Download (2.2 MB) - Volksbank AG

Download (2.2 MB) - Volksbank AG

Download (2.2 MB) - Volksbank AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

78 NOTES / ACCOUNTING AND VALUATION PRINCIPLES<br />

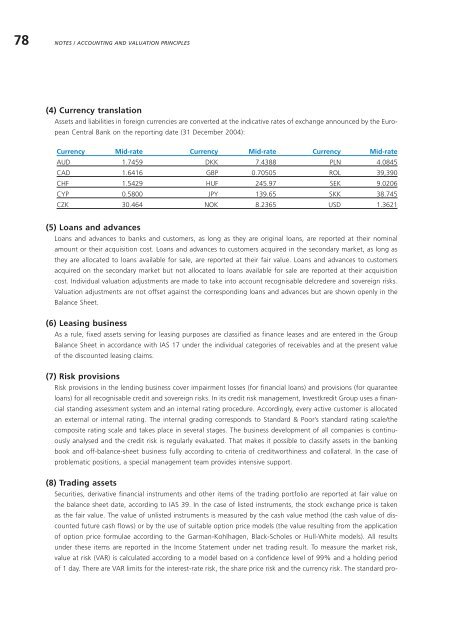

(4) Currency translation<br />

Assets and liabilities in foreign currencies are converted at the indicative rates of exchange announced by the European<br />

Central Bank on the reporting date (31 December 2004):<br />

Currency Mid-rate Currency Mid-rate Currency Mid-rate<br />

AUD 1.7459 DKK 7.4388 PLN 4.0845<br />

CAD 1.6416 GBP 0.70505 ROL 39,390<br />

CHF 1.5429 HUF 245.97 SEK 9.0206<br />

CYP 0.5800 JPY 139.65 SKK 38.745<br />

CZK 30.464 NOK 8.2365 USD 1.3621<br />

(5) Loans and advances<br />

Loans and advances to banks and customers, as long as they are original loans, are reported at their nominal<br />

amount or their acquisition cost. Loans and advances to customers acquired in the secondary market, as long as<br />

they are allocated to loans available for sale, are reported at their fair value. Loans and advances to customers<br />

acquired on the secondary market but not allocated to loans available for sale are reported at their acquisition<br />

cost. Individual valuation adjustments are made to take into account recognisable delcredere and sovereign risks.<br />

Valuation adjustments are not offset against the corresponding loans and advances but are shown openly in the<br />

Balance Sheet.<br />

(6) Leasing business<br />

As a rule, fixed assets serving for leasing purposes are classified as finance leases and are entered in the Group<br />

Balance Sheet in accordance with IAS 17 under the individual categories of receivables and at the present value<br />

of the discounted leasing claims.<br />

(7) Risk provisions<br />

Risk provisions in the lending business cover impairment losses (for financial loans) and provisions (for quarantee<br />

loans) for all recognisable credit and sovereign risks. In its credit risk management, Investkredit Group uses a financial<br />

standing assessment system and an internal rating procedure. Accordingly, every active customer is allocated<br />

an external or internal rating. The internal grading corresponds to Standard & Poor’s standard rating scale/the<br />

composite rating scale and takes place in several stages. The business development of all companies is continuously<br />

analysed and the credit risk is regularly evaluated. That makes it possible to classify assets in the banking<br />

book and off-balance-sheet business fully according to criteria of creditworthiness and collateral. In the case of<br />

problematic positions, a special management team provides intensive support.<br />

(8) Trading assets<br />

Securities, derivative financial instruments and other items of the trading portfolio are reported at fair value on<br />

the balance sheet date, according to IAS 39. In the case of listed instruments, the stock exchange price is taken<br />

as the fair value. The value of unlisted instruments is measured by the cash value method (the cash value of discounted<br />

future cash flows) or by the use of suitable option price models (the value resulting from the application<br />

of option price formulae according to the Garman-Kohlhagen, Black-Scholes or Hull-White models). All results<br />

under these items are reported in the Income Statement under net trading result. To measure the market risk,<br />

value at risk (VAR) is calculated according to a model based on a confidence level of 99% and a holding period<br />

of 1 day. There are VAR limits for the interest-rate risk, the share price risk and the currency risk. The standard pro-