REGISTRATION DOCUMENT AND FINANCIAL REPORT - Iliad

REGISTRATION DOCUMENT AND FINANCIAL REPORT - Iliad

REGISTRATION DOCUMENT AND FINANCIAL REPORT - Iliad

- TAGS

- registration

- iliad

- iliad.fr

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

20. <strong>FINANCIAL</strong> INFORMATION CONCERNING THE COMPANY’S ASSETS <strong>AND</strong> LIABILITIES,<br />

<strong>FINANCIAL</strong> POSITION <strong>AND</strong> PROFITS <strong>AND</strong> LOSSES<br />

20.1 CONSOLIDATED <strong>FINANCIAL</strong> STATEMENTS FOR 2007, 2006 <strong>AND</strong> 2005<br />

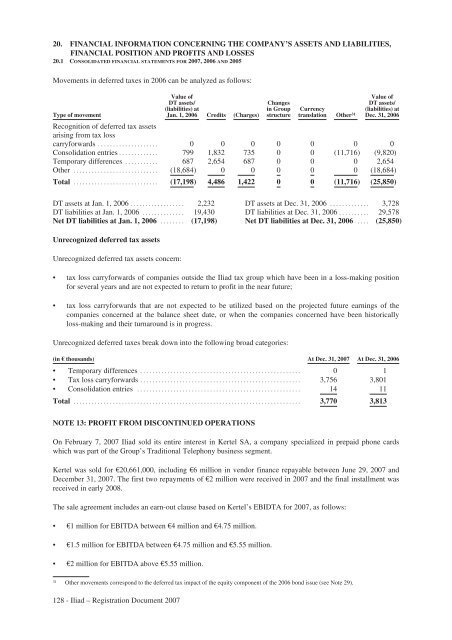

Movements in deferred taxes in 2006 can be analyzed as follows:<br />

Type of movement<br />

Value of<br />

DT assets/<br />

(liabilities) at<br />

Jan. 1, 2006 Credits (Charges)<br />

Changes<br />

in Group<br />

structure<br />

Currency<br />

translation Other 31<br />

Value of<br />

DT assets/<br />

(liabilities) at<br />

Dec. 31, 2006<br />

Recognition of deferred tax assets<br />

arising from tax loss<br />

carryforwards .................... 0 0 0 0 0 0 0<br />

Consolidation entries ............. 799 1,832 735 0 0 (11,716) (9,820)<br />

Temporary differences ........... 687 2,654 687 0 0 0 2,654<br />

Other ............................ (18,684) 0 0 0 0 0 (18,684)<br />

Total ............................ (17,198) 4,486 1,422 0 0 (11,716) (25,850)<br />

DT assets at Jan. 1, 2006 .................. 2,232 DT assets at Dec. 31, 2006 ............. 3,728<br />

DT liabilities at Jan. 1, 2006 .............. 19,430 DT liabilities at Dec. 31, 2006 .......... 29,578<br />

Net DT liabilities at Jan. 1, 2006 ........ (17,198) Net DT liabilities at Dec. 31, 2006 .... (25,850)<br />

Unrecognized deferred tax assets<br />

Unrecognized deferred tax assets concern:<br />

• tax loss carryforwards of companies outside the <strong>Iliad</strong> tax group which have been in a loss-making position<br />

for several years and are not expected to return to profit in the near future;<br />

• tax loss carryforwards that are not expected to be utilized based on the projected future earnings of the<br />

companies concerned at the balance sheet date, or when the companies concerned have been historically<br />

loss-making and their turnaround is in progress.<br />

Unrecognized deferred taxes break down into the following broad categories:<br />

(in € thousands) At Dec. 31, 2007 At Dec. 31, 2006<br />

• Temporary differences ..................................................... 0 1<br />

• Tax loss carryforwards ..................................................... 3,756 3,801<br />

• Consolidation entries ...................................................... 14 11<br />

Total ........................................................................... 3,770 3,813<br />

NOTE 13: PROFIT FROM DISCONTINUED OPERATIONS<br />

On February 7, 2007 <strong>Iliad</strong> sold its entire interest in Kertel SA, a company specialized in prepaid phone cards<br />

which was part of the Group’s Traditional Telephony business segment.<br />

Kertel was sold for €20,661,000, including €6 million in vendor finance repayable between June 29, 2007 and<br />

December 31, 2007. The first two repayments of €2 million were received in 2007 and the final installment was<br />

received in early 2008.<br />

The sale agreement includes an earn-out clause based on Kertel’s EBIDTA for 2007, as follows:<br />

• €1 million for EBITDA between €4 million and €4.75 million.<br />

• €1.5 million for EBITDA between €4.75 million and €5.55 million.<br />

• €2 million for EBITDA above €5.55 million.<br />

31 Other movements correspond to the deferred tax impact of the equity component of the 2006 bond issue (see Note 29).<br />

128 - <strong>Iliad</strong> – Registration Document 2007