Download (2.2 MB) - Volksbank AG

Download (2.2 MB) - Volksbank AG

Download (2.2 MB) - Volksbank AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

106 NOTES / OTHER DETAILS AND RISK REPORT<br />

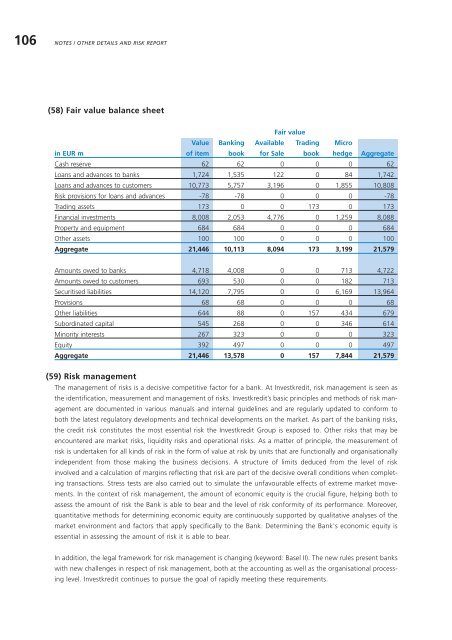

(58) Fair value balance sheet<br />

Fair value<br />

Value Banking Available Trading Micro<br />

in EUR m of item book for Sale book hedge Aggregate<br />

Cash reserve 62 62 0 0 0 62<br />

Loans and advances to banks 1,724 1,535 122 0 84 1,742<br />

Loans and advances to customers 10,773 5,757 3,196 0 1,855 10,808<br />

Risk provisions for loans and advances -78 -78 0 0 0 -78<br />

Trading assets 173 0 0 173 0 173<br />

Financial investments 8,008 2,053 4,776 0 1,259 8,088<br />

Property and equipment 684 684 0 0 0 684<br />

Other assets 100 100 0 0 0 100<br />

Aggregate 21,446 10,113 8,094 173 3,199 21,579<br />

Amounts owed to banks 4,718 4,008 0 0 713 4,722<br />

Amounts owed to customers 693 530 0 0 182 713<br />

Securitised liabilities 14,120 7,795 0 0 6,169 13,964<br />

Provisions 68 68 0 0 0 68<br />

Other liabilities 644 88 0 157 434 679<br />

Subordinated capital 545 268 0 0 346 614<br />

Minority interests 267 323 0 0 0 323<br />

Equity 392 497 0 0 0 497<br />

Aggregate 21,446 13,578 0 157 7,844 21,579<br />

(59) Risk management<br />

The management of risks is a decisive competitive factor for a bank. At Investkredit, risk management is seen as<br />

the identification, measurement and management of risks. Investkredit’s basic principles and methods of risk management<br />

are documented in various manuals and internal guidelines and are regularly updated to conform to<br />

both the latest regulatory developments and technical developments on the market. As part of the banking risks,<br />

the credit risk constitutes the most essential risk the Investkredit Group is exposed to. Other risks that may be<br />

encountered are market risks, liquidity risks and operational risks. As a matter of principle, the measurement of<br />

risk is undertaken for all kinds of risk in the form of value at risk by units that are functionally and organisationally<br />

independent from those making the business decisions. A structure of limits deduced from the level of risk<br />

involved and a calculation of margins reflecting that risk are part of the decisive overall conditions when completing<br />

transactions. Stress tests are also carried out to simulate the unfavourable effects of extreme market movements.<br />

In the context of risk management, the amount of economic equity is the crucial figure, helping both to<br />

assess the amount of risk the Bank is able to bear and the level of risk conformity of its performance. Moreover,<br />

quantitative methods for determining economic equity are continuously supported by qualitative analyses of the<br />

market environment and factors that apply specifically to the Bank. Determining the Bank's economic equity is<br />

essential in assessing the amount of risk it is able to bear.<br />

In addition, the legal framework for risk management is changing (keyword: Basel II). The new rules present banks<br />

with new challenges in respect of risk management, both at the accounting as well as the organisational processing<br />

level. Investkredit continues to pursue the goal of rapidly meeting these requirements.