Download (2.2 MB) - Volksbank AG

Download (2.2 MB) - Volksbank AG

Download (2.2 MB) - Volksbank AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

40 SEGMENT REPORTING / CORPORATES<br />

CORPORATES<br />

Structure<br />

The corporate segment consists of Investkredit<br />

Bank <strong>AG</strong> as the Bank for Corporates, Investkredit<br />

International Bank p.l.c., Invest Mezzanine Capital<br />

Management, Europa Consult<br />

CORPORATES – and additional companies that<br />

INVESTKREDIT GROUP’S<br />

manage investment transac-<br />

CORE SEGMENT<br />

tions on behalf of companies.<br />

There were 246 employees<br />

(49% of the Group) as at year-end 2004 in the corporate<br />

segment.<br />

Business approach<br />

Owing to a rising demand from companies for differentiated<br />

financing solutions tuned to their<br />

specific needs, capital market instruments,<br />

specialist instruments, such as mezzanine capital,<br />

but also innovations in<br />

OPTIMISING CORPORATES’ traditional, loan-oriented cor-<br />

CAPITAL STRUCTURE<br />

porate lending, have gained in<br />

importance as an alternative<br />

to the long-term loan. However, this broadened<br />

spectrum and increased complexity of instruments<br />

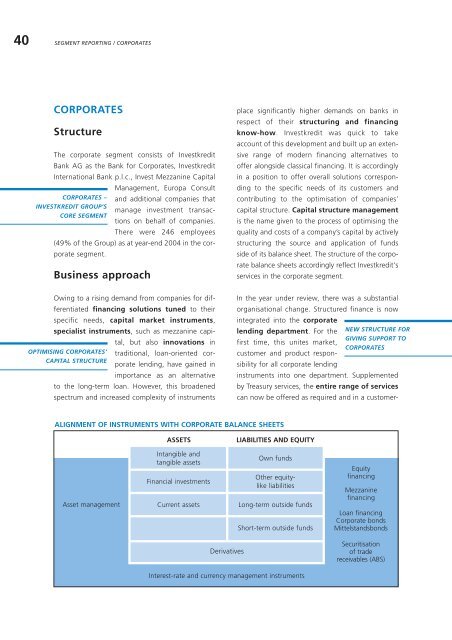

ALIGNMENT OF INSTRUMENTS WITH CORPORATE BALANCE SHEETS<br />

Asset management<br />

Intangible and<br />

tangible assets<br />

Financial investments<br />

Current assets<br />

place significantly higher demands on banks in<br />

respect of their structuring and financing<br />

know-how. Investkredit was quick to take<br />

account of this development and built up an extensive<br />

range of modern financing alternatives to<br />

offer alongside classical financing. It is accordingly<br />

in a position to offer overall solutions corresponding<br />

to the specific needs of its customers and<br />

contributing to the optimisation of companies’<br />

capital structure. Capital structure management<br />

is the name given to the process of optimising the<br />

quality and costs of a company’s capital by actively<br />

structuring the source and application of funds<br />

side of its balance sheet. The structure of the corporate<br />

balance sheets accordingly reflect Investkredit's<br />

services in the corporate segment.<br />

In the year under review, there was a substantial<br />

organisational change. Structured finance is now<br />

integrated into the corporate<br />

lending department. For the NEW STRUCTURE FOR<br />

GIVING SUPPORT TO<br />

first time, this unites market,<br />

CORPORATES<br />

customer and product responsibility<br />

for all corporate lending<br />

instruments into one department. Supplemented<br />

by Treasury services, the entire range of services<br />

can now be offered as required and in a customer-<br />

ASSETS LIABILITIES AND EQUITY<br />

Derivatives<br />

Own funds<br />

Other equitylike<br />

liabilities<br />

Long-term outside funds<br />

Short-term outside funds<br />

Interest-rate and currency management instruments<br />

Equity<br />

financing<br />

Mezzanine<br />

financing<br />

Loan financing<br />

Corporate bonds<br />

Mittelstandsbonds<br />

Securitisation<br />

of trade<br />

receivables (ABS)