Notes to the Financial Statements - Cahaya Mata Sarawak Bhd

Notes to the Financial Statements - Cahaya Mata Sarawak Bhd

Notes to the Financial Statements - Cahaya Mata Sarawak Bhd

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Issue of Shares<br />

During <strong>the</strong> fi nancial year, <strong>the</strong> Company increased its issued and paid-up ordinary share capital from RM329,445,840<br />

<strong>to</strong> RM329,480,840 by way of <strong>the</strong> issuance of 35,000 new ordinary shares of RM1 each issued <strong>to</strong> eligible employees<br />

of <strong>the</strong> Group under <strong>the</strong> Employees’ Share Option Scheme at an exercise price of RM2.20 per ordinary share for<br />

cash.<br />

The new ordinary shares issued during <strong>the</strong> fi nancial year rank pari passu in all respects with <strong>the</strong> existing ordinary<br />

shares of <strong>the</strong> Company.<br />

Employees’ Share Option Scheme<br />

At an Extraordinary General Meeting held on 27 May 2010, <strong>the</strong> shareholders approved <strong>the</strong> Employees’ Share<br />

Option Scheme (“ESOS”) for <strong>the</strong> granting of non-transferable options that are settled by physical delivery of <strong>the</strong><br />

ordinary shares of <strong>the</strong> Company, <strong>to</strong> eligible executive direc<strong>to</strong>rs and eligible employees of <strong>the</strong> Company and/or<br />

its eligible subsidiaries.<br />

The salient features and o<strong>the</strong>r terms of <strong>the</strong> ESOS are disclosed in Note 38 <strong>to</strong> <strong>the</strong> fi nancial statements.<br />

Pursuant <strong>to</strong> <strong>the</strong> Company’s ESOS which came in<strong>to</strong> effect on 23 June 2010, <strong>the</strong> Company granted 20,196,500<br />

share options under <strong>the</strong> ESOS. These options expire on 22 June 2015 and are exercisable at an exercise price of<br />

RM2.20 per share if vesting conditions as detailed in Note 38 <strong>to</strong> <strong>the</strong> fi nancial statements are met.<br />

The Company has been granted exemption by <strong>the</strong> Companies Commission of Malaysia from having <strong>to</strong> disclose<br />

<strong>the</strong> names of option holders and <strong>the</strong>ir holdings, who have been granted options <strong>to</strong> subscribe for less than<br />

800,000 ordinary shares of RM1 each.<br />

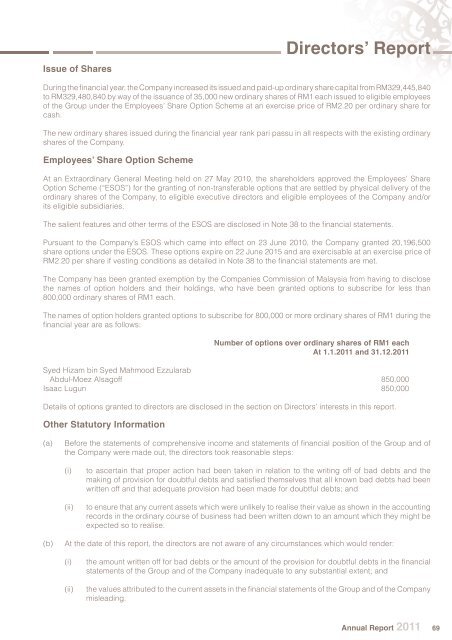

The names of option holders granted options <strong>to</strong> subscribe for 800,000 or more ordinary shares of RM1 during <strong>the</strong><br />

fi nancial year are as follows:<br />

Number of options over ordinary shares of RM1 each<br />

At 1.1.2011 and 31.12.2011<br />

Syed Hizam bin Syed Mahmood Ezzularab<br />

Abdul-Moez Alsagoff 850,000<br />

Isaac Lugun 850,000<br />

Details of options granted <strong>to</strong> direc<strong>to</strong>rs are disclosed in <strong>the</strong> section on Direc<strong>to</strong>rs’ interests in this report.<br />

O<strong>the</strong>r Statu<strong>to</strong>ry Information<br />

Direc<strong>to</strong>rs’ Report<br />

(a) Before <strong>the</strong> statements of comprehensive income and statements of fi nancial position of <strong>the</strong> Group and of<br />

<strong>the</strong> Company were made out, <strong>the</strong> direc<strong>to</strong>rs <strong>to</strong>ok reasonable steps:<br />

(i) <strong>to</strong> ascertain that proper action had been taken in relation <strong>to</strong> <strong>the</strong> writing off of bad debts and <strong>the</strong><br />

making of provision for doubtful debts and satisfi ed <strong>the</strong>mselves that all known bad debts had been<br />

written off and that adequate provision had been made for doubtful debts; and<br />

(ii) <strong>to</strong> ensure that any current assets which were unlikely <strong>to</strong> realise <strong>the</strong>ir value as shown in <strong>the</strong> accounting<br />

records in <strong>the</strong> ordinary course of business had been written down <strong>to</strong> an amount which <strong>the</strong>y might be<br />

expected so <strong>to</strong> realise.<br />

(b) At <strong>the</strong> date of this report, <strong>the</strong> direc<strong>to</strong>rs are not aware of any circumstances which would render:<br />

(i) <strong>the</strong> amount written off for bad debts or <strong>the</strong> amount of <strong>the</strong> provision for doubtful debts in <strong>the</strong> fi nancial<br />

statements of <strong>the</strong> Group and of <strong>the</strong> Company inadequate <strong>to</strong> any substantial extent; and<br />

(ii) <strong>the</strong> values attributed <strong>to</strong> <strong>the</strong> current assets in <strong>the</strong> fi nancial statements of <strong>the</strong> Group and of <strong>the</strong> Company<br />

misleading.<br />

Annual Report 2011 69