REGISTRATION DOCUMENT AND FINANCIAL REPORT - Iliad

REGISTRATION DOCUMENT AND FINANCIAL REPORT - Iliad

REGISTRATION DOCUMENT AND FINANCIAL REPORT - Iliad

- TAGS

- registration

- iliad

- iliad.fr

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

6. OVERVIEW OF THE GROUP’S BUSINESS<br />

6.2 PRINCIPAL MARKETS<br />

Since mid-2002, most of the Group’s main competitors have decided to focus on providing ADSL-based<br />

broadband offerings. The proliferation of different service offerings accompanied by increased segmentation and<br />

strong competitive pressure on prices stimulated growth in the Internet market between 2003 and 2007.<br />

Over the last two years, Orange, Neuf and Free have established themselves as the major players in the market.<br />

Since the end of 2002, local loop unbundling has provided a major opportunity for growth for the Group,<br />

particularly with regard to profitability and the development of service offerings (such as fixed telephony and<br />

audiovisual services).<br />

In addition to pursuing market growth for broadband access in order to increase broadband use in the home as a<br />

means of winning new customers, Internet service providers also aim to migrate as many subscribers as possible<br />

from dial-up services to broadband in order to benefit from higher average revenue per user.<br />

6.2.2 Telephony operators<br />

Competition in the fixed telephony market is characterized by the overwhelming dominance of the incumbent<br />

operator and by the considerable number of emerging operators.<br />

Since January 1, 2002, all subscribers have been able to choose which operator to use for local calls, as had<br />

already been the case since January 1, 1998 for long distance and international calls and since November 1, 2000<br />

for fixed-to-mobile calls. The operator can be selected on a call-by-call basis or by automatic carrier<br />

pre-selection which allows subscribers to specify that all calls be automatically routed through the operator of<br />

their choice. There was a significant fall in subscribers opting for carrier selection in 2007 and this trend looks set<br />

to continue. Based on information published by ARCEP, there were some 39.2 million telephone service<br />

customers (retail and corporate) in France at end-2007, including 5.3 million who had opted for carrier<br />

pre-selection and 1.7 million for call-by-call selection.<br />

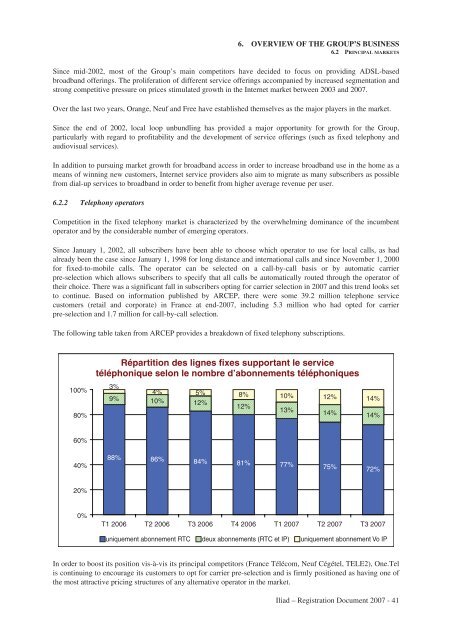

The following table taken from ARCEP provides a breakdown of fixed telephony subscriptions.<br />

100%<br />

80%<br />

60%<br />

40%<br />

20%<br />

0%<br />

Répartition des lignes fixes supportant le service<br />

téléphonique selon le nombre d’abonnements téléphoniques<br />

3%<br />

4% 5% 8%<br />

9%<br />

10% 12%<br />

10% 14%<br />

12%<br />

12%<br />

13%<br />

14% 14%<br />

88% 86% 84% 81% 77% 75% 72%<br />

T1 2006 T2 2006 T3 2006 T4 2006 T1 2007 T2 2007 T3 2007<br />

uniquement abonnement RTC deux abonnements (RTC et IP) uniquement abonnement Vo IP<br />

In order to boost its position vis-à-vis its principal competitors (France Télécom, Neuf Cégétel, TELE2), One.Tel<br />

is continuing to encourage its customers to opt for carrier pre-selection and is firmly positioned as having one of<br />

the most attractive pricing structures of any alternative operator in the market.<br />

<strong>Iliad</strong> – Registration Document 2007 - 41