Download (2.2 MB) - Volksbank AG

Download (2.2 MB) - Volksbank AG

Download (2.2 MB) - Volksbank AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

DEVELOPMENT OF EARNINGS<br />

AND OF THE BUSINESS<br />

Results improved again<br />

The Investkredit Group had its best ever result in<br />

the year under review. Increases in volumes and<br />

earnings in all three segments were responsible for<br />

this success. Improved exploitation of the opportunities<br />

for business in the Central European core<br />

market raised total assets to EUR 21.4 bn.<br />

Return on equity improved again to 14.6%.<br />

180<br />

150<br />

120<br />

90<br />

60<br />

30<br />

0<br />

FACTORS OF INCREASED EARNINGS IN 2004<br />

in EUR m 2003 2004<br />

Net interest income 118.0 158.7<br />

Credit risk provisions (net) -8.5 -9.1<br />

Other operating income 15.8 21.0<br />

General administrative expenses<br />

Balance of other income<br />

-62.8 -75.2<br />

and expenses 9.8 3.6<br />

Pre-tax profit for the year 7<strong>2.2</strong> 98.8<br />

After-tax profit for the year 60.0 83.6<br />

Net profit 40.8 54.1<br />

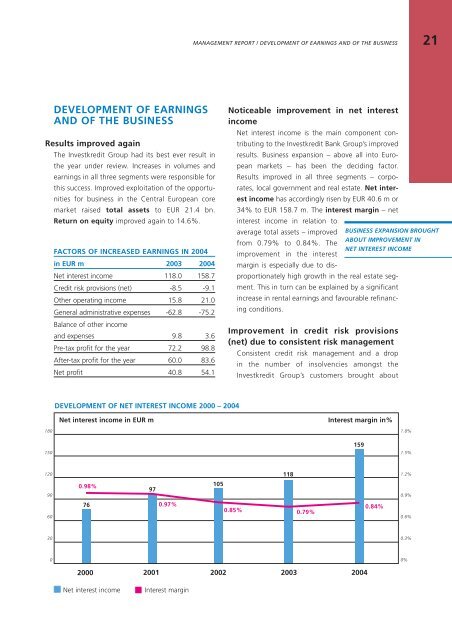

DEVELOPMENT OF NET INTEREST INCOME 2000 – 2004<br />

2000<br />

0.97%<br />

2001 2002<br />

Net interest income Interest margin<br />

MAN<strong>AG</strong>EMENT REPORT / DEVELOPMENT OF EARNINGS AND OF THE BUSINESS<br />

Noticeable improvement in net interest<br />

income<br />

Net interest income is the main component contributing<br />

to the Investkredit Bank Group’s improved<br />

results. Business expansion – above all into European<br />

markets – has been the deciding factor.<br />

Results improved in all three segments – corporates,<br />

local government and real estate. Net interest<br />

income has accordingly risen by EUR 40.6 m or<br />

34% to EUR 158.7 m. The interest margin – net<br />

interest income in relation to<br />

average total assets – improved<br />

from 0.79% to 0.84%. The<br />

improvement in the interest<br />

margin is especially due to disproportionately<br />

high growth in the real estate segment.<br />

This in turn can be explained by a significant<br />

increase in rental earnings and favourable refinancing<br />

conditions.<br />

Improvement in credit risk provisions<br />

(net) due to consistent risk management<br />

Consistent credit risk management and a drop<br />

in the number of insolvencies amongst the<br />

Investkredit Group’s customers brought about<br />

0.85% 0.79%<br />

2003<br />

2004<br />

1.8%<br />

1.5%<br />

1.2%<br />

0.9%<br />

0.6%<br />

0.3%<br />

0%<br />

21<br />

BUSINESS EXPANSION BROUGHT<br />

ABOUT IMPROVEMENT IN<br />

NET INTEREST INCOME<br />

Net interest income in EUR m Interest margin in%<br />

0.98%<br />

76<br />

97<br />

105<br />

118<br />

159<br />

0.84%