Notes to the Financial Statements - Cahaya Mata Sarawak Bhd

Notes to the Financial Statements - Cahaya Mata Sarawak Bhd

Notes to the Financial Statements - Cahaya Mata Sarawak Bhd

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

128<br />

<strong>Notes</strong> <strong>to</strong> <strong>the</strong> <strong>Financial</strong> <strong>Statements</strong><br />

For <strong>the</strong> fi nancial year ended 31 December 2011<br />

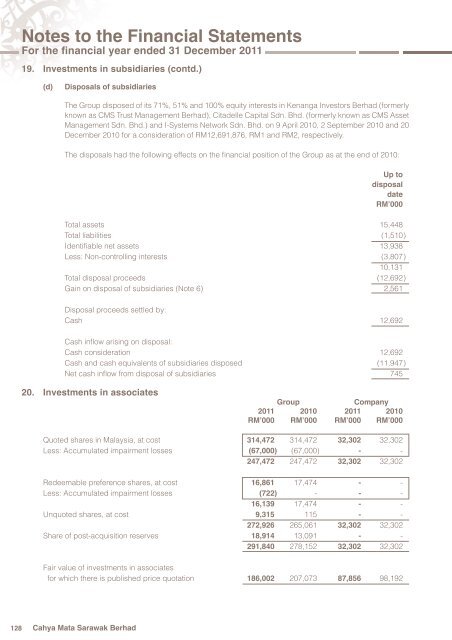

19. Investments in subsidiaries (contd.)<br />

(d) Disposals of subsidiaries<br />

The Group disposed of its 71%, 51% and 100% equity interests in Kenanga Inves<strong>to</strong>rs Berhad (formerly<br />

known as CMS Trust Management Berhad), Citadelle Capital Sdn. <strong>Bhd</strong>. (formerly known as CMS Asset<br />

Management Sdn. <strong>Bhd</strong>.) and I-Systems Network Sdn. <strong>Bhd</strong>. on 9 April 2010, 2 September 2010 and 20<br />

December 2010 for a consideration of RM12,691,876, RM1 and RM2, respectively.<br />

The disposals had <strong>the</strong> following effects on <strong>the</strong> fi nancial position of <strong>the</strong> Group as at <strong>the</strong> end of 2010:<br />

Cahya <strong>Mata</strong> <strong>Sarawak</strong> Berhad<br />

Up <strong>to</strong><br />

disposal<br />

date<br />

RM’000<br />

Total assets 15,448<br />

Total liabilities (1,510 )<br />

Identifi able net assets 13,938<br />

Less: Non-controlling interests (3,807 )<br />

10,131<br />

Total disposal proceeds (12,692 )<br />

Gain on disposal of subsidiaries (Note 6) 2,561<br />

Disposal proceeds settled by:<br />

Cash 12,692<br />

Cash infl ow arising on disposal:<br />

Cash consideration 12,692<br />

Cash and cash equivalents of subsidiaries disposed (11,947 )<br />

Net cash infl ow from disposal of subsidiaries 745<br />

20. Investments in associates<br />

Group Company<br />

2011 2010 2011 2010<br />

RM’000 RM’000 RM’000 RM’000<br />

Quoted shares in Malaysia, at cost 314,472 314,472 32,302 32,302<br />

Less: Accumulated impairment losses (67,000 ) (67,000 ) - -<br />

247,472 247,472 32,302 32,302<br />

Redeemable preference shares, at cost 16,861 17,474 - -<br />

Less: Accumulated impairment losses (722 ) - - -<br />

16,139 17,474 - -<br />

Unquoted shares, at cost 9,315 115 - -<br />

272,926 265,061 32,302 32,302<br />

Share of post-acquisition reserves 18,914 13,091 - -<br />

291,840 278,152 32,302 32,302<br />

Fair value of investments in associates<br />

for which <strong>the</strong>re is published price quotation 186,002 207,073 87,856 98,192