Download (2.2 MB) - Volksbank AG

Download (2.2 MB) - Volksbank AG

Download (2.2 MB) - Volksbank AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTES / BALANCE SHEET<br />

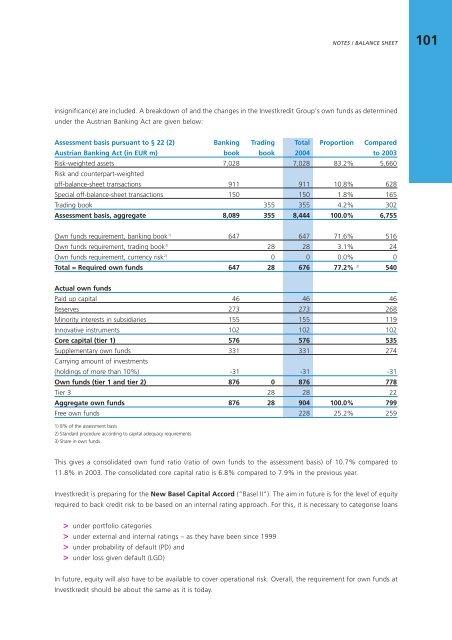

insignificance) are included. A breakdown of and the changes in the Investkredit Group's own funds as determined<br />

under the Austrian Banking Act are given below:<br />

Assessment basis pursuant to § 22 (2) Banking Trading Total Proportion Compared<br />

Austrian Banking Act (in EUR m) book book 2004 to 2003<br />

Risk-weighted assets<br />

Risk and counterpart-weighted<br />

7,028 7,028 83.2% 5,660<br />

off-balance-sheet transactions 911 911 10.8% 628<br />

Special off-balance-sheet transactions 150 150 1.8% 165<br />

Trading book 355 355 4.2% 302<br />

Assessment basis, aggregate 8,089 355 8,444 100.0% 6,755<br />

Own funds requirement, banking book 1) 647 647 71.6% 516<br />

Own funds requirement, trading book 2) 28 28 3.1% 24<br />

Own funds requirement, currency risk 2) 0 0 0.0% 0<br />

Total = Required own funds 647 28 676 77.2% 3) 540<br />

Actual own funds<br />

Paid up capital 46 46 46<br />

Reserves 273 273 268<br />

Minority interests in subsidiaries 155 155 119<br />

Innovative instruments 102 102 102<br />

Core capital (tier 1) 576 576 535<br />

Supplementary own funds<br />

Carrying amount of investments<br />

331 331 274<br />

(holdings of more than 10%) -31 -31 -31<br />

Own funds (tier 1 and tier 2) 876 0 876 778<br />

Tier 3 28 28 22<br />

Aggregate own funds 876 28 904 100.0% 799<br />

Free own funds 228 25.2% 259<br />

1) 8% of the assessment basis<br />

2) Standard procedure according to capital adequacy requirements<br />

3) Share in own funds<br />

This gives a consolidated own fund ratio (ratio of own funds to the assessment basis) of 10.7% compared to<br />

11.8% in 2003. The consolidated core capital ratio is 6.8% compared to 7.9% in the previous year.<br />

Investkredit is preparing for the New Basel Capital Accord (“Basel II”). The aim in future is for the level of equity<br />

required to back credit risk to be based on an internal rating approach. For this, it is necessary to categorise loans<br />

> under portfolio categories<br />

> under external and internal ratings – as they have been since 1999<br />

> under probability of default (PD) and<br />

> under loss given default (LGD)<br />

In future, equity will also have to be available to cover operational risk. Overall, the requirement for own funds at<br />

Investkredit should be about the same as it is today.<br />

101