Download (2.2 MB) - Volksbank AG

Download (2.2 MB) - Volksbank AG

Download (2.2 MB) - Volksbank AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES / BALANCE SHEET<br />

by active employees for disability and widows’ pensions. The full actuarially calculated obligation for pensions is<br />

EUR 62.4 m (2003: EUR 56.6 m), of which entitlements amounting to EUR 38.3 m (2003: EUR 35.7 m) have been<br />

transferred to the pension fund, resulting in provisions of EUR 24.1 m (2003: EUR 20.9).<br />

As at 31 December 2004, other provisions included EUR 6.6 m retroactive purchase price adjustments in real estate<br />

companies, EUR 2.4 m bonuses for participating in the preparation of the Balance Sheet and EUR 0.7 m auditing<br />

and consulting expenses.<br />

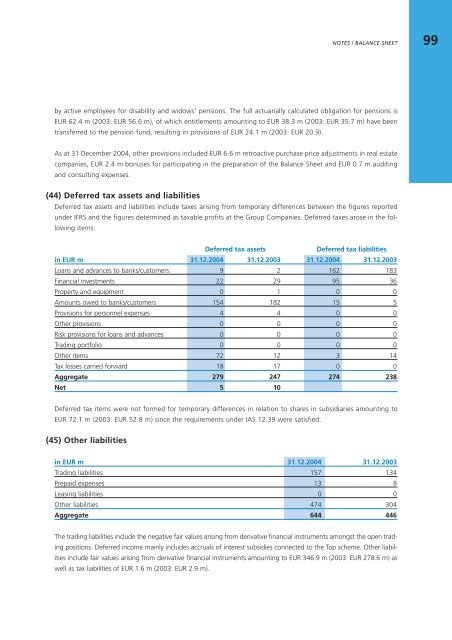

(44) Deferred tax assets and liabilities<br />

Deferred tax assets and liabilities include taxes arising from temporary differences between the figures reported<br />

under IFRS and the figures determined as taxable profits at the Group Companies. Deferred taxes arose in the following<br />

items:<br />

Deferred tax assets Deferred tax liabilities<br />

in EUR m 31.1<strong>2.2</strong>004 31.1<strong>2.2</strong>003 31.1<strong>2.2</strong>004 31.1<strong>2.2</strong>003<br />

Loans and advances to banks/customers 9 2 162 183<br />

Financial investments 22 29 95 36<br />

Property and equipment 0 1 0 0<br />

Amounts owed to banks/customers 154 182 15 5<br />

Provisions for personnel expenses 4 4 0 0<br />

Other provisions 0 0 0 0<br />

Risk provisions for loans and advances 0 0 0 0<br />

Trading portfolio 0 0 0 0<br />

Other items 72 12 3 14<br />

Tax losses carried forward 18 17 0 0<br />

Aggregate 279 247 274 238<br />

Net 5 10<br />

Deferred tax items were not formed for temporary differences in relation to shares in subsidiaries amounting to<br />

EUR 72.1 m (2003: EUR 52.8 m) since the requirements under IAS 12.39 were satisfied.<br />

(45) Other liabilities<br />

in EUR m 31.1<strong>2.2</strong>004 31.1<strong>2.2</strong>003<br />

Trading liabilities 157 134<br />

Prepaid expenses 13 8<br />

Leasing liabilities 0 0<br />

Other liabilities 474 304<br />

Aggregate 644 446<br />

The trading liabilities include the negative fair values arising from derivative financial instruments amongst the open trading<br />

positions. Deferred income mainly includes accruals of interest subsidies connected to the Top scheme. Other liabilities<br />

include fair values arising from derivative financial instruments amounting to EUR 346.9 m (2003: EUR 278.6 m) as<br />

well as tax liabilities of EUR 1.6 m (2003: EUR 2.9 m).<br />

99