Notes to the Financial Statements - Cahaya Mata Sarawak Bhd

Notes to the Financial Statements - Cahaya Mata Sarawak Bhd

Notes to the Financial Statements - Cahaya Mata Sarawak Bhd

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

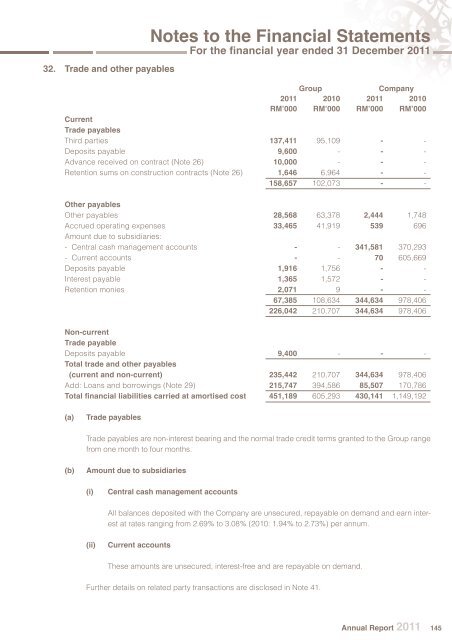

32. Trade and o<strong>the</strong>r payables<br />

<strong>Notes</strong> <strong>to</strong> <strong>the</strong> <strong>Financial</strong> <strong>Statements</strong><br />

For <strong>the</strong> fi nancial year ended 31 December 2011<br />

Group Company<br />

2011 2010 2011 2010<br />

RM’000 RM’000 RM’000 RM’000<br />

Current<br />

Trade payables<br />

Third parties 137,411 95,109 - -<br />

Deposits payable 9,600 - - -<br />

Advance received on contract (Note 26) 10,000 - - -<br />

Retention sums on construction contracts (Note 26) 1,646 6,964 - -<br />

158,657 102,073 - -<br />

O<strong>the</strong>r payables<br />

O<strong>the</strong>r payables 28,568 63,378 2,444 1,748<br />

Accrued operating expenses 33,465 41,919 539 696<br />

Amount due <strong>to</strong> subsidiaries:<br />

- Central cash management accounts - - 341,581 370,293<br />

- Current accounts - - 70 605,669<br />

Deposits payable 1,916 1,756 - -<br />

Interest payable 1,365 1,572 - -<br />

Retention monies 2,071 9 - -<br />

67,385 108,634 344,634 978,406<br />

226,042 210,707 344,634 978,406<br />

Non-current<br />

Trade payable<br />

Deposits payable 9,400 - - -<br />

Total trade and o<strong>the</strong>r payables<br />

(current and non-current) 235,442 210,707 344,634 978,406<br />

Add: Loans and borrowings (Note 29) 215,747 394,586 85,507 170,786<br />

Total fi nancial liabilities carried at amortised cost 451,189 605,293 430,141 1,149,192<br />

(a) Trade payables<br />

Trade payables are non-interest bearing and <strong>the</strong> normal trade credit terms granted <strong>to</strong> <strong>the</strong> Group range<br />

from one month <strong>to</strong> four months.<br />

(b) Amount due <strong>to</strong> subsidiaries<br />

(i) Central cash management accounts<br />

All balances deposited with <strong>the</strong> Company are unsecured, repayable on demand and earn interest<br />

at rates ranging from 2.69% <strong>to</strong> 3.08% (2010: 1.94% <strong>to</strong> 2.73%) per annum.<br />

(ii) Current accounts<br />

These amounts are unsecured, interest-free and are repayable on demand.<br />

Fur<strong>the</strong>r details on related party transactions are disclosed in Note 41.<br />

Annual Report 2011 145