REGISTRATION DOCUMENT AND FINANCIAL REPORT - Iliad

REGISTRATION DOCUMENT AND FINANCIAL REPORT - Iliad

REGISTRATION DOCUMENT AND FINANCIAL REPORT - Iliad

- TAGS

- registration

- iliad

- iliad.fr

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

4. RISK FACTORS<br />

4.3 <strong>FINANCIAL</strong> RISKS<br />

worth of OCEANE convertible/exchangeable bonds. At December 31, 2007, the Group’s net cash position stood<br />

at €223.1 million, compared with €276.3 million at December 31, 2006.<br />

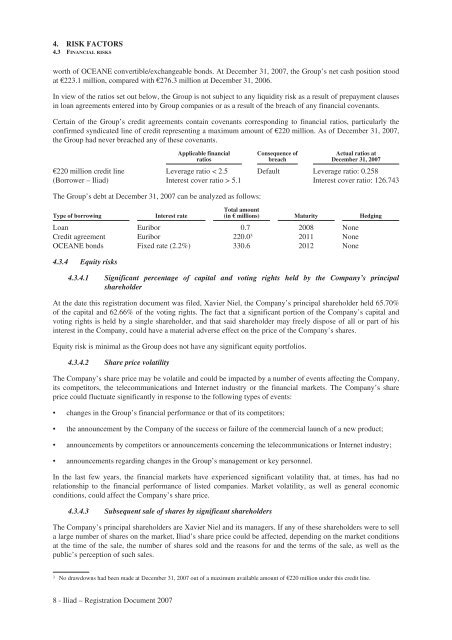

In view of the ratios set out below, the Group is not subject to any liquidity risk as a result of prepayment clauses<br />

in loan agreements entered into by Group companies or as a result of the breach of any financial covenants.<br />

Certain of the Group’s credit agreements contain covenants corresponding to financial ratios, particularly the<br />

confirmed syndicated line of credit representing a maximum amount of €220 million. As of December 31, 2007,<br />

the Group had never breached any of these covenants.<br />

Applicable financial<br />

ratios<br />

Consequence of<br />

breach<br />

Actual ratios at<br />

December 31, 2007<br />

€220 million credit line Leverage ratio < 2.5 Default Leverage ratio: 0.258<br />

(Borrower – <strong>Iliad</strong>) Interest cover ratio > 5.1 Interest cover ratio: 126.743<br />

The Group’s debt at December 31, 2007 can be analyzed as follows:<br />

Type of borrowing Interest rate<br />

Total amount<br />

(in € millions) Maturity Hedging<br />

Loan Euribor 0.7 2008 None<br />

Credit agreement Euribor 220.0 3 2011 None<br />

OCEANE bonds Fixed rate (2.2%) 330.6 2012 None<br />

4.3.4 Equity risks<br />

4.3.4.1 Significant percentage of capital and voting rights held by the Company’s principal<br />

shareholder<br />

At the date this registration document was filed, Xavier Niel, the Company’s principal shareholder held 65.70%<br />

of the capital and 62.66% of the voting rights. The fact that a significant portion of the Company’s capital and<br />

voting rights is held by a single shareholder, and that said shareholder may freely dispose of all or part of his<br />

interest in the Company, could have a material adverse effect on the price of the Company’s shares.<br />

Equity risk is minimal as the Group does not have any significant equity portfolios.<br />

4.3.4.2 Share price volatility<br />

The Company’s share price may be volatile and could be impacted by a number of events affecting the Company,<br />

its competitors, the telecommunications and Internet industry or the financial markets. The Company’s share<br />

price could fluctuate significantly in response to the following types of events:<br />

• changes in the Group’s financial performance or that of its competitors;<br />

• the announcement by the Company of the success or failure of the commercial launch of a new product;<br />

• announcements by competitors or announcements concerning the telecommunications or Internet industry;<br />

• announcements regarding changes in the Group’s management or key personnel.<br />

In the last few years, the financial markets have experienced significant volatility that, at times, has had no<br />

relationship to the financial performance of listed companies. Market volatility, as well as general economic<br />

conditions, could affect the Company’s share price.<br />

4.3.4.3 Subsequent sale of shares by significant shareholders<br />

The Company’s principal shareholders are Xavier Niel and its managers. If any of these shareholders were to sell<br />

a large number of shares on the market, <strong>Iliad</strong>’s share price could be affected, depending on the market conditions<br />

at the time of the sale, the number of shares sold and the reasons for and the terms of the sale, as well as the<br />

public’s perception of such sales.<br />

3 No drawdowns had been made at December 31, 2007 out of a maximum available amount of €220 million under this credit line.<br />

8 - <strong>Iliad</strong> – Registration Document 2007