Notes to the Financial Statements - Cahaya Mata Sarawak Bhd

Notes to the Financial Statements - Cahaya Mata Sarawak Bhd

Notes to the Financial Statements - Cahaya Mata Sarawak Bhd

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

90<br />

<strong>Notes</strong> <strong>to</strong> <strong>the</strong> <strong>Financial</strong> <strong>Statements</strong><br />

For <strong>the</strong> fi nancial year ended 31 December 2011<br />

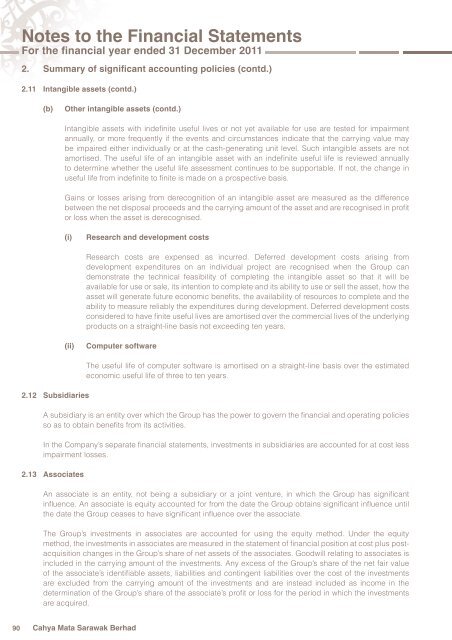

2. Summary of signifi cant accounting policies (contd.)<br />

2.11 Intangible assets (contd.)<br />

(b) O<strong>the</strong>r intangible assets (contd.)<br />

2.12 Subsidiaries<br />

Intangible assets with indefi nite useful lives or not yet available for use are tested for impairment<br />

annually, or more frequently if <strong>the</strong> events and circumstances indicate that <strong>the</strong> carrying value may<br />

be impaired ei<strong>the</strong>r individually or at <strong>the</strong> cash-generating unit level. Such intangible assets are not<br />

amortised. The useful life of an intangible asset with an indefi nite useful life is reviewed annually<br />

<strong>to</strong> determine whe<strong>the</strong>r <strong>the</strong> useful life assessment continues <strong>to</strong> be supportable. If not, <strong>the</strong> change in<br />

useful life from indefi nite <strong>to</strong> fi nite is made on a prospective basis.<br />

Gains or losses arising from derecognition of an intangible asset are measured as <strong>the</strong> difference<br />

between <strong>the</strong> net disposal proceeds and <strong>the</strong> carrying amount of <strong>the</strong> asset and are recognised in profi t<br />

or loss when <strong>the</strong> asset is derecognised.<br />

(i) Research and development costs<br />

Cahya <strong>Mata</strong> <strong>Sarawak</strong> Berhad<br />

Research costs are expensed as incurred. Deferred development costs arising from<br />

development expenditures on an individual project are recognised when <strong>the</strong> Group can<br />

demonstrate <strong>the</strong> technical feasibility of completing <strong>the</strong> intangible asset so that it will be<br />

available for use or sale, its intention <strong>to</strong> complete and its ability <strong>to</strong> use or sell <strong>the</strong> asset, how <strong>the</strong><br />

asset will generate future economic benefi ts, <strong>the</strong> availability of resources <strong>to</strong> complete and <strong>the</strong><br />

ability <strong>to</strong> measure reliably <strong>the</strong> expenditures during development. Deferred development costs<br />

considered <strong>to</strong> have fi nite useful lives are amortised over <strong>the</strong> commercial lives of <strong>the</strong> underlying<br />

products on a straight-line basis not exceeding ten years.<br />

(ii) Computer software<br />

The useful life of computer software is amortised on a straight-line basis over <strong>the</strong> estimated<br />

economic useful life of three <strong>to</strong> ten years.<br />

A subsidiary is an entity over which <strong>the</strong> Group has <strong>the</strong> power <strong>to</strong> govern <strong>the</strong> fi nancial and operating policies<br />

so as <strong>to</strong> obtain benefi ts from its activities.<br />

In <strong>the</strong> Company’s separate fi nancial statements, investments in subsidiaries are accounted for at cost less<br />

impairment losses.<br />

2.13 Associates<br />

An associate is an entity, not being a subsidiary or a joint venture, in which <strong>the</strong> Group has signifi cant<br />

infl uence. An associate is equity accounted for from <strong>the</strong> date <strong>the</strong> Group obtains signifi cant infl uence until<br />

<strong>the</strong> date <strong>the</strong> Group ceases <strong>to</strong> have signifi cant infl uence over <strong>the</strong> associate.<br />

The Group’s investments in associates are accounted for using <strong>the</strong> equity method. Under <strong>the</strong> equity<br />

method, <strong>the</strong> investments in associates are measured in <strong>the</strong> statement of fi nancial position at cost plus postacquisition<br />

changes in <strong>the</strong> Group’s share of net assets of <strong>the</strong> associates. Goodwill relating <strong>to</strong> associates is<br />

included in <strong>the</strong> carrying amount of <strong>the</strong> investments. Any excess of <strong>the</strong> Group’s share of <strong>the</strong> net fair value<br />

of <strong>the</strong> associate’s identifi able assets, liabilities and contingent liabilities over <strong>the</strong> cost of <strong>the</strong> investments<br />

are excluded from <strong>the</strong> carrying amount of <strong>the</strong> investments and are instead included as income in <strong>the</strong><br />

determination of <strong>the</strong> Group’s share of <strong>the</strong> associate’s profi t or loss for <strong>the</strong> period in which <strong>the</strong> investments<br />

are acquired.