Download (2.2 MB) - Volksbank AG

Download (2.2 MB) - Volksbank AG

Download (2.2 MB) - Volksbank AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

INVESTKREDIT SHARES<br />

Investkredit shares – an attractive investment<br />

Investkredit shares have been listed since 1990.<br />

They are listed on the Prime Market of the Vienna<br />

Stock Exchange. Share capital did not increase<br />

in the year under review and stands at around<br />

EUR 46 m.<br />

Over the course of 2004, a marked increase in the<br />

number of shares traded could be observed. With<br />

“In August 2004 GEF Beteiligungs-<strong>AG</strong> took over<br />

Leobersdorfer Maschinenfabrik <strong>AG</strong>, a manufacturer<br />

of high-pressure piston compressor systems<br />

with business activities all over the<br />

world. The acquisition by INVEST<br />

EQUITY is intended to reinforce the<br />

company’s strategic positioning and<br />

safeguard its production site.”<br />

Ernst Huttar<br />

Managing Director<br />

Leobersdorfer Maschinenfabrik <strong>AG</strong><br />

INVEST EQUITY realised this acquisition<br />

through its Greater Europe<br />

Fund – GEF Beteiligungs-<strong>AG</strong> – and<br />

was responsible for the structuring<br />

and arranging of the acquisition<br />

finance.<br />

“In May 2004 the HELLA Group – Austria’s market<br />

leader for protection systems against sun and rain<br />

– acquired the RAU arabella Group in Germany.<br />

Quick decision-making processes<br />

based on professional and comprehensive<br />

corporate analysis convinced<br />

us to have Investkredit finance the<br />

takeover.”<br />

Martin Troyer<br />

Managing Director<br />

HELLA Sonnen- und Wetterschutztechnik GmbH<br />

Investkredit Bank <strong>AG</strong> structured and<br />

arranged the financing of the acquisition<br />

as sole arranger.<br />

PERFORMANCE / INVESTKREDIT SHARES<br />

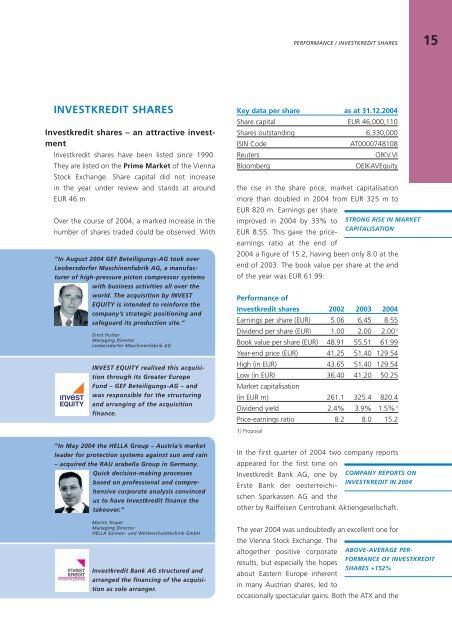

Key data per share as at 31.1<strong>2.2</strong>004<br />

Share capital EUR 46,000,110<br />

Shares outstanding 6,330,000<br />

ISIN Code AT0000748108<br />

Reuters OIKV.VI<br />

Bloomberg OEIKAVEquity<br />

the rise in the share price, market capitalisation<br />

more than doubled in 2004 from EUR 325 m to<br />

EUR 820 m. Earnings per share<br />

improved in 2004 by 33% to STRONG RISE IN MARKET<br />

CAPITALISATION<br />

EUR 8.55. This gave the priceearnings<br />

ratio at the end of<br />

2004 a figure of 15.2, having been only 8.0 at the<br />

end of 2003. The book value per share at the end<br />

of the year was EUR 61.99.<br />

Performance of<br />

Investkredit shares 2002 2003 2004<br />

Earnings per share (EUR) 5.06 6.45 8.55<br />

Dividend per share (EUR) 1.00 2.00 2.00 1)<br />

Book value per share (EUR) 48.91 55.51 61.99<br />

Year-end price (EUR) 41.25 51.40 129.54<br />

High (in EUR) 43.65 51.40 129.54<br />

Low (in EUR)<br />

Market capitalisation<br />

36.40 41.20 50.25<br />

(in EUR m) 261.1 325.4 820.4<br />

Dividend yield 2.4% 3.9% 1.5% 1)<br />

Price-earnings ratio 8.2 8.0 15.2<br />

1) Proposal<br />

In the first quarter of 2004 two company reports<br />

appeared for the first time on<br />

Investkredit Bank <strong>AG</strong>, one by COMPANY REPORTS ON<br />

INVESTKREDIT IN 2004<br />

Erste Bank der oesterreichischen<br />

Sparkassen <strong>AG</strong> and the<br />

other by Raiffeisen Centrobank Aktiengesellschaft.<br />

15<br />

The year 2004 was undoubtedly an excellent one for<br />

the Vienna Stock Exchange. The<br />

altogether positive corporate ABOVE-AVER<strong>AG</strong>E PER-<br />

FORMANCE OF INVESTKREDIT<br />

results, but especially the hopes<br />

SHARES +152%<br />

about Eastern Europe inherent<br />

in many Austrian shares, led to<br />

occasionally spectacular gains. Both the ATX and the