Download (2.2 MB) - Volksbank AG

Download (2.2 MB) - Volksbank AG

Download (2.2 MB) - Volksbank AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

52 SEGMENT REPORTING / CORPORATES<br />

highly selective basis. This prevented a drop in<br />

weighted average margins.<br />

The quality of the complete portfolio – expressed in<br />

terms of its weighted average rating – remained virtually<br />

unchanged in relation to the previous year. The<br />

proportion of transactions in the portfolio as a whole<br />

classified as sub investment grade fell below 5%.<br />

The table shows the overall level of financing in the<br />

corporate segment. By contrast to previous years,<br />

there were increases in all regional markets. The<br />

biggest growth – in absolute numbers too – was in<br />

the Central European core market.<br />

Credit risk management and syndication<br />

The care that Investkredit takes in its credit risk<br />

management is demonstrated, on the one hand, by<br />

the low rates of default and, on the other, in the<br />

employment of the most mod-<br />

CAUTIOUS CREDIT ern and innovative methods.<br />

RISK MAN<strong>AG</strong>EMENT<br />

For instance, a portfolio model<br />

has been used since 1999 to<br />

calculate credit risk and diversification. In line with<br />

its core competence in risk management and legal<br />

requirements, all responsibilities for risk assessment,<br />

analysis, management and hedging have<br />

been centralised in the “Portfolio and Risk Management”<br />

department. This ensures an objective<br />

assessment of creditworthiness and collateral as<br />

well as a consistent ongoing management of the<br />

portfolio and hedging of risk. The following decisive<br />

measures were laid down in 2004 to improve<br />

hedging and management of credit risks: the Banks<br />

to Banks syndication platform was set up and relevant<br />

competencies in portfolio and risk management<br />

were centralised in the organisation in anticipation<br />

of regulatory requirements.<br />

Banks to Banks – Investkredit’s innovative<br />

syndication platform<br />

In order to be able to employ measures used in portfolio<br />

management for the illiquid lending business as<br />

well, Investkredit developed in<br />

Banks to Banks an efficient platform<br />

for swapping credit risks.<br />

This makes opportunities that are otherwise only<br />

available with large international financing transac-<br />

www.banks2banks.com<br />

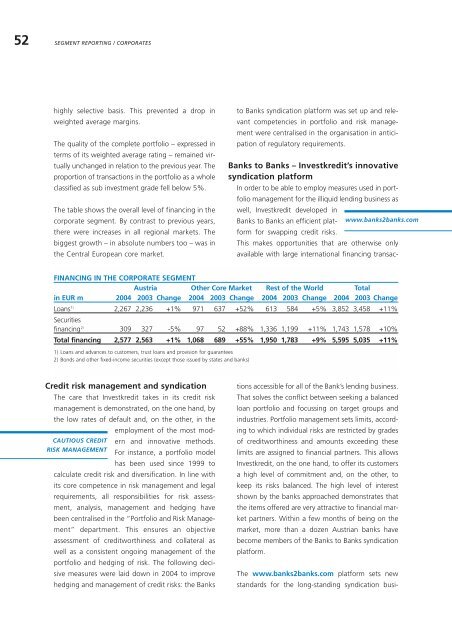

FINANCING IN THE CORPORATE SEGMENT<br />

Austria Other Core Market Rest of the World Total<br />

in EUR m 2004 2003 Change 2004 2003 Change 2004 2003 Change 2004 2003 Change<br />

Loans1) Securities<br />

2,267 2,236 +1% 971 637 +52% 613 584 +5% 3,852 3,458 +11%<br />

financing2) 309 327 -5% 97 52 +88% 1,336 1,199 +11% 1,743 1,578 +10%<br />

Total financing 2,577 2,563 +1% 1,068 689 +55% 1,950 1,783 +9% 5,595 5,035 +11%<br />

1) Loans and advances to customers, trust loans and provision for guarantees<br />

2) Bonds and other fixed-income securities (except those issued by states and banks)<br />

tions accessible for all of the Bank’s lending business.<br />

That solves the conflict between seeking a balanced<br />

loan portfolio and focussing on target groups and<br />

industries. Portfolio management sets limits, according<br />

to which individual risks are restricted by grades<br />

of creditworthiness and amounts exceeding these<br />

limits are assigned to financial partners. This allows<br />

Investkredit, on the one hand, to offer its customers<br />

a high level of commitment and, on the other, to<br />

keep its risks balanced. The high level of interest<br />

shown by the banks approached demonstrates that<br />

the items offered are very attractive to financial market<br />

partners. Within a few months of being on the<br />

market, more than a dozen Austrian banks have<br />

become members of the Banks to Banks syndication<br />

platform.<br />

The www.banks2banks.com platform sets new<br />

standards for the long-standing syndication busi-