Download (2.2 MB) - Volksbank AG

Download (2.2 MB) - Volksbank AG

Download (2.2 MB) - Volksbank AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

62 SEGMENT REPORTING / LOCAL GOVERNMENT<br />

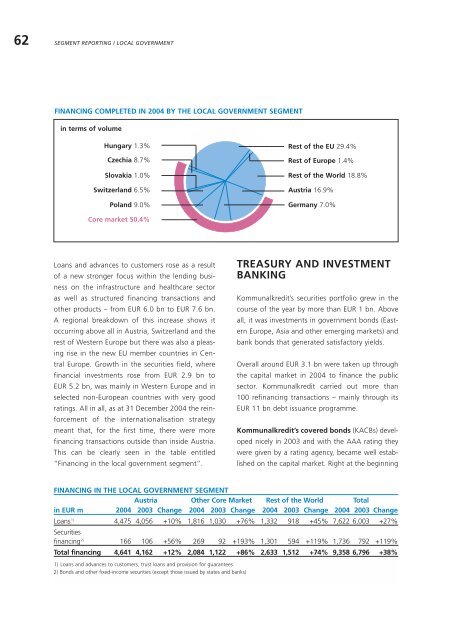

FINANCING COMPLETED IN 2004 BY THE LOCAL GOVERNMENT SEGMENT<br />

in terms of volume<br />

Hungary 1.3% Rest of the EU 29.4%<br />

Czechia 8.7% Rest of Europe 1.4%<br />

Slovakia 1.0%<br />

Switzerland 6.5%<br />

Poland 9.0%<br />

Core market 50.4%<br />

Loans and advances to customers rose as a result<br />

of a new stronger focus within the lending business<br />

on the infrastructure and healthcare sector<br />

as well as structured financing transactions and<br />

other products – from EUR 6.0 bn to EUR 7.6 bn.<br />

A regional breakdown of this increase shows it<br />

occurring above all in Austria, Switzerland and the<br />

rest of Western Europe but there was also a pleasing<br />

rise in the new EU member countries in Central<br />

Europe. Growth in the securities field, where<br />

financial investments rose from EUR 2.9 bn to<br />

EUR 5.2 bn, was mainly in Western Europe and in<br />

selected non-European countries with very good<br />

ratings. All in all, as at 31 December 2004 the reinforcement<br />

of the internationalisation strategy<br />

meant that, for the first time, there were more<br />

financing transactions outside than inside Austria.<br />

This can be clearly seen in the table entitled<br />

“Financing in the local government segment”.<br />

Rest of the World 18.8%<br />

Austria 16.9%<br />

Germany 7.0%<br />

TREASURY AND INVESTMENT<br />

BANKING<br />

Kommunalkredit’s securities portfolio grew in the<br />

course of the year by more than EUR 1 bn. Above<br />

all, it was investments in government bonds (Eastern<br />

Europe, Asia and other emerging markets) and<br />

bank bonds that generated satisfactory yields.<br />

Overall around EUR 3.1 bn were taken up through<br />

the capital market in 2004 to finance the public<br />

sector. Kommunalkredit carried out more than<br />

100 refinancing transactions – mainly through its<br />

EUR 11 bn debt issuance programme.<br />

Kommunalkredit’s covered bonds (KACBs) developed<br />

nicely in 2003 and with the AAA rating they<br />

were given by a rating agency, became well established<br />

on the capital market. Right at the beginning<br />

FINANCING IN THE LOCAL GOVERNMENT SEGMENT<br />

Austria Other Core Market Rest of the World Total<br />

in EUR m 2004 2003 Change 2004 2003 Change 2004 2003 Change 2004 2003 Change<br />

Loans 1) Securities<br />

4,475 4,056 +10% 1,816 1,030 +76% 1,332 918 +45% 7,622 6,003 +27%<br />

financing 2) 166 106 +56% 269 92 +193% 1,301 594 +119% 1,736 792 +119%<br />

Total financing 4,641 4,162 +12% 2,084 1,122 +86% 2,633 1,512 +74% 9,358 6,796 +38%<br />

1) Loans and advances to customers, trust loans and provision for guarantees<br />

2) Bonds and other fixed-income securities (except those issued by states and banks)