REGISTRATION DOCUMENT AND FINANCIAL REPORT - Iliad

REGISTRATION DOCUMENT AND FINANCIAL REPORT - Iliad

REGISTRATION DOCUMENT AND FINANCIAL REPORT - Iliad

- TAGS

- registration

- iliad

- iliad.fr

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

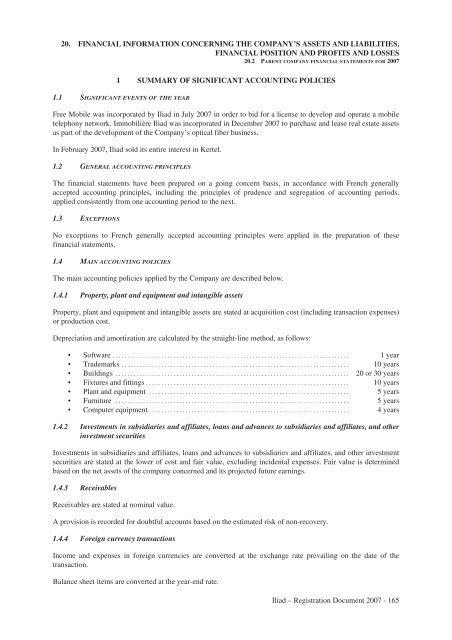

20. <strong>FINANCIAL</strong> INFORMATION CONCERNING THE COMPANY’S ASSETS <strong>AND</strong> LIABILITIES,<br />

<strong>FINANCIAL</strong> POSITION <strong>AND</strong> PROFITS <strong>AND</strong> LOSSES<br />

20.2 PARENT COMPANY <strong>FINANCIAL</strong> STATEMENTS FOR 2007<br />

1 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES<br />

1.1 SIGNIFICANT EVENTS OF THE YEAR<br />

Free Mobile was incorporated by <strong>Iliad</strong> in July 2007 in order to bid for a license to develop and operate a mobile<br />

telephony network. Immobilière <strong>Iliad</strong> was incorporated in December 2007 to purchase and lease real estate assets<br />

as part of the development of the Company’s optical fiber business.<br />

In February 2007, <strong>Iliad</strong> sold its entire interest in Kertel.<br />

1.2 GENERAL ACCOUNTING PRINCIPLES<br />

The financial statements have been prepared on a going concern basis, in accordance with French generally<br />

accepted accounting principles, including the principles of prudence and segregation of accounting periods,<br />

applied consistently from one accounting period to the next.<br />

1.3 EXCEPTIONS<br />

No exceptions to French generally accepted accounting principles were applied in the preparation of these<br />

financial statements.<br />

1.4 MAIN ACCOUNTING POLICIES<br />

The main accounting policies applied by the Company are described below.<br />

1.4.1 Property, plant and equipment and intangible assets<br />

Property, plant and equipment and intangible assets are stated at acquisition cost (including transaction expenses)<br />

or production cost.<br />

Depreciation and amortization are calculated by the straight-line method, as follows:<br />

• Software .............................................................................. 1 year<br />

• Trademarks ........................................................................... 10 years<br />

• Buildings ............................................................................. 20 or 30 years<br />

• Fixtures and fittings ................................................................... 10 years<br />

• Plant and equipment .................................................................. 5 years<br />

• Furniture ............................................................................. 5 years<br />

• Computer equipment .................................................................. 4 years<br />

1.4.2 Investments in subsidiaries and affiliates, loans and advances to subsidiaries and affiliates, and other<br />

investment securities<br />

Investments in subsidiaries and affiliates, loans and advances to subsidiaries and affiliates, and other investment<br />

securities are stated at the lower of cost and fair value, excluding incidental expenses. Fair value is determined<br />

based on the net assets of the company concerned and its projected future earnings.<br />

1.4.3 Receivables<br />

Receivables are stated at nominal value.<br />

A provision is recorded for doubtful accounts based on the estimated risk of non-recovery.<br />

1.4.4 Foreign currency transactions<br />

Income and expenses in foreign currencies are converted at the exchange rate prevailing on the date of the<br />

transaction.<br />

Balance sheet items are converted at the year-end rate.<br />

<strong>Iliad</strong> – Registration Document 2007 - 165