Financial Statements - Cahaya Mata Sarawak Bhd

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

136<br />

<strong>Notes</strong> <strong>to</strong> <strong>the</strong> <strong>Financial</strong> <strong>Statements</strong><br />

For <strong>the</strong> fi nancial year ended 31 December 2011<br />

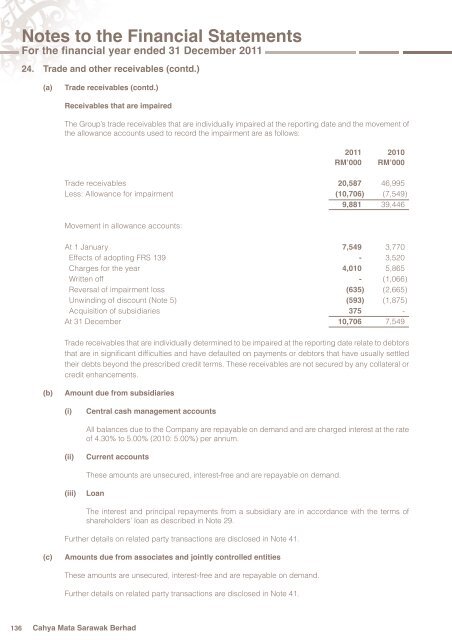

24. Trade and o<strong>the</strong>r receivables (contd.)<br />

(a) Trade receivables (contd.)<br />

Receivables that are impaired<br />

The Group’s trade receivables that are individually impaired at <strong>the</strong> reporting date and <strong>the</strong> movement of<br />

<strong>the</strong> allowance accounts used <strong>to</strong> record <strong>the</strong> impairment are as follows:<br />

Cahya <strong>Mata</strong> <strong>Sarawak</strong> Berhad<br />

2011 2010<br />

RM’000 RM’000<br />

Trade receivables 20,587 46,995<br />

Less: Allowance for impairment (10,706 ) (7,549 )<br />

9,881 39,446<br />

Movement in allowance accounts:<br />

At 1 January 7,549 3,770<br />

Effects of adopting FRS 139 - 3,520<br />

Charges for <strong>the</strong> year 4,010 5,865<br />

Written off - (1,066 )<br />

Reversal of impairment loss (635 ) (2,665 )<br />

Unwinding of discount (Note 5) (593 ) (1,875 )<br />

Acquisition of subsidiaries 375 -<br />

At 31 December 10,706 7,549<br />

Trade receivables that are individually determined <strong>to</strong> be impaired at <strong>the</strong> reporting date relate <strong>to</strong> deb<strong>to</strong>rs<br />

that are in signifi cant diffi culties and have defaulted on payments or deb<strong>to</strong>rs that have usually settled<br />

<strong>the</strong>ir debts beyond <strong>the</strong> prescribed credit terms. These receivables are not secured by any collateral or<br />

credit enhancements.<br />

(b) Amount due from subsidiaries<br />

(i) Central cash management accounts<br />

All balances due <strong>to</strong> <strong>the</strong> Company are repayable on demand and are charged interest at <strong>the</strong> rate<br />

of 4.30% <strong>to</strong> 5.00% (2010: 5.00%) per annum.<br />

(ii) Current accounts<br />

(iii) Loan<br />

These amounts are unsecured, interest-free and are repayable on demand.<br />

The interest and principal repayments from a subsidiary are in accordance with <strong>the</strong> terms of<br />

shareholders’ loan as described in Note 29.<br />

Fur<strong>the</strong>r details on related party transactions are disclosed in Note 41.<br />

(c) Amounts due from associates and jointly controlled entities<br />

These amounts are unsecured, interest-free and are repayable on demand.<br />

Fur<strong>the</strong>r details on related party transactions are disclosed in Note 41.