Notes to the Financial Statements - Cahaya Mata Sarawak Bhd

Notes to the Financial Statements - Cahaya Mata Sarawak Bhd

Notes to the Financial Statements - Cahaya Mata Sarawak Bhd

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

19. Investments in subsidiaries (contd.)<br />

(b) Acquisition of subsidiaries (contd.)<br />

<strong>Notes</strong> <strong>to</strong> <strong>the</strong> <strong>Financial</strong> <strong>Statements</strong><br />

For <strong>the</strong> fi nancial year ended 31 December 2011<br />

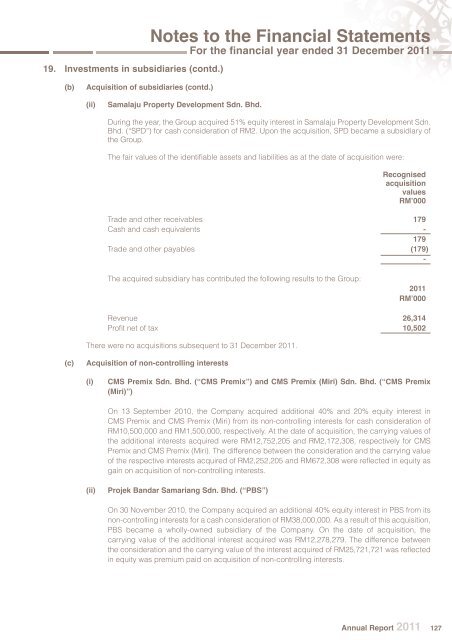

(ii) Samalaju Property Development Sdn. <strong>Bhd</strong>.<br />

During <strong>the</strong> year, <strong>the</strong> Group acquired 51% equity interest in Samalaju Property Development Sdn.<br />

<strong>Bhd</strong>. (“SPD”) for cash consideration of RM2. Upon <strong>the</strong> acquisition, SPD became a subsidiary of<br />

<strong>the</strong> Group.<br />

The fair values of <strong>the</strong> identifi able assets and liabilities as at <strong>the</strong> date of acquisition were:<br />

Recognised<br />

acquisition<br />

values<br />

RM’000<br />

Trade and o<strong>the</strong>r receivables 179<br />

Cash and cash equivalents -<br />

179<br />

Trade and o<strong>the</strong>r payables (179 )<br />

-<br />

The acquired subsidiary has contributed <strong>the</strong> following results <strong>to</strong> <strong>the</strong> Group:<br />

2011<br />

RM’000<br />

Revenue 26,314<br />

Profi t net of tax 10,502<br />

There were no acquisitions subsequent <strong>to</strong> 31 December 2011.<br />

(c) Acquisition of non-controlling interests<br />

(i) CMS Premix Sdn. <strong>Bhd</strong>. (“CMS Premix”) and CMS Premix (Miri) Sdn. <strong>Bhd</strong>. (“CMS Premix<br />

(Miri)”)<br />

On 13 September 2010, <strong>the</strong> Company acquired additional 40% and 20% equity interest in<br />

CMS Premix and CMS Premix (Miri) from its non-controlling interests for cash consideration of<br />

RM10,500,000 and RM1,500,000, respectively. At <strong>the</strong> date of acquisition, <strong>the</strong> carrying values of<br />

<strong>the</strong> additional interests acquired were RM12,752,205 and RM2,172,308, respectively for CMS<br />

Premix and CMS Premix (Miri). The difference between <strong>the</strong> consideration and <strong>the</strong> carrying value<br />

of <strong>the</strong> respective interests acquired of RM2,252,205 and RM672,308 were refl ected in equity as<br />

gain on acquisition of non-controlling interests.<br />

(ii) Projek Bandar Samariang Sdn. <strong>Bhd</strong>. (“PBS”)<br />

On 30 November 2010, <strong>the</strong> Company acquired an additional 40% equity interest in PBS from its<br />

non-controlling interests for a cash consideration of RM38,000,000. As a result of this acquisition,<br />

PBS became a wholly-owned subsidiary of <strong>the</strong> Company. On <strong>the</strong> date of acquisition, <strong>the</strong><br />

carrying value of <strong>the</strong> additional interest acquired was RM12,278,279. The difference between<br />

<strong>the</strong> consideration and <strong>the</strong> carrying value of <strong>the</strong> interest acquired of RM25,721,721 was refl ected<br />

in equity was premium paid on acquisition of non-controlling interests.<br />

Annual Report 2011 127